For anyone unaware of the forces driving current public policy, the Kochs are funders of the sharp rightward turn in American politics. In the last presidential election, they spent an estimated $889 million. The linked article says that's as much as the major political parties spend; Jane Mayer's biography of the Kochs (Dark Money) says they spend three times the Republicans party's budget. In contrast, unions spent roughly $27 million, and "lefty" (actually, capitalist currency speculator) George Soros spent $17 million. Note: Hillary officially spent nearly twice what Trump did, but that comparison ignores outside money (like Kochs).

But what is behind the Koch's extraordinary commitment to what Thomas Franks calls "The Wrecking Crew"--the anti-government lobby?

Fred Koch, the father and founder of the Koch dynasty was a brilliant chemist who invented the methods used to manufacture useful products like gasoline and kerosine from crude oil. He patented these, and his company manufactured refineries worldwide, including ones for Hitler in Germany and Stalin in the Communist U.S.S.R. He apparently hated Stalinist Russia and loved the Germans. In fact he hired a German nanny to raise his sons. The nanny was so sympathetic to the Nazis that she eventually left the Koch's employ to return to the Third Reich when Hitler consolidated his power there.

...so the current Koch generation was literally raised by a Nazi.

One other root of this committment to anti-government philosophy: Despite Teddy Roosevelt's Trust busting, the Rockefellers largely monopolized oil production in the U.S. and began using Fred Koch's technology in their refineries too--but without paying him any royalties for his patents. Fred Koch sued for that royalty money....and lost! About a dozen years later, news surfaced that Rockefellers had bribed the judge in Koch's lawsuit. Koch re-sued and won. One can only imagine the amount of skepticism in the honesty of government this produced in Fred Koch.

Fred Koch went on to continue building his fortune, and his political empire. Among the organizations he founded and funded was the John Birch Society. You may remember them as an organization that accused Dwight D. Eisenhower of being a communist, or at least a communist dupe. Calling the Birchers right wing is an understatement.

Nevertheless, the Kochs currently oppose "collectivism" (anything done by the community on its own behalf) as the seed of corruption, and understandably, given the history. They fund enormous enterprises to press these beliefs in the popular press, and in the courts. The current Janus vs. AFSCME lawsuit against union dues collection in the Supreme Court was funded, partly, by their organizations.

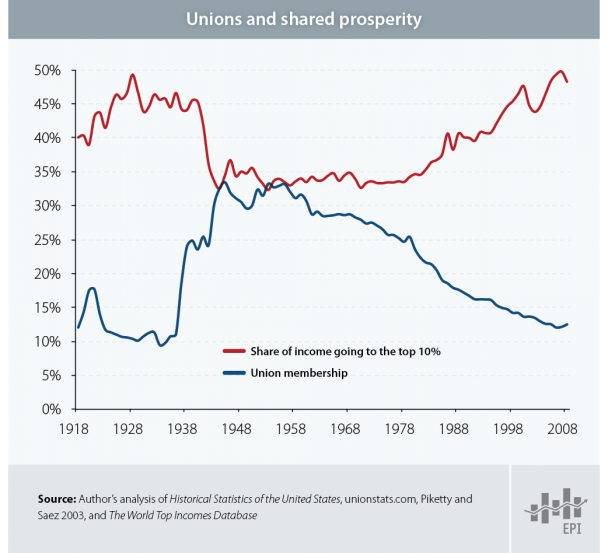

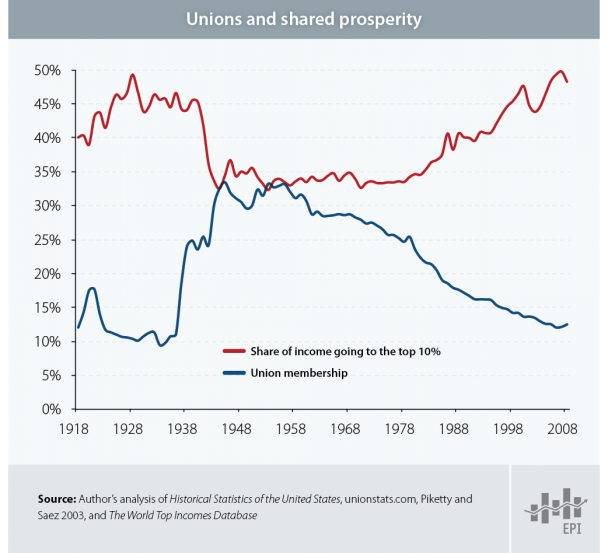

The attack on unions, partly funded by the Kochs, correlates with the rising income disparity in the U.S. economy (see the graph).

...anyway, that judicial corruption has certainly borne bitter fruit.

But what is behind the Koch's extraordinary commitment to what Thomas Franks calls "The Wrecking Crew"--the anti-government lobby?

Fred Koch, the father and founder of the Koch dynasty was a brilliant chemist who invented the methods used to manufacture useful products like gasoline and kerosine from crude oil. He patented these, and his company manufactured refineries worldwide, including ones for Hitler in Germany and Stalin in the Communist U.S.S.R. He apparently hated Stalinist Russia and loved the Germans. In fact he hired a German nanny to raise his sons. The nanny was so sympathetic to the Nazis that she eventually left the Koch's employ to return to the Third Reich when Hitler consolidated his power there.

...so the current Koch generation was literally raised by a Nazi.

One other root of this committment to anti-government philosophy: Despite Teddy Roosevelt's Trust busting, the Rockefellers largely monopolized oil production in the U.S. and began using Fred Koch's technology in their refineries too--but without paying him any royalties for his patents. Fred Koch sued for that royalty money....and lost! About a dozen years later, news surfaced that Rockefellers had bribed the judge in Koch's lawsuit. Koch re-sued and won. One can only imagine the amount of skepticism in the honesty of government this produced in Fred Koch.

Fred Koch went on to continue building his fortune, and his political empire. Among the organizations he founded and funded was the John Birch Society. You may remember them as an organization that accused Dwight D. Eisenhower of being a communist, or at least a communist dupe. Calling the Birchers right wing is an understatement.

Nevertheless, the Kochs currently oppose "collectivism" (anything done by the community on its own behalf) as the seed of corruption, and understandably, given the history. They fund enormous enterprises to press these beliefs in the popular press, and in the courts. The current Janus vs. AFSCME lawsuit against union dues collection in the Supreme Court was funded, partly, by their organizations.

The attack on unions, partly funded by the Kochs, correlates with the rising income disparity in the U.S. economy (see the graph).

...anyway, that judicial corruption has certainly borne bitter fruit.