(c) by Mark Dempsey

A recent NPR Throughline podcast summarizes Austrian economist Friedrich Hayek's thought, and includes an account of his 1947 meeting with other like-minded thinkers in Switzerland at Mont Pelerin. Hayek began the Mont Pelerin Society (MPS) with the 39 economists, historians and sociologists who met there, and they eventually became influential--of 76 economic advisers on Ronald Reagan's 1980 campaign staff, 22 were MPS members. It's also worth noting that MPS is full of climate change deniers, and membership includes right-wing petrochemical billionaire Charles Koch. If the wealth of multi-billionaire brothers Charles and David Koch were held by a single individual, he would be the wealthiest on the planet.

The historical context may have influenced some of MPS' more extreme positions. After all, Hayek and his MPS colleagues were concerned about the rise of Mussolini, Stalin and Hitler. So perhaps even their exaggerated libertarian, freewheeling, free market economic prescriptions are more understandable in that context, acting as a protest against a troubling authoritarian trend. Nevertheless, the MPS economists were, and are, not at all on the left side of the political spectrum--and Throughline certainly does not align with NPR's supposedly liberal editorial policy with this relatively uncritical presentation.

Central to MPS and Hayek’s thought is their advocacy for markets relatively free of state influence and regulation. “When you go down to the store and buy [a] pencil, you are, in effect, trading a few minutes of your time for a few seconds of the time of all those thousands of people [who made the pencil]....That's the miracle of the price system. Everybody has benefited. There's been no central direction.” The quote is from Milton Friedman, but the reverence for "free," unregulated markets is a sentiment shared by Hayek and MPS generally.

In fact, conservative economists like the Hayek's fellow Austrians and Milton Friedman's Monetarists have been devoted to "free" markets with a quasi-religious fervor, and they are positively giddy that consumers can command a huge crowd of pencil producers for a trivial amount of money. Throughline's reporting does say Hayek himself advocated a more nuanced view rather than a completely unregulated free market, after all, Hayek insisted on a pension to replace his Austrian state pension before he would move to the U.S.

Apparently a Readers' Digest version of Hayek's most famous work, The Road to Serfdom, is what guided many subsequent followers to advocate nuance-less dispensing with state regulation, or even most of the state iself. Grover Norquist, a part of the Koch's network of political influencers, famously said he wanted to reduce government until it's small enough to "drown in a bathtub." In their view, states and regulation simply interfere with the "magic" of the market.

Still, a few inconvenient truths contradict Friedman's assertion that "there's no central direction,"even in that pencil transaction. Among other things, some central direction makes sure the pencil is not coated with poisonous lead paint. Market regulations also makes sure the money used for that purchase isn’t counterfeit, and the state provides enough security so thieves generally do not rob the buyer or seller as the purchase occurs. There are certainly more examples of central direction, but poisonous paint, counterfeit money and security are not immediately obvious, so "free" marketers can continue to believe these assertions without questioning the premise as long as they don't look too closely at what's really going on.

And don't get me wrong, the U.S.' "central direction" is anything but perfect. Scientists knew since the 1920s that lead in paint was toxic to humans, but one had to wait until 1978 for the Carter administration to sue and to get manufacturers to get the lead out. Those who suffered from the paint manufacturers' negligence sued for compensation, and they won their suit, at least initially. However, the U.S. Supreme Court vacated the multi-million-dollar judgment against the paint manufacturers.

Historians speculate that Caligula was not so much mad as poisoned by his lead plumbing. Other historians note that Beethoven's deafness is one symptom lead poisoning could have produced. Even small amounts of lead can cause serious health problems. Children younger than 6 years are especially vulnerable to lead poisoning, which can severely affect mental and physical development. And no, pre-1978 pencils did not come with a warning not to put them in your mouth.

Given the number and frequency of arms-length transactions in modern economies, one cannot help but be astonished that MPS and its successors continue to advocate dramatic deregulation. After all, in recent years the Chinese shipped the U.S. dog food containing poisonous methyl mercaptan. What drives deregulation, then, a feeling of invulnerability? Arrogance? Ignorance?

As for the historical record of "central direction," David Graeber (in Debt: the first 5,000 years) asserts there have never markets without states, ever. It's even a recent re-interpretation of "freedom" to say markets can be free of regulation. Classical economics talks about markets free from the influence of economic rent--money paid for no productive purpose, particularly to landlords--not markets free of regulation.

The Throughline transcript continues with more of Friedman's fervor: “That is why the operation of the free market is so essential - but even more to foster harmony and peace among the peoples of the world.” Given the frequency of various conflicts, including wars and assassinations, over the shape of markets and the states that regulate them, calling this sunny assertion bizarre is an understatement.

The only historical example of a libertarian, completely unregulated market is the "dark web." This portion of the internet, which originated with U.S. military research, encrypts communication so thoroughly, no central direction is possible; in fact, those visiting dark web websites cannot identify buyers or sellers at all, and must use an anonymous payment method like bitcoin to transact their business.

On the dark web, one can buy drugs, kiddie porn, even assassinations. There are no regulations at all. As you might imagine, criminals cheat customers and each other, so the "brand" of such websites, assuring the transaction would occur as advertised, became very important. One such website was the Silk Road, run by "Dread Pirate Roberts" (Robert Ulricht), who proclaimed that his website would demonstrate the validity of his libertarian principles.

Ulricht was making roughly $40 million a year from the Silk Road when he was arrested by the FBI for trying to hire a hitman to kill someone he believed cheated him. No evidentiary hearing, jury, or law made this decision, just the feudal lord who decided whether that cheater would live or die.

This reminds me of a sentiment I'm told is Russian: things are never so bad they can’t get worse. In any case the dark internet is as close to a libertarian market as humanity has ever seen. I'd suggest the inevitable destination of such completely unregulated markets is the feudalism Ulricht practiced.

We might be a little more sanguine about Friedman if his disciples hadn’t participated in the overthrow of Salvador Allende’s elected government in Chile in 1973, installing human rights criminal General Augusto Pinochet, killing an estimated 10,000 people in the process, including any economists who disagreed with the "Chicago Boys" (Friedman taught at the University of Chicago). That legacy endures, too. Here's a picture of a recent (October 25, 2019) million-plus person Chilean demonstration, protesting the failing, privatized Chilean pension system under Pinochet, created at the Chicago boys' direction.

This enormous demonstration was so spontaneous no one had time to make signs. Meanwhile, the U.S. pension system--Social Security--eliminated 65% of elder poverty.

Reagan followed some of Friedman's economic advice about controlling the money supply, at least for the first two years of his administration. Paul Krugman’s

Peddling Prosperity outlines just how Friedman’s monetarist economics

failed to produce the desired result, and were abandoned. And this

reliance on bogus economics persists even today. People still tell me that the

Fed can control the money supply, even though 97% of the money is bank credit, not federally-issued dollars.

Many readers might remember when Ron and Nancy

Reagan were ridiculed mercilessly for consulting an astrologer. Would

that astrologer provide better advice than they had from their economic advisors? Reagan apparently refused to privatize Social Security, as the Kochs wished. Perhaps the stars didn't align.

Here are some common criticisms of Hayek's Austrian economics:

- The belief in the pure efficiency of markets does not square market failures like the growth of subprime mortgages / securitisation leading up to credit crisis of 2008. Note that Democrat Bill Clinton colluded with Newt Gingrich's congress in deregulating Wall Street. Glass-Steagall remains repealed.

- High tax and high spending regimes do not necessarily impinge on social freedoms. Many western European economies have high tax and high government spending, but, citizens get a comprehensive welfare state, education and health care. Healthcare in particular is roughly half the cost of the U.S.' privatized system, and, uncontroversially, produces better outcomes.

- Austrians advocate a return to the deflationary bias of the Gold Standard. Political economist Mark Blythe says "You can either have the gold standard or democracy, not both." In any case, it's truly insane to tie the success of the economy to the output of its gold mines.

- Austrians suggest economies will recover from downturns without government intervention, but experience says leaving economic policy to market forces may means moving the economy back to full capacity takes a very long time. Therefore, Austrians' policy prescriptions for the Great Depression are considered to be ‘nihilistic’ because they advocated no government intervention. In effect, the Austrians have been shaping their political beliefs into economic policy.

- The Austrian model says consumption will rise in a recession. Actually, in a recession there is a powerful negative multiplier effect reducing output of all sectors.

- Even their ally, Milton Friedman, argues an examination of US data suggests the Austrian theories of credit cycles are wrong. Surprisingly, even Friedman advocates a basic income guarantee.

Given the sorry historical performance of such economic principles one has to ask why anyone would give these people credence, never mind the time of day. The answer is fairly simple, though: their recommendations give intellectual respectability to the plutocrats who profit from poison, counterfeiting and insecurity, among other things.

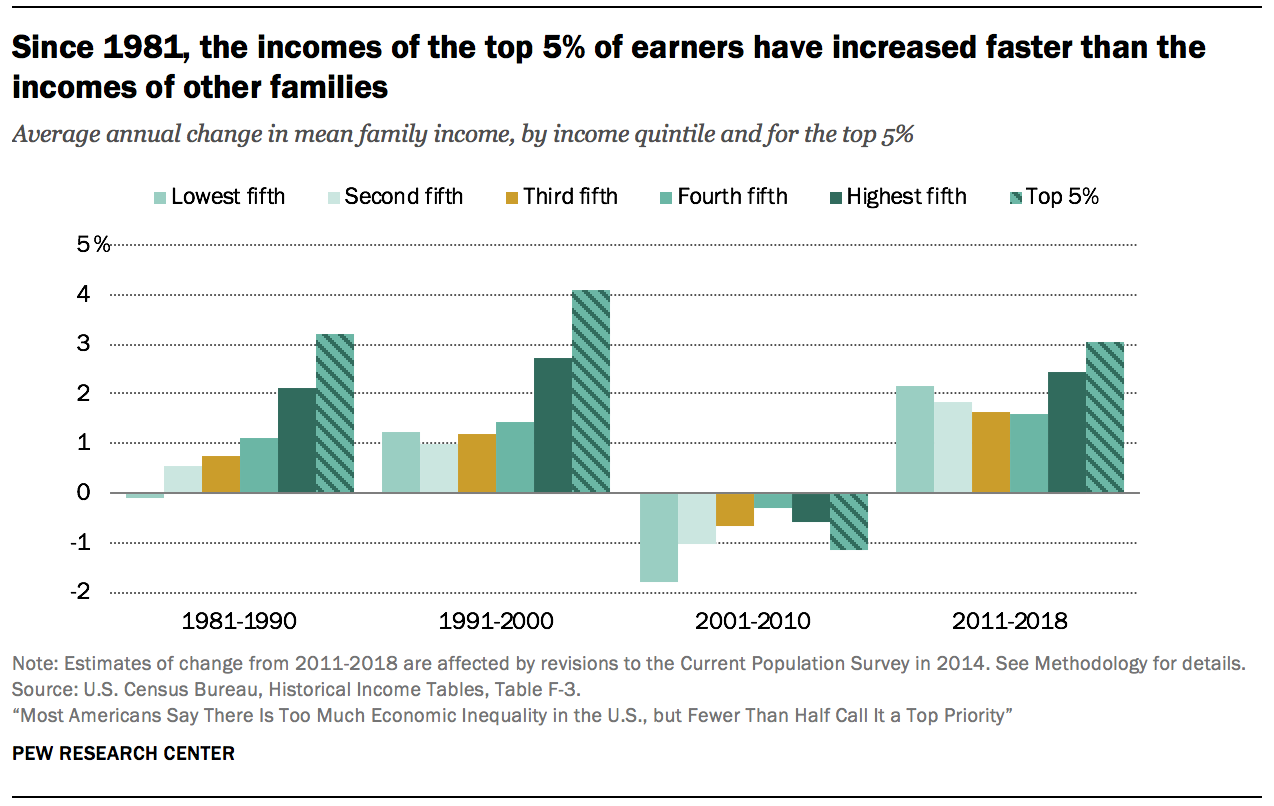

The graph above shows that, generally speaking, the upper income brackets have profited most from the U.S. economy since 1980, as influenced by the MPS economists. The bar on the far right would be even taller if it were for the top 0.1%. Investigative reporter David Cay Johnstone notes that median, real income for the bottom 90% has increased all of $59 since 1972. If that $59 were an inch on a bar graph, the bar for the top 10% would be 141 feet tall. The bar for the top 0.1% would be five miles high.

The profit achieved by those top brackets gives them the resources to fund MPS and its allies, and the plutocrats have not stinted in doing so. For the 2016 election cycle alone, the Kochs spent $889 million. Their supposed "lefty" nemesis, George Soros, spent only $27 million. Soros, incidentally, is a fan of philosopher Karl Popper, and Popper was a founder of MPS. So, the spectrum of respectable public policy options has been narrowed tremendously. Even a capitalist's capitalist like currency speculator Soros is thought to be a lefty.

"Indeed, [Professor Tyler Cowen, the Holbert L. Harris Chair of Economics at

George Mason University and the partner with Charles Koch for two decades now in the

academic base camp of Koch’s political project, housed at George Mason University’s Mercatus Center] pointed out of the very few [what libertarians would call] success stories to date that 'in no case were reforms brought on by popular demand for market-oriented ideas.” More challenging still, the libertarian cause had run up against a persistent problem: it wanted a radical transformation that 'find[s] little or no support” in the electorate.'" (From Nancy MacLean's essay "'Since We Are Greatly Outnumbered':Why and How the Koch Network Uses Disinformation to Thwart Democracy" [pdf])

MacLean continues: "one thing is abundantly clear from the available evidence: operations funded by Koch and his wealthy allies through organizations such as Freedom Partners Chamber of Commerce and Donors Trust have relied on disinformation and manipulation to advance their agenda of radical transformation, leveraging the specter of a supposedly threatening “liberal elite” and strategic racism (what Ian Haney López calls “dog whistle politics”) to compensate for lack of persuasive evidence by inciting clannish responses.

"Indeed, after witnessing several years of the Tea Party doing precisely that, a Cato Institute

publication boasted of libertarians’ role in encouraging the cause and exulted that Tea Party

activism was pushing the GOP to become 'functionally libertarian.'"

So these conservative economists and philosophers have been successful beyond the dreams of avarice at least partly because they are willing to disseminate lies in service to their principles. In the U.S. they have whittled opponents down to a tiny remnant. Among other things, thanks to Koch money, any legislator who strays from the Republican party line can expect well-funded opposition in the next election.

This is a perilous course, if only because even well-regulated markets are very good at solving short-term, individual problems, but long-term, systemic problems remain inevitably unsolved. Unemployment, immigration, healthcare, infrastructure and the climate catastrophe barreling down the tracks toward us are a few examples.

Humanity has been delusional enough to believe counter-factual information for literally millenia--the heliocentric solar system is common knowledge in the West only since the Renaissance. It's difficult to get out of a rut in thinking and perception. The propaganda narrative is very effective, and thanks to the Kochs, well-funded. But rude awakenings await those who believe this kind of sleep walking is a winning life strategy. Heck, closing one's eyes and stopping up one's ears isn't a good strategy to navigate the living room furniture.

No comments:

Post a Comment

One of the objects if this blog is to elevate civil discourse. Please do your part by presenting arguments rather than attacks or unfounded accusations.