"Only puny secrets need protection. Big discoveries are protected by public incredulity." - Marshall McLuhan

How can you ask for what you want, much less get it, if you don't know the words?

Thursday, April 29, 2021

Tuesday, April 20, 2021

How to (really) pay off student debt

(c) by Mark Dempsey

Recently, a student authored an opinion piece for the Davis Vanguard, saying that instead of forgiving, or the government paying off, student debt, the U.S. should work to lower tuition. Sadly, this is the state of play about this issue: even students believe student debt forgiveness is not necessarily a good thing. "It would be unfair to those who did pay debt, too!" is another common reaction.

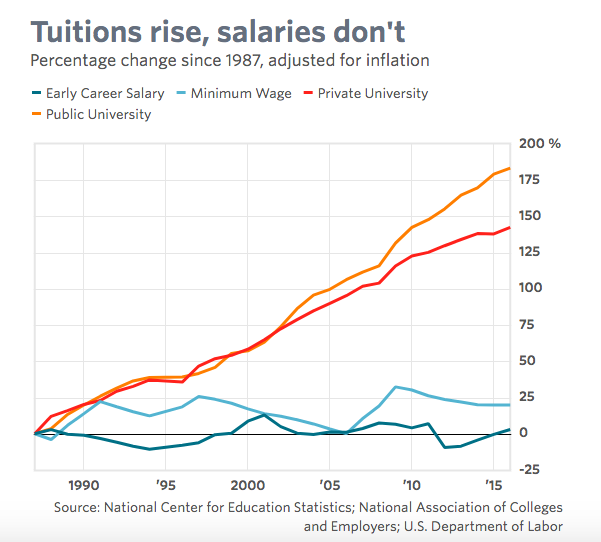

Discussing debt alone ignores one origin of the student debt crisis, too. Investigative reporter David Cay Johnston says that federal grants for higher education have declined 55% since 1972. States have cut their funding for higher education even more sharply. Gosh, I wonder why tuition is so high?

It looks like the fix is in. Ignoring this agrees with then-governor Reagan eliminating civics education in California's high schools, and congress' self-lobotomy, when Newt Gingrich fired its expert staff.

Meanwhile, only mortgage debt exceeds student debt in the U.S, so student loans are a significant problem. Solving that problem has not been helped by the recent bipartisan legislation which says courts can no longer retire student debt in bankruptcy. Members of both parties, Joe Biden and Hillary Clinton included, voted for this change to the law. That change means that in the U.S. now, we're literally garnishing Social Security checks to pay off student debt.

Another source of the problem is mathematically baked into the way debt compounds. When someone asked Einstein what was the most powerful force in the universe, "compound interest" was his reply. The problem is that in compounding, interest inevitably makes the amount owed head toward infinity.

On the other hand, the real economy that provides the means of repayment is finite. Even ancient societies in Israel and Babylon knew debts would inevitably become unpayable, and had periodic "clean slates" (jubilees) during which debts were forgiven, not as something revolutionary, rather as a way of ensuring stability in their societies.

Yet when I've mentioned clean slates as a potential solution, I've even had people suggest that since ancient times, the economy hasn’t really “leveled out” so repaying loans whose interest compounds might be possible today. But interest compounding is up to the task of making loans unpayable. Says one website about "The Explosive Effect Of Compound Interest: If you had invested [a penny] at the time of the birth of Jesus, with a compound interest of 5%, it would have a value today of the number of pure gold balls, each the size of the Earth, shown below:

606,894,448"

So...I’ll stick to my original story: Some loans inevitably become unpayable because it’s impossible for the real economy to keep up with the demands of compound interest owed. Jubilees for societies and bankruptcies for individuals aren’t optional if you want to prevent effectively enslaving debtors.

Currently, the Federal Reserve reports that 40% of the population in the U.S. can't afford a $400 emergency without borrowing or selling something. This means that creditors are in the driver's seat.

Creditors control the popular narrative about debt, too, so it's not surprising that one often hears "everyone should pay their debts." But that statement ignores the context in which previously covered expenses are no longer paid by government, and the fact that, inevitably, compounding makes repayment of some loans impossible.

We cannot count on lenders' kindness, either. For one example, Mr. Potter, the villain in It's a Wonderful Life, was interested in enslaving the population, not empowering them with what they borrowed.

That "everyone should pay their debts" sentiment also ignores the responsibility of the lender. If I have a hot tip on a horse in the fourth race, and persuade a bank to lend me the money for a bet, does the sheriff need to honor that lender's decision and make me forfeit any security for the debt? If a dictator borrows from the World Bank, embezzles the money, then absconds to Switzerland, should the population still be obliged to pay that (odious) debt? Looser bankruptcy makes for better loan underwriting, and believe it or not, sometimes deception and less-than-honest motives make lenders deceive borrowers so they take on more debt than they can possibly afford (see Confessions of an Economic Hit Man by Tom Perkins).

Borrowing is not always fair. Repayment is not always virtuous, and financializing all decisions in pursuit of profit is not always healthy, or even ethical. Ignoring that is at the root of many problems, including student debt.

This is a systemic problem, too, amenable to systemic solutions only. Protesting that individual virtue will save the day is a distraction, not a solution.

Update: Naked Capitalism covers the accounting shenanigans that make the student loan problem even worse.

Update #2: From Why Does College Cost So Much

The article states lower subsidies are not the cause of higher tuition. It blames that on higher administrative costs (CEOs are more expensive now, too), and the fact that overhead--amenities for students--has nearly tripled.

"Here’s the change in average revenue generated per student at American colleges and universities across the last 40 years, in constant inflation-adjusted dollars (1978 through 2018, which is the most recent year for which data are available):

Increase in per student revenue between 1978 and 1988: 18.4%

Increase in per student revenue between 1988 and 1998: 28.6%

Increase in per student revenue between 1998 and 2008: 12.1%

Increase in per student revenue between 2008 and 2018: 24.2%

Total increase in per student revenue at American colleges and universities during the New Gilded Age (1978-2018): 111.9%.....

It is certainly arguable that American higher education should be funded at even higher levels than it is today. What is not defensible is the idea that we should give the people who have constructed the current system even more money, without also creating some better system of accountability in regard to how they are choosing to spend that money."

Monday, April 19, 2021

Maybe America Is Racist

A few years ago, while covering a story on Republican New Hampshire legislator Werner Horn, I summoned the best and brightest scholars that America had to offer. Horn, who represents his 95.9 percent white hometown in his state’s House of Representatives, confounded people who actually know things by stating that “owning slaves doesn’t make you racist.” During an interview with The Root, Horn doubled down by insisting that the Founding Fathers were not racist.

A Republican Legislator Said Slavery Wasn't Racist Because Slave Owners 'Were Making Money.&...

A New Hampshire state legislator is under fire for insisting that “owning slaves doesn’t make you…Read more

In an attempt to disprove the premise of Horn’s statement, I called on Dr. Henry Louis Gates, perhaps the most well-known historian in America (and co-founder of The Root). Gates began with an explanation of America’s history of racism by citing David Hume’s racist footnote to his essay Of National Characters, in which he claimed that in all of Africa, there were no arts, no sciences. He noted that Immanuel Kant’s Observations on the Feeling of the Beautiful and the Sublime also expounded on the racial differences between white and Black people. He explained that Thomas Jefferson’s Notes on the State of Virginia, which was written the same year as the Constitution, was classical racism defined.

But Gates was just a world-famous historian and Werner Horn was a white man. So, to make sure that I had all the bases covered, I called professor, historian, and widely recognized super-genius, Dr. Greg Carr, who heads the Howard University Afro-American Studies Department, teaches at Howard University School of Law and instructs the largest Africana Studies classroom in the world. Before launching into a history of racism, Carr swatted down Horn’s thesis with one request:

“Show me the white slaves.” [Actually, the Slavs were slaves to the Romans...hence the similarity between their ethnic designation...and one good reason europeans were reluctant to have slavery after the fall of Rome]

Carr (who may or may not be an actual human-like android from the future loaded with all the knowledge that ever existed) was using the concept known as Occam’s Razor. In the fields of science, economics, or any reason-based pursuit of understanding, researchers adhere to this time-honored principle which states:

Of two competing theories, the simpler explanation of an entity is to be preferred.

Engineers know it as KISS, or “Keep it simple, stupid.” In research, the concept is called ontological parsimony. Medical researcher Theodore Woodward said: “When you hear hoofbeats, think of horses, not zebras.” Scientists from Stephen Hawking to Albert Einstein to Sir Isaac Newton, accept the premise that whenever there are two different possibilities, the simpler one is usually the correct one.

Unless, of course, white people are talking about racism.

There are a lot of things we know.

We know police disproportionately kill Black people. Although some people attempt to explain that the discrepancy is a function of the disproportionate Black crime rate, research shows that does not hold true. Again, research shows that is a lie. Once more for the people in the back (I’m talking to you, Matt Walsh) every peer-reviewed study that finds police shoot and kill Black people at disproportionate rates and “the only thing that was significant in predicting whether someone shot and killed by police was unarmed was whether or not they were Black,” according to Justin Nix, a criminal justice researcher at the University of Louisville, who noted that police shootings do not correlate with crime rate, the neighborhood violence, age or mental illness.

Maybe it’s racism.

In any other area of sociology, criminology or statistical analysis, this would be accepted as fact. But when it comes to racial data, the big brains in academia and scientific research will break their graphic calculators trying to explain away the outcomes of systemic inequality. They never can.

We know even the poorest majority-white school districts are better funded than the wealthiest non-white school districts. It is an indisputable fact that majority-Black schools offer fewer advanced-level courses. No serious person can argue against the fact that Black students are punished more harshly than white students. Yet, the idea that the education system is racist at its core is somehow seen as incendiary, even though it is the simplest explanation.

It’s easy for me to call the criminal justice system racist. Or, perhaps there’s another reason why Black male offenders receive sentences that are, on average, 19.1 percent longer than white male offenders who commit the same crimes and have the same criminal history, according to the United States Sentencing Commission. Explain why white people use illegal drugs, possess illegal narcotics and sell illegal substances at higher rates than Black people but Black people are six-and-a-half times more likely to be arrested and convicted for drugs. The Stanford Open Policing Project—the largest police stop project that ever existed—found that Black people are 2.5 times more likely to be stopped and 4 times more likely to be searched than white drivers even though white drivers were more likely to have contraband.

Police are twice as likely to use force on Black people versus white suspects, according to a 2015 report from the Bureau of Justice Statistics. Black defendants get charged with harsher crimes, receive higher bail and are offered fewer plea deals according to Harvard researchers...and researchers in Wisconsin...and Philadelphia...and Maryland.

A study by the National Registry of Exonerations found that “African Americans are only 13% of the American population but...They constitute 47% of the 1,900 exonerations listed in the National Registry of Exonerations (as of October 2016), and the great majority of more than 1,800 additional innocent defendants who were framed and convicted of crimes in 15 large-scale police scandals and later cleared in ‘group exonerations.’”

Racists love to point out the FBI crime data as an explanation, even though the stats only refer to arrests. Even knowing that most crimes go unsolved, we’re supposed to believe that the cops who use force on, shoot, kill, stop, frisk, search, sentence, and wrongfully incarcerate Black people at disproportionate rates somehow have it right when it comes to arresting Black people.

Maybe it’s poverty.

We know that crime is related to poverty, socioeconomic conditions and access to education. But Black people are not three times as poor or less educated. In fact, a Black child born to wealthy Black parents is just as likely to end up poor or in jail as a poor white child. A home in a Black neighborhood is worth $48,000 less than the exact same home in a white neighborhood, even if the crime rate and neighborhood amenities are exactly the same. A white high school dropout is more likely to find a job than a Black college student. Of all the manufactured hypotheses that attempt to explain these racial disparities, none of them even comes close to the simplest explanation.

It’s racism.

Perhaps racism is the reason that these valiant scholarly attempts at whitesplaining away America’s racial toxicity exist in the first place. In any other scientific discipline, the general consensus would adhere to the tried and true methodologies found in every other field of research. Maybe white people genuinely cannot fathom that white supremacy is responsible for these racial incongruities because, by proxy, it would also mean that they benefit from these inequities.

Maybe that’s why most white people “are satisfied with the way Blacks are treated in society.” Perhaps that’s why two out of every three white people believe Black people have “as good a chance as whites to get any kind of job for which they are qualified.” The majority of white people do not believe Black people face discrimination in voting, medical treatment or when applying for a loan or mortgage, even though numerous studies have documented these systemic issues.

Of course, there is another possibility. Perhaps Black people are inherently dumber, lazier and more prone to violence. While this assumption is also racist, it is a more logical explanation than believing that—despite the history of slavery, Jim Crow, redlining, voter suppression and employment discrimination —this country made an about-face from its past and spontaneously regenerated itself into a bastion of equality and impartiality.

So either America is racist or America is racist.

Or maybe it’s zebras.

Michael Harriot is a world-renowned wypipologist. Getter and doer of "it." Never reneged, never will. Last real negus alive.

Famous Topics in Art History: Hercules tries to give his cat a pill

— Well, actually, Bruce Baugh (@BruceRedux) April 16, 2021

Sunday, April 18, 2021

Neighborhood Sweeties

(c) by Mark Dempsey

One of my neighbors recently had emergency surgery that put her out of commission for a couple of weeks. What was touching about the recovery period is that the neighbors picked up the slack in her household duties. "You're so sweet," she said to the neighbors who did this.

What did they do? One neighbor boarded her dog. Another neighbor rolled in her garbage cans and paid her gardener. Another made a text group to keep everyone up to date about her progress. Now that she's back, other neighbors are walking her dog, bringing her food, and checking in to see how she's recovering, and if she needs anything. Her family is helping too, but neighbors are really stepping up.

Another neighbor had to leave town for a funeral. The neighborhood sweetie across the street cared for her cat, took care of her garbage cans, and kept an eye on the house. Another neighbor lost her husband to COVID-19, and still talks about how the neighbors stepped up for emotional support.

How did this all happen?

1. Several neighbors own dogs and met each other as they walked. That made acquaintances and friends.

2. The neighbor with emergency surgery likes throwing parties and teas, so the neighborhood made even more connections as she invited neighbors.

3. We made a map of the neighborhood with our addresses, emails and phone numbers. We update the map as the neighborhood changes, but those contacts, even people who don't stay in touch often, are all available. This is what a Neighborhood Watch recommends, incidentally. It makes the neighborhood more cohesive and safer since no one need be alone, with help just a phone call away.

4. Neighbors have been sharing their extras...particularly extra desserts!

These are all sweet things, and a nice counterpoint to the constant news about selfish behavior. We're actually happier when we're more connected and taking care of each other, not just when we're watching out for number one.

So...next time you make some cookies, take those "extras" to a neighbor. It takes a little time and attention, but you can have such a neighborhood, too.

Thursday, April 15, 2021

Modern Money (in a nutshell) and the Environment

(c) by Mark Dempsey

Modern Money Theory provides an accurate description of federal fiscal policy, and frankly one that's not that exotic--but it appears to be news to environmentalists. Most of us were raised to believe federal fiscal policy is tax and spend. Just as your household requires earning its spending money, government needs to tax the population to get the wherewithal to make its purchases.

Both political right and left agree that tax and spend describes federal budgeting too. Margaret Thatcher famously said "If the state wishes to spend more, it can do so only by borrowing your savings or by taxing you more. There is no such thing as public money, there is only taxpayers’ money." Barack Obama went so far as to sponsor a commission (Simpson-Bowles) to close the gap between revenue and spending, comparing the government to a household with a big credit card bill.

But tax and spend cannot be true. For one thing, where would taxpayers get the dollars they use to pay taxes if the monopoly provider of currency (government) did not spend dollars out into the economy first? The fiscal policy of money creators like the federal government must be completely different from households'. Spend first, then retrieve some dollars in taxes is the way things must work . That's just the operational nature of reality.

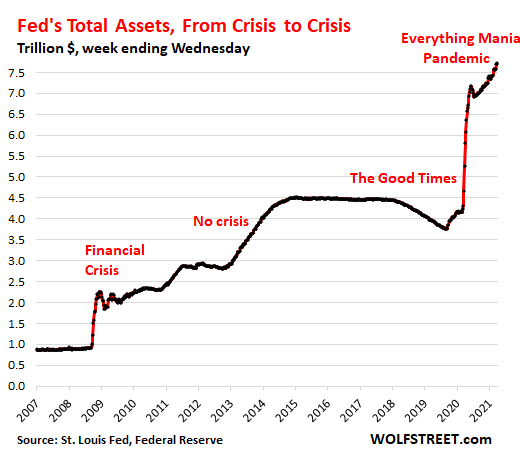

This observation means several things: first and foremost, money creators like the U.S. are fiscally unconstrained. Government doesn't have to wait for tax revenue to provision federal programs. It can't! This insight is not that "Modern," either--see New York Federal Reserve governor Beardsly Ruml's paper "Taxes for Revenue are Obsolete"...from 1946. Resources may constrain what government can do, but lack of tax dollars never can.

Then why have taxes? Answer: to make the money do something valuable...like retiring the inevitable liability of taxes. Without the power to tax, the money becomes valueless--see the Confederate States of America for one example.

And what do we call the dollars left out in the economy, not retrieved in taxes? Answer #1: the dollar financial assets of the population--i.e. their savings. Answer #2: National 'debt.' Both answers describe exactly the the same thing, just as your bank account is your asset, but the bank's liability. Marching down to the bank to demand it reduce its debt (i.e. the size of your account) is not very sensible, yet it's a commonplace when it comes to National 'debt.' (See this for the history of its effects.)

What has this got to do with the environment? I just got a fundraising appeal from the Sierra Club asking for lobbying money to eliminate carbon-producing coal from the world's energy mix. It also mentioned we also need to take care of the coal miners and others displaced by this switch. It's worth mentioning that no new tax would be needed to do this, but Sierra Club omitted that bit.

Government management of the big public works project we call "World War II" consumed 50% of the American economy. The proposed Green New Deal, which also would compensate those displaced by the switch to renewables, would only consume 5% of the current economy.

Besides lobbying to remove coal from our energy mix, my personal favorite would be a federal farm policy that paid farmers to sequester carbon rather than one paying them to not grow crops. We have the technology to measure how much carbon crops put in the soil, and adding carbon actually makes the soil more fertile. As farm policy, it would be far more effective than letting them "launder money for Cargill and ADM"--two big agribusinesses--as Michael Pollan notes in The Omnivore's Dilemma.

In any case, we can now see a possibility for programs to wean us off carbon-producing energy in a way that respects those displaced, and could move us toward planet-saving renewables and carbon sequestration. All that is possible without any change to tax policy. The Biden administration is trying to raise corporate taxes to "pay for" its infrastructure proposals. That's not necessary, and now you, and the Sierra Club, know it.

Update: “A Soil Scientist’s Perspective – Carbon Farming, CO2 Certification & Carbon Sequestration in Soil” [Resilience]. “When it comes to humus and soils, the focus must be on soil fertility, ecosystem services and greater resilience to climate change, and not on CO2 sequestration, certificate trading and carbon storage. Considering an isolated factor within an agricultural ecosystem in purely economic terms does not put enough value on ecosystem services and risks incentivising the adoption of one-sided measures.”

Update #2: Joanne Chory is using plants to save the planet

Sunday, April 4, 2021

Four Numbers That Show the Cost of Slavery on Black Wealth Today - Tulsa is famous!

At the end of the Civil War, Union General William Tecumseh Sherman promised some 4 million freed slaves land that they would own, live, and work on to build an economic future for themselves — also known as 40 acres and a mule. “Genuine freedom required some kind of economic base,” says Eric Foner, a professor emeritus of history at Columbia University, on episode 2 of The Pay Check podcast. “And in an agricultural society that meant owning land.”

Instead, after President Abraham Lincoln’s assassination, his successor, Andrew Johnson, reneged on the deal. Black Americans started their freed lives empty handed. By some estimates that land would have been worth as much as $3.1 trillion today….

The racial wealth gap begins with slavery itself, which was a huge wealth generator for White Americans. The economic value of the 4 million slaves in 1860 was, on average, $1,000 per person, or about $4 billion total. That was more than all the banks, railroads and factories in the U.S. were worth at the time. In today’s dollars, that would come out to as much as $42 trillion, accounting for inflation and compounding interest….

Slavery was also the engine driving the cotton economy, which enriched everyone from banks, shopkeepers, and insurers, too. Meanwhile, slaves lost out on an estimated $20.3 trillion in wages for their labor….

What little wealth Black families were able to build after the Civil War was often destroyed violently. In the most egregious incident, the Tulsa massacre of 1921, mobs and police officers burned down what was then known as Black Wall Street, obliterating $200 million in homes and businesses and displacing 10,000 Black Tulsans…. After the Civil War and well into the 20th Century, there were about 100 of these attacks, in addition to some 3,000 lynchings of Black Americans.

Saturday, April 3, 2021

Deficit, Debt, and Foreigners, Oh my!

The biggest holders of US debt are neither China nor the Fed.

— Daniel Lacalle (@dlacalle_IA) April 2, 2021

The biggest holders of US debt are American investors and institutions.

China is not even the largest foreign holder (it is Japan) pic.twitter.com/zUmJUKSeoy

Cats with jobs

pic.twitter.com/tZ2t2cTr8d — cats with jobs 🛠 (@CatWorkers) April 18, 2024

-

Russia "wins" (achieves stalemate after conquering lots of territory) over the long term unless something extraordinary happens....

-

Debt! It's scary! (c) by Mark Dempsey You are as likely to get a straight answer from a conventional economist as you are to get the tr...

-

(c) by Mark Dempsey In its majestic equality, t he law forbids rich and poor alike from sleeping under bridges, begging in the street, and ...