(c) by Mark Dempsey

Everyone knows national 'debt' is bad. Why...all debt is bad! It reduces your economic freedom! You are in a kind of quasi-slavery to creditors if your household has debt. And you must always pay your debts, too!

Except none of that is true. If a bank lends me money because I have a hot tip on the fourth race at Santa Anita, does anyone really believe the public sector's courts and sheriffs have a duty to enforce payment of that debt? There's even law that predates the American Revolutionary War that says loans designed to default and give the lender title to the security in foreclosure are not legal. The sub-prime/derivatives scandal is the most recent reminder that impossible-to-pay-back loans are not fair, never mind legal.

There's also an enormous amount of propaganda designed to make the public believe currency creators are just like households... but what household can pay its mortgage with what it prints in the back bedroom?

Popular opinion thinks "tax and spend" describes the fiscal operation of the federal government--the monopoly creator of legal currency. But...where do people get the dollars to pay those taxes if government doesn't spend the dollars first?

The real-world sequence of fiscal actions must be "spend first, then retrieve some dollars in taxes." That's how the real world actually works. Taxes remain important because they create the demand for the otherwise useless pieces of paper we call "dollars," but spending must precede the receipt of tax revenue, so taxes do not and cannot provision federal programs.

Alone in the economy, the federal government is fiscally unconstrained. Remember that the next time you hear the "Eeek! We're running out of money!" talk. We will never run out of money. We might run out of resources, goods and services, but the symbols of wealth are never ending.

Incidentally, for the inflationistas ("If you just print lots of money, you'll get [gasp!]...[hyper-] inflation!"): According to our central bank's own audit--required by the congressional mandate--it issued $16 - $29 trillion in credit in 2007-8 to the same financial sector whose frauds crashed the economy. Where was the inflation? (And where was the tax rise?)

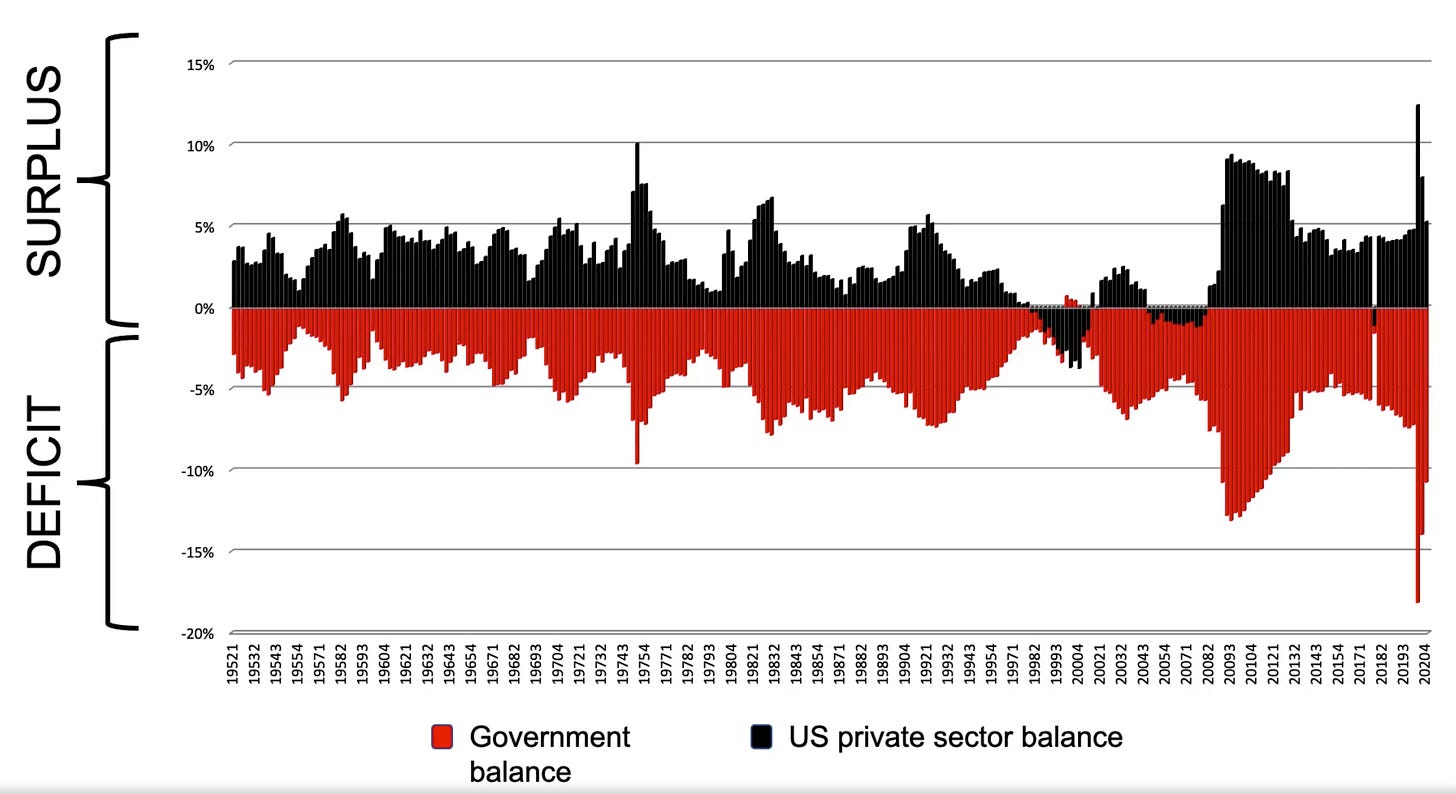

What do we call the money spent, but not retrieved in taxes--the dollars with which people conduct their business? First, we call them the dollar financial assets of the population. But, just as accurately, we call them the national 'debt.' That's not exotic economics, it's double-entry bookkeeping.

In a way, it's analogous to your bank account. That's your asset, just as it is the bank's liability. The "deficit hawks" are adamant in advising people, in effect, to march down to their bank and demand it have less debt. An honest bank officer would say "But that would shrink your accounts, too!" The American public is supposed to say "We don't care! We just hate the word 'debt'!"

I'm moved to write these words because, once again, propagandist George Will has written a column decrying federal 'debt.' Will is a pundit whose ethics were flexible enough that in the run up to the 1980 election, he stole President Carter's debate briefing book and handed it to the Reagan campaign. Nevertheless, Mr. Will he feels he has enough ethical standing to to critique "profligate Democrats and delusional Republicans."

One economist, Stephanie Kelton, answered the current 'debt' panic on her blog (and with her book The Deficit Myth: Modern Monetary Theory and the Birth of the People's Economy). The truth, says Dr. Kelton: "government deficits supply the non-government sector with net financial assets—i.e. the government’s red ink is our collective black ink."

"But what about Greece?" True, Greece had a relatively high national debt, and as a consequence was at one time paying 35% interest to sell the debt. But Greece is a European Union member, and uses the euro. It's not a monetary sovereign, like the U.S. and Japan. It can't print drachmas any more, but the U.S. and Japan can issue dollars and yen literally without limit. That critical distinction escapes the press and the likes of George Will.

One might think Mr. Will, or any of the other promoters of 'debt'

panic would appreciate the distinction between household debt and

national 'debt,' or between those who print their own money and have to get others to do that... but no. Will apparently has difficulty distinguishing

between theft and legitimate reporting, too.

Meanwhile (from Mona Ali): "Just this week, COVAX, the WHO program created to deliver vaccines to Africa, Asia, and Latin America, revealed that it is fresh out of cash. It needs $5.2 billion to continue vaccine rollout in low-income countries that have received fewer total vaccine doses than richer economies’ residents have total booster jabs. Our crisis-prone system breeds instability whose effects fall unevenly. Unless our disordered world economy is reoriented toward protecting the interests of the majority, it may not withstand this catastrophe—let alone the next one."