On Nakedcapitalism.com: Posted on March 30, 2020 by Yves Smith

Yves here. Aside from the fact that readers have indicated they’d like some breaks from COVID-19 programming, this post is important because it addresses what seems be a widely-held misperception of Modern Monetary Theory, namely, the role of tax.

Modern Monetary Theory scholars stress that tax is what legitimates a currency. Individuals and businesses must obtain it to settle their tax obligations to the state. They also point out that tax serves to drain demand, as in contain inflation. But Modern Monetary Theory proponents also (usually) point out that taxes also serve to provide incentives and disincentives and redistribute income. But they regard these as potential applications, as opposed to core to their theory.

As Modern Monetary Theory has started to be taken more seriously, critics have usually focused on either “This can’t work” or “ZOMG, free money, hyperinflation just around the corner!” That has led Modern Monetary Theory scholars to focus on the necessary purposes of tax in their system, validating the currency and curbing inflation, to the detriment of acknowledging the other important roles that taxation can play.

Another area for potential confusion is not recognizing the difference between a currency issuer (the US, the UK, the Eurozone) versus currency users (Italy, countries that have dollarized their currencies or borrowed in foreign currencies).

Having said that, I think Modern Monetary Theory proponents have made acceptance of their ideas a bit more difficult by not drawing a bright line between their theory, which is a description of how government spending works in a fiat currency system, versus what they believe are resulting sound policy approaches, such as setting the price of labor (a Job Guarantee) rather than the price of money.

By Richard Murphy, a chartered accountant and a political economist. He has been described by the Guardian newspaper as an “anti-poverty campaigner and tax expert”. He is Professor of Practice in International Political Economy at City University, London and Director of Tax Research UK. He is a non-executive director of Cambridge Econometrics. He is a member of the Progressive Economy Forum. Originally published at Tax Research UK

There seems to be the most, and quite extraordinary, lack of understanding of modern monetary theory and its interaction with tax in the tax justice world. John Christensen and Naomi Fowler of the Tax Justice Network and I were aware of this a year ago, and this blog and Taxcast were the result. I’m sharing both again because an appreciation that tax is not just about revenue raising, if it is about that at all, is absolutely fundamental now. Nick Shaxson added to the words:

Modern Monetary Theory (MMT) has gained prominence since the global financial crisis. The rising star US politician Alexandria Ocasio-Cortez said recently we should be “open” to its ideas, and some mainstream economists have given it a (qualified) endorsement. For many, it offers a powerful critique of the damaging austerity policies that were implemented in the western world since the global financial crisis, and an important plank of new progressive thought. MMT also has many critics.

For the tax justice movement, however, MMT opens an important debate about the role of tax. One of the MMTers’ central arguments — that governments don’t need tax revenues if they want to spend money — seems to conflict with our argument that governments must tax rich corporations and crack down on tax cheating and tax havens in order to pay for roads, schools, teachers and hospitals.

To illustrate this clash, take the words of UK Shadow Chancellor John McDonnell during the Panama Papers tax haven scandal that “every pound avoided in tax by the super-rich is a pound desperately needed by our National Health Service, our schools and our caring services.” We’d strongly agree with this statement — though Bill Mitchell, a prominent MMT economist, attacked it as a “dangerous and misguided narrative for progressives to engage in,” because it “fuels damaging myths” about how the tax and spending system works.

This blog asks some big questions about MMT. Is it ”correct“? If not, how not? But if so, is it compatible with tax justice – and could it even be useful? Is tax justice useful to MMT? We’ve given MMT a partial endorsement and suggest there is no real conflict between MMT and tax justice — that tax justice doesn’t especially need MMT, but without tax justice, MMT is incomplete. You can listen to a discussion here exploring these issues in this Taxcast Extra below: (our monthly podcast, the Taxcast is available here)

So What Is MMT Anyway?

There seem to be differing versions of MMT out there, but they contain a few core elements, three in particular. To understand the first part of the MMT canon, let’s start with another British politician, Theresa May, who once told an underpaid nurse she couldn’t have a pay rise because “there is no magic money tree.” We haven’t got the tax revenues, May was saying, to pay nurses a decent wage.

Her predecessor Margaret Thatcher, thrifty Germans, and many others, endorse this idea, which rests on the intuitively appealing notion that a government budget is like personal or household finances: that we need to earn money before we can spend it. This legitimises the alleged need to make “tough choices” (like paying wealth-creating nurses or teachers a pittance, while allowing wealth-extracting private equity titans to earn billions) and has underpinned vicious and counter-productive austerity policies around the world.

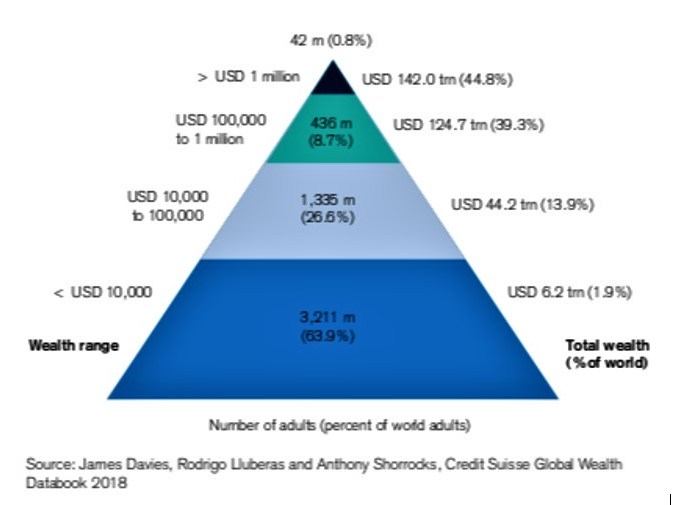

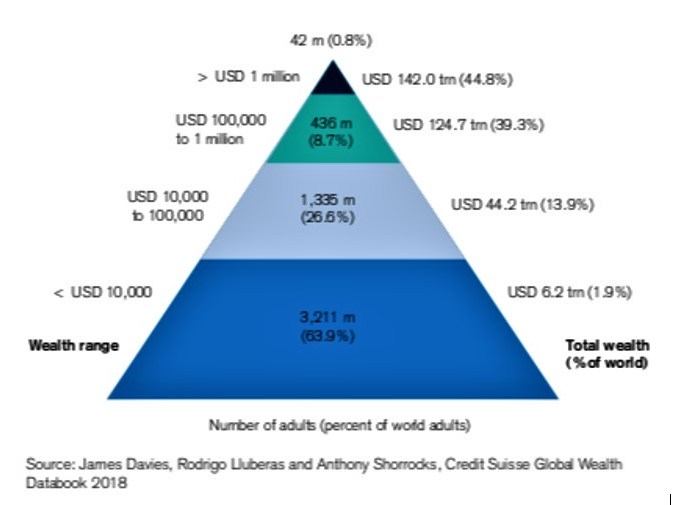

The tax justice movement doesn’t generally voice opinions about spending — our focus is on the revenue side of things — but we disagree with the “there is no magic money tree” worldview. We argue that there is a magic money tree or trees: one version of which would be “tax havens, multinational enterprises, and the mega rich.” If they stopped avoiding tax we could pay teachers better. In fact, we’ve even got a picture of one of these trees. It looks like the top section (or two sections) of this image, from the latest Credit Suisse World Wealth Report:

World Wealth Report 2018

(There are, conventionally speaking, other magic money trees – the debt markets, for instance: you borrow to pay for productive spending and investment — but let’s leave that aside for now).

MMTers take a different view. They also agree that there is a Magic Money Tree or trees, but they say it’s not in the tax havens: it’s elsewhere. Mitchell puts it, in a piece co-authored with Thomas Fazi:

The magic money tree does exist, but it’s located much closer to home than we think: in each country’s central bank, not on some faraway tropical island.”

In its crudest form, a central bank can use special papers, inks and a printer, to create money. A more sophisticated form of money creation is Quantitative Easing, where the central bank issues electronic money to buy real assets, simply by clicking the keys on a computer to credit someone’s bank account. (The private banking system can also create money, but again let’s not complicate things needlessly for now).

Governments that issue their own currencies can’t really “run out of money” since they can always create more if needed. Money is created first, and tax comes later. And spending and taxes don’t necessarily have to match. So that’s the first MMT concept: the idea that money can be conjured out of thin air. This idea isn’t really controversial either: the Bank of England has even endorsed a version of it. The tax justice community doesn’t need to generally disagree with it either — and this blog describes a framework that happily includes both varieties of the magic money tree.

But one also has to be careful here, because such thinking could encourage people to think ‘if governments can just create money, what’s the point of tax?’ Well, as we’ll see, tax serves a whole range of crucial purposes. MMTers tend to obsess about just one of them — which is the second MMT concept.

Just weird?

To grasp this, consider the curious words on a £5 note, under ‘Bank of England.’ It says “I promise to pay the bearer on demand the sum of five pounds.”

What could that mean? If you give the bank five pounds, they’ll give you five pounds back? This seems tautological and, frankly, a bit weird.

But in fact this goes to the essence of what money is. This bluish-green piece of paper isn’t worth anything in itself — nor is gold. They are only worth something because enough other people believe they are worth something, and are prepared to exchange them for real resources.

But why do we collectively believe they are worth something? Just because everyone else does? Isn’t this a bit fragile? Wouldn’t this confidence, and the value of money, evaporate if everyone got the jitters for some reason? Why would a soldier go off and risk his life in a foreign war, in exchange for these weird paper (or electronic) will-o-the-wisps?

Well, the MMTers explain, we believe in these pieces of paper ultimately because the currency has a large and stable anchor, which is the biggest player of all: the government. It will ultimately accept these pieces of paper, or electronic money, as payment of tax. For MMTers, the purpose of tax here isn’t to fund spending: it’s to provide that essential role tying money to something solid. Again, people in the tax justice movement don’t need to disagree with this idea, either, as far as it goes. It’s not wrong – although there aren’t many policy makers who think about tax in this way.

The third MMT principle follows on from this. A government, or your central bank, can’t just create money, willy-nilly, to pay for anything they fancy. An economy is essentially a circular flow of spending, production and income, but if you start flushing enough freshly-minted money into a system that’s nicely in balance, this might lead to Venezuela-ish hyperinflation, or a currency collapse, or some other unstable thing. Equally, if there’s too little money in the system there may be stagnation and under-employment. So, responsible governments should aim first to create sufficient money to make things go around in healthy ways, but when things go too fast use other tools, including (but not only) increasing taxes to withdraw money from circulation.

How does tax take money out of the system? Well, in a sense, tax destroys money. It is a bit like a cinema ticket: the cinema prints it, and it’s worth something in your hands as a temporary store of value — and then as a medium of exchange when you hand the ticket in just before you get your popcorn and take your seat. But when the usher takes your ticket, they tear it up and throw it in the bin. Having served its purpose, it can be dispensed with. This is essentially what happens when the government receives your tax payment.

Tax and money creation, the MMTers argue, are key tools for fine-tuning the amount of money whooshing around in your economy, to help keep it in the Goldilocks zone: not too hot, and not too cold. In very general terms, we don’t need to disagree that this happens — though again, this does not fit with how tax policy-makers generally think about tax.

Is MMT Right? Can It agree With the Tax Justice Movement?

These insights from MMT show that (i) spending comes before taxes, (ii) spending can happily outstrip revenue, and (iii) that while fiscal deficits (that is, more spending than revenue) do matter in some circumstances, there’s plenty more flexibility in the system than most people realise. So MMT is helpful as a political tool to push back against austerity.

We don’t disagree with MMT’s core principles. And we’re not alone. In the recent words of the (mainstream) US economist Brad DeLong, MMT “is a good gospel . . . much better than the ravings of those yahoos, including President Obama, who said nearly a decade ago that the United States government needed to freeze spending because it needed to tighten its belt just as American households had been forced tighten theirs.” In most ways, he summarised, MMT is “just macroeconomic common sense.”

But there are, as we’ve hinted, objections to MMT, from others, and from us. First, from others:

For one thing, MMTers admit that there are situations where it simply doesn’t apply. For example, unstable countries where people lack confidence in the state aren’t stable enough to serve as reliable currency anchors. Sometimes, an anchor is provided by pegging the shaky currency to another solid currency like the US dollar, or their economies become “dollarised” (which is when most people prefer to trade in dollars rather than in the local currency.) These governments can’t always create the money they need, and such countries have little alternative other than to match revenue and spending pretty closely, or risk bad things happening, like hyperinflation (one of your writers has lived through such times, in Angola, and it isn’t nice.)

There may also be institutional reasons why revenue and spending can’t diverge, or can’t diverge very far, as MMTers also generally accept. Governments which use the Euro currency are institutionally constrained in terms of what they can and can’t spend relative to their tax revenues, and the European Union also requires its members to exhibit a fair degree of austerity, (which may explain such lacklustre growth in Europe for so many years).

Similarly, local and state governments in many countries generally can’t create their own money, and they are also often constitutionally constrained from spending beyond their local and state tax revenues. Vermont in the USA can’t issue dollars, nor can it easily ”spend now and tax later,” (though it has some flexibility.)

Another possible objection to MMT is that if it is to serve as a useful policy tool, it needs debt markets to be efficient and investors to be wise, so that when the supply of money moves out of line with demand in the economy, it will show up quickly in shifting interest rates or rises in unemployment, which can be promptly addressed. Hence, among other important things, MMT may struggle to deal with bubbles, manias and panics, which are all too common. (It’s not alone, in not having a panacea for these things.)

Some have urged MMT to consider the private banking system, rather than the central bank, as the prime creator of money, though MMT does accept this. Others say that MMTers tend to sweep central banks and treasuries into a single entity, ‘government,’ while in reality the two are typically independent of each other. Treasuries, which make tax and spending decisions, generally do ‘fund’ their spending with tax revenues, whereas central banks don’t.

These are all big wrinkles, though they don’t need to negate the whole edifice.

So Where Does MMT Meet Tax Justice?

Now let’s return to UK Shadow Chancellor John McDonnell’s statement that “every pound avoided in tax by the super-rich is a pound desperately needed by our National Health Service, our schools and our caring services,” — and its apparent clash with the MMT view that we don’t need to collect taxes in order to achieve our spending goals.

From a purely economic point of view the MMT argument is that governments need not collect a dollar in tax for every dollar they spend. That’s fine: almost any (sane) economist would agree. Governments (or central banks) can create money, and fiscal deficits are acceptable in principle, and often healthy, in practice. MMTers agree that fiscal deficits can matter (though, as they put it, “not in the way you think”), and also that if there’s too much money in circulation, higher taxes can help re-balance things. So there are important links between levels of tax and levels of spending, even for MMTers. That’s already a move away from the argument that taxes don’t fund spending.

But there’s a still closer connection between levels of tax and levels of spending. Taxes and spending are not just economic matters: they are intensely political. It’s not just Eurozone countries and dollarised economies that face tax-and-spend constraints: it’s everyone. You may disagree violently with the deficit scolds, austerian hysterians, Swabian Hausfraus, Big Banker budget surplus fiends, hyperinflation hyperventilators, monetarist maniacs or those blindly following the credo of the confidence fairy — but that doesn’t mean these powerful people and institutions don’t shape the political climate or constrain a government’s ability to run deficits. They very much do.

The political climate — along with judicious dollops of corrupt money injected into politics — dictate how far government spending is constrained by the levels of taxes. The constraints can be shifted — and MMT can help shift them in a helpful direction — but they are still real constraints. (There are also people who argue that MMT is operationally wrong about the link between taxes and spending, but this is outside of our area of expertise.)

But overall McDonnell was correct: more taxes make more spending possible, certainly by creating the political space for it, and MMTers should concede this. Their attack on “tax the rich to pay for teachers and firefighters” is ultimately a presentational issue for them. They don’t generally oppose taxing the rich. They just think this statement makes it harder for them to get their points across. That’s not a good reason to attack and undermine the case for taxing the rich.

Yet at this point we might also make a concession. Instead of saying:

“Taxes pay for schools, hospitals and firefighters”

we are comfortable with adding a word:

“Taxes help pay for schools, hospitals and firefighters.”

And we’d go further still. Since this stuff is so intensely political, and tackling inequality is now such a monumental task, we need stout political mechanisms to tackle it. And we know from long experience that the slogan “Tax the rich to help pay for schools and hospitals” is a transformationally powerful political slogan that builds support for using the tax system to achieve urgent, vital goals. When MMTers attack this linkage, whatever the rights and wrongs of their technical arguments they are politically wrong, introducing a dangerous and misguided narrative of their own.

But beyond these questions of the relative levels of taxes and spending, there is a more fundamental set of points that MMT needs to take on board. Tax doesn’t just serve one purpose: it serves many. And this is where there’s enormous scope for MMT to become more sophisticated — and more acceptable to the mainstream and the wider public. There’s no need for a fundamental clash between our positions and those of MMT.

The Six Rs of Tax

In 2005 and 2007 the Oxford Council on Good Governance published two papers by Alex Cobham, now the Tax Justice Network’s Executive Director. Alex decried the ‘Tax Consensus’ advocated at that time by the IMF and other global actors, as a subset of the well-known ‘Washington Consensus’, which was pushing many countries into austerity, privatisation and financial liberalisation: policies that have been largely discredited in light of all that’s happened since.

The Tax Consensus had an overwhelming focus on ‘efficiency’ (a tricky term at the best of times) and wasn’t bothered about inequality. It focused on persuading countries to lower taxes, to aim for a “neutral” tax system whose taxes shouldn’t distort production or consumption decisions, and argued that any redistribution should happen via spending, not via the tax system. Cobham attacked this tax consensus, and laid out what he called ‘The Four Rs of Taxation,’ which he summarised as:

Raising Revenue. The most obvious purpose of tax. We’ve laid out why the MMTers don’t like this message, because they say it gets the order of things the wrong way round, but also we’ve explained that more tax revenues at the very least create the political space, and even the economic space, for more spending on schools, hospitals etc.

Redistribution. The tax system in itself is a fine tool for tackling economic (and political, gender, racial, and other) inequalities. And to be fair, most MMTers already accept the idea that a tax system should be structured to levy taxes in progressive ways.

Repricing. Tax policy can also create incentives and disincentives to encourage or discourage desirable and undesirable things, like curbing smoking or alcoholism, tackling climate change, stimulating certain kinds of investment, discouraging excessive borrowing, curbing rent-seeking, and so on. (MMTers don’t reject this either.)

Representation. This is a crucial, and the most forgotten, function of tax. The central bargain at the heart of a fiscal system is reflected in the American colonists’ slogan of “no taxation without representation.” Citizens pay taxes as part of a grand social and democratic bargain, that government will be accountable to them in return. This has been shown empirically, and it’s direct taxes that seem to be most effective in generating strong accountability.

More recently, Richard Murphy has added two or three more ‘Rs’ to this list, explicitly to reflect modern monetary theory. These are:

Ratifying the value of money. That’s the anchor role discussed above: money has value because people have faith in it, and they have faith because they know government will accept it for tax payments.

Reclaiming money that has been created. That’s the cinema-ticket role: using the tax system to take back (and Retire, there’s an alternative R word) money that’s been created, to help regulate the economy and stop it overheating or stagnating.

MMTers tend to pay lip service to the Rs that they aren’t busy attacking. Yet each is crucial.

The Structure of a Tax System

MMTers’ main fight is about overall levels of taxes, relative to overall levels of spending. It is not, in general terms, a theory about how to put a tax system together, which in turn hinges on the all-important question of who pays – or how the tax charge is shared among different constituencies. Yet this is the core of our work. We and the MMTers are mostly fighting different battles, so we need not necessarily clash. And MMT creates interesting insights about tax. If a core purpose of tax is to take money out of circulation (or ”destroy money“) to prevent excessive inflation, then the wealthy should love tax, because inflation erodes the value of their assets. The problem we point out is, the wealthy want poorer people, and not them, to have their money taken out through tax.

We’ve noticed that few MMTers are experts on international tax, or tax havens, or on how to structure a good tax system. This gap can be remedied, without doing any damage to MMT itself, except for perhaps that one presentational issue. These are huge areas, so we’ll just take a couple of examples to demonstrate what we mean, and to show how MMT is compatible with tax justice.

The Corporate Tax, Its Many Roles, and the Many Misunderstandings

Take, for instance, the Corporate Income Tax, and some of the roles it plays, even beyond the six Rs of tax. Our document entitled Ten Reasons to Defend the Corporate Income Tax, and accompanying articles, lay out a range of benefits that the corporate tax provides, far beyond what most people would imagine – and even beyond the Four (or Six) Rs. In practice the corporate income tax is one of the most precious taxes of them all.

Here’s one of its functions — one that is strong enough on its own to justify the corporate tax, and indeed was a key reason why many countries introduced the tax in the first place: it is an essential backstop to the personal income tax. If we abolished the corporate tax or cut it severely, large numbers of people would opt to convert their ordinary income into corporate forms held by personal shell companies, so as to pay the lower rate. (Unless they take their income out as dividends, they can defer paying tax on it indefinitely — and often forever.)

So corporate tax cuts can cannibalise the (much larger) personal income tax. In fact, different parts of the tax system ‘spillover’ like this into other parts of the tax system, and onto other countries’ tax systems. (This new article by Andrew Baker of Sheffield Political Economic Research Institute, and Richard Murphy outlines a new framework for understanding these spillovers.) Modern Tax Theory should be able to incorporate these kinds of complexities in how tax systems work.

Not only that, but any theory which has tax at its heart also needs to consider the international dimension.

MMT, International Tax, and the Race to the Bottom

The tax system of Country A can harm the tax system of Country B (tax havens provide ample evidence of this.) A related matter is something that is widely called ‘tax competitiveness.’ Here’s an example from the US economist Randall Wray, a prominent MMTer. He said:

Taxing corporations is a bad idea. It causes corporations to move out of the US. Or to cut special deals: ’give me a tax break and I will build a factory in your community.’ We ought to get rid of the tax. Level the playing field . . . Instead, if we wanted to, we just tax the owners [of corporations.]”

And on taxing the rich, more generally, he said:

Trying to reduce inequality using taxes is not likely to be successful—because the rich influence the tax code and get exemptions. . . I argue for “predistribution”—prevent the growth of excessive income and wealth by . . . eliminat[ing] the practices that lead to inequality.”

These statements don’t generally represent an MMT position on how to structure a tax system or on international tax — there isn’t an easily categorisable position on these matters, as far as we can tell — but it does show how easy it is for MMTers to fall prey to bad old ideas.

Let’s start with the second one: in its purest form — don’t tax the rich because they’ll dodge the tax — is a counsel of despair: a special case of a more general statement: “let’s not try and subject the rich to the rule of law because they’ll use clever lawyers and accountants to escape it.” It’s a version of an argument we see all the time – don’t crack down on tax havens because it’s too difficult, or because the real problem is elsewhere.

These are dangerous, anti-democratic arguments — and we spurn them. Wray’s argument isn’t as stark as this, but he does veer towards the “either/or fallacy” – either we do one thing (raise taxes on the rich) or we do the other (“predistribution.”) Obviously, we should do both.

On corporation taxes Wray, like many MMTers, enters complex terrain without acknowledging enough of the functions of the tax, as laid out in our “10 Reasons to Defend the Corporate Income Tax” document. For one thing, the argument that it’s more efficient to stop taxing corporations and tax the owners of corporations directly, would entail a vast giveaway to the billionaire classes, for reasons outlined here. And his view that corporate taxes encourage corporations to relocate elsewhere is part of a misguided old ‘Competitiveness Agenda,’ laid out here, whose core argument is that we must keep piling tax cuts and other goodies on multinational corporations and mobile global capital, for fear they’ll run away to more ‘hospitable’ locations. This idea is woolly-headed nonsense, from top to bottom.

This takes us into complex terrain, so read this article and this book to get a fuller picture of what we’re talking about. But as a taster, here are a couple of killer problems with this view. When you cut taxes on multinational corporations, or provide them with other goodies, certain things happen, which are eminently measurable. Corporate profits rise, at least in the short term. And corporations may (or, more likely, may not) change their investment plans. Crucially, while the gross benefits that flow from corporate welfare are measurable, many of the costs aren’t. And here are some of those costs:

(Click here and associated links to see how each of these works, or refer to the “10 Reasons” document.)

What happens, however, is that traditional tax theorists will look at the measurable benefits of the corporate tax cuts – especially higher profits for corporations – and highlight them, but then airbrush out that much broader range of equally important costs because so many of them are hard or impossible to measure.

Because of this generic imbalance between measurable benefits and unmeasurable costs, a body of tax theory and measurement has grown up that promotes this view that is favourable to corporate tax cuts but isn’t rooted in the real world. As a result, many, if not most of the conventional (academic and other) views on corporate taxes are downright wrong: rooted in generic distortions to the measurements that will never go away. (For a more detailed look at this imbalance, see the “Evidence Machine” in the UK edition of the Finance Curse book.)

Modern Monetary Theory needs to grapple with these issues. Our thinking in this area is a progressive, internally coherent body of work, which encompasses tax havens, the structure of tax systems, crime, and plenty more. Pretty much all of it — tax justice, or Modern Tax Theory, if you like — doesn’t need to be seen as incompatible with Modern Monetary Theory.

___________

NB: This paper by me was one of the consequences of this, and was recognised by Randy Wray as a major contribution to debate on this issue.

Yves here. Aside from the fact that readers have indicated they’d like some breaks from COVID-19 programming, this post is important because it addresses what seems be a widely-held misperception of Modern Monetary Theory, namely, the role of tax.

Modern Monetary Theory scholars stress that tax is what legitimates a currency. Individuals and businesses must obtain it to settle their tax obligations to the state. They also point out that tax serves to drain demand, as in contain inflation. But Modern Monetary Theory proponents also (usually) point out that taxes also serve to provide incentives and disincentives and redistribute income. But they regard these as potential applications, as opposed to core to their theory.

As Modern Monetary Theory has started to be taken more seriously, critics have usually focused on either “This can’t work” or “ZOMG, free money, hyperinflation just around the corner!” That has led Modern Monetary Theory scholars to focus on the necessary purposes of tax in their system, validating the currency and curbing inflation, to the detriment of acknowledging the other important roles that taxation can play.

Another area for potential confusion is not recognizing the difference between a currency issuer (the US, the UK, the Eurozone) versus currency users (Italy, countries that have dollarized their currencies or borrowed in foreign currencies).

Having said that, I think Modern Monetary Theory proponents have made acceptance of their ideas a bit more difficult by not drawing a bright line between their theory, which is a description of how government spending works in a fiat currency system, versus what they believe are resulting sound policy approaches, such as setting the price of labor (a Job Guarantee) rather than the price of money.

By Richard Murphy, a chartered accountant and a political economist. He has been described by the Guardian newspaper as an “anti-poverty campaigner and tax expert”. He is Professor of Practice in International Political Economy at City University, London and Director of Tax Research UK. He is a non-executive director of Cambridge Econometrics. He is a member of the Progressive Economy Forum. Originally published at Tax Research UK

There seems to be the most, and quite extraordinary, lack of understanding of modern monetary theory and its interaction with tax in the tax justice world. John Christensen and Naomi Fowler of the Tax Justice Network and I were aware of this a year ago, and this blog and Taxcast were the result. I’m sharing both again because an appreciation that tax is not just about revenue raising, if it is about that at all, is absolutely fundamental now. Nick Shaxson added to the words:

Modern Monetary Theory (MMT) has gained prominence since the global financial crisis. The rising star US politician Alexandria Ocasio-Cortez said recently we should be “open” to its ideas, and some mainstream economists have given it a (qualified) endorsement. For many, it offers a powerful critique of the damaging austerity policies that were implemented in the western world since the global financial crisis, and an important plank of new progressive thought. MMT also has many critics.

For the tax justice movement, however, MMT opens an important debate about the role of tax. One of the MMTers’ central arguments — that governments don’t need tax revenues if they want to spend money — seems to conflict with our argument that governments must tax rich corporations and crack down on tax cheating and tax havens in order to pay for roads, schools, teachers and hospitals.

To illustrate this clash, take the words of UK Shadow Chancellor John McDonnell during the Panama Papers tax haven scandal that “every pound avoided in tax by the super-rich is a pound desperately needed by our National Health Service, our schools and our caring services.” We’d strongly agree with this statement — though Bill Mitchell, a prominent MMT economist, attacked it as a “dangerous and misguided narrative for progressives to engage in,” because it “fuels damaging myths” about how the tax and spending system works.

This blog asks some big questions about MMT. Is it ”correct“? If not, how not? But if so, is it compatible with tax justice – and could it even be useful? Is tax justice useful to MMT? We’ve given MMT a partial endorsement and suggest there is no real conflict between MMT and tax justice — that tax justice doesn’t especially need MMT, but without tax justice, MMT is incomplete. You can listen to a discussion here exploring these issues in this Taxcast Extra below: (our monthly podcast, the Taxcast is available here)

So What Is MMT Anyway?

There seem to be differing versions of MMT out there, but they contain a few core elements, three in particular. To understand the first part of the MMT canon, let’s start with another British politician, Theresa May, who once told an underpaid nurse she couldn’t have a pay rise because “there is no magic money tree.” We haven’t got the tax revenues, May was saying, to pay nurses a decent wage.

Her predecessor Margaret Thatcher, thrifty Germans, and many others, endorse this idea, which rests on the intuitively appealing notion that a government budget is like personal or household finances: that we need to earn money before we can spend it. This legitimises the alleged need to make “tough choices” (like paying wealth-creating nurses or teachers a pittance, while allowing wealth-extracting private equity titans to earn billions) and has underpinned vicious and counter-productive austerity policies around the world.

The tax justice movement doesn’t generally voice opinions about spending — our focus is on the revenue side of things — but we disagree with the “there is no magic money tree” worldview. We argue that there is a magic money tree or trees: one version of which would be “tax havens, multinational enterprises, and the mega rich.” If they stopped avoiding tax we could pay teachers better. In fact, we’ve even got a picture of one of these trees. It looks like the top section (or two sections) of this image, from the latest Credit Suisse World Wealth Report:

World Wealth Report 2018

(There are, conventionally speaking, other magic money trees – the debt markets, for instance: you borrow to pay for productive spending and investment — but let’s leave that aside for now).

MMTers take a different view. They also agree that there is a Magic Money Tree or trees, but they say it’s not in the tax havens: it’s elsewhere. Mitchell puts it, in a piece co-authored with Thomas Fazi:

The magic money tree does exist, but it’s located much closer to home than we think: in each country’s central bank, not on some faraway tropical island.”

In its crudest form, a central bank can use special papers, inks and a printer, to create money. A more sophisticated form of money creation is Quantitative Easing, where the central bank issues electronic money to buy real assets, simply by clicking the keys on a computer to credit someone’s bank account. (The private banking system can also create money, but again let’s not complicate things needlessly for now).

Governments that issue their own currencies can’t really “run out of money” since they can always create more if needed. Money is created first, and tax comes later. And spending and taxes don’t necessarily have to match. So that’s the first MMT concept: the idea that money can be conjured out of thin air. This idea isn’t really controversial either: the Bank of England has even endorsed a version of it. The tax justice community doesn’t need to generally disagree with it either — and this blog describes a framework that happily includes both varieties of the magic money tree.

But one also has to be careful here, because such thinking could encourage people to think ‘if governments can just create money, what’s the point of tax?’ Well, as we’ll see, tax serves a whole range of crucial purposes. MMTers tend to obsess about just one of them — which is the second MMT concept.

Just weird?

To grasp this, consider the curious words on a £5 note, under ‘Bank of England.’ It says “I promise to pay the bearer on demand the sum of five pounds.”

What could that mean? If you give the bank five pounds, they’ll give you five pounds back? This seems tautological and, frankly, a bit weird.

But in fact this goes to the essence of what money is. This bluish-green piece of paper isn’t worth anything in itself — nor is gold. They are only worth something because enough other people believe they are worth something, and are prepared to exchange them for real resources.

But why do we collectively believe they are worth something? Just because everyone else does? Isn’t this a bit fragile? Wouldn’t this confidence, and the value of money, evaporate if everyone got the jitters for some reason? Why would a soldier go off and risk his life in a foreign war, in exchange for these weird paper (or electronic) will-o-the-wisps?

Well, the MMTers explain, we believe in these pieces of paper ultimately because the currency has a large and stable anchor, which is the biggest player of all: the government. It will ultimately accept these pieces of paper, or electronic money, as payment of tax. For MMTers, the purpose of tax here isn’t to fund spending: it’s to provide that essential role tying money to something solid. Again, people in the tax justice movement don’t need to disagree with this idea, either, as far as it goes. It’s not wrong – although there aren’t many policy makers who think about tax in this way.

The third MMT principle follows on from this. A government, or your central bank, can’t just create money, willy-nilly, to pay for anything they fancy. An economy is essentially a circular flow of spending, production and income, but if you start flushing enough freshly-minted money into a system that’s nicely in balance, this might lead to Venezuela-ish hyperinflation, or a currency collapse, or some other unstable thing. Equally, if there’s too little money in the system there may be stagnation and under-employment. So, responsible governments should aim first to create sufficient money to make things go around in healthy ways, but when things go too fast use other tools, including (but not only) increasing taxes to withdraw money from circulation.

How does tax take money out of the system? Well, in a sense, tax destroys money. It is a bit like a cinema ticket: the cinema prints it, and it’s worth something in your hands as a temporary store of value — and then as a medium of exchange when you hand the ticket in just before you get your popcorn and take your seat. But when the usher takes your ticket, they tear it up and throw it in the bin. Having served its purpose, it can be dispensed with. This is essentially what happens when the government receives your tax payment.

Tax and money creation, the MMTers argue, are key tools for fine-tuning the amount of money whooshing around in your economy, to help keep it in the Goldilocks zone: not too hot, and not too cold. In very general terms, we don’t need to disagree that this happens — though again, this does not fit with how tax policy-makers generally think about tax.

Is MMT Right? Can It agree With the Tax Justice Movement?

These insights from MMT show that (i) spending comes before taxes, (ii) spending can happily outstrip revenue, and (iii) that while fiscal deficits (that is, more spending than revenue) do matter in some circumstances, there’s plenty more flexibility in the system than most people realise. So MMT is helpful as a political tool to push back against austerity.

We don’t disagree with MMT’s core principles. And we’re not alone. In the recent words of the (mainstream) US economist Brad DeLong, MMT “is a good gospel . . . much better than the ravings of those yahoos, including President Obama, who said nearly a decade ago that the United States government needed to freeze spending because it needed to tighten its belt just as American households had been forced tighten theirs.” In most ways, he summarised, MMT is “just macroeconomic common sense.”

But there are, as we’ve hinted, objections to MMT, from others, and from us. First, from others:

For one thing, MMTers admit that there are situations where it simply doesn’t apply. For example, unstable countries where people lack confidence in the state aren’t stable enough to serve as reliable currency anchors. Sometimes, an anchor is provided by pegging the shaky currency to another solid currency like the US dollar, or their economies become “dollarised” (which is when most people prefer to trade in dollars rather than in the local currency.) These governments can’t always create the money they need, and such countries have little alternative other than to match revenue and spending pretty closely, or risk bad things happening, like hyperinflation (one of your writers has lived through such times, in Angola, and it isn’t nice.)

There may also be institutional reasons why revenue and spending can’t diverge, or can’t diverge very far, as MMTers also generally accept. Governments which use the Euro currency are institutionally constrained in terms of what they can and can’t spend relative to their tax revenues, and the European Union also requires its members to exhibit a fair degree of austerity, (which may explain such lacklustre growth in Europe for so many years).

Similarly, local and state governments in many countries generally can’t create their own money, and they are also often constitutionally constrained from spending beyond their local and state tax revenues. Vermont in the USA can’t issue dollars, nor can it easily ”spend now and tax later,” (though it has some flexibility.)

Another possible objection to MMT is that if it is to serve as a useful policy tool, it needs debt markets to be efficient and investors to be wise, so that when the supply of money moves out of line with demand in the economy, it will show up quickly in shifting interest rates or rises in unemployment, which can be promptly addressed. Hence, among other important things, MMT may struggle to deal with bubbles, manias and panics, which are all too common. (It’s not alone, in not having a panacea for these things.)

Some have urged MMT to consider the private banking system, rather than the central bank, as the prime creator of money, though MMT does accept this. Others say that MMTers tend to sweep central banks and treasuries into a single entity, ‘government,’ while in reality the two are typically independent of each other. Treasuries, which make tax and spending decisions, generally do ‘fund’ their spending with tax revenues, whereas central banks don’t.

These are all big wrinkles, though they don’t need to negate the whole edifice.

So Where Does MMT Meet Tax Justice?

Now let’s return to UK Shadow Chancellor John McDonnell’s statement that “every pound avoided in tax by the super-rich is a pound desperately needed by our National Health Service, our schools and our caring services,” — and its apparent clash with the MMT view that we don’t need to collect taxes in order to achieve our spending goals.

From a purely economic point of view the MMT argument is that governments need not collect a dollar in tax for every dollar they spend. That’s fine: almost any (sane) economist would agree. Governments (or central banks) can create money, and fiscal deficits are acceptable in principle, and often healthy, in practice. MMTers agree that fiscal deficits can matter (though, as they put it, “not in the way you think”), and also that if there’s too much money in circulation, higher taxes can help re-balance things. So there are important links between levels of tax and levels of spending, even for MMTers. That’s already a move away from the argument that taxes don’t fund spending.

But there’s a still closer connection between levels of tax and levels of spending. Taxes and spending are not just economic matters: they are intensely political. It’s not just Eurozone countries and dollarised economies that face tax-and-spend constraints: it’s everyone. You may disagree violently with the deficit scolds, austerian hysterians, Swabian Hausfraus, Big Banker budget surplus fiends, hyperinflation hyperventilators, monetarist maniacs or those blindly following the credo of the confidence fairy — but that doesn’t mean these powerful people and institutions don’t shape the political climate or constrain a government’s ability to run deficits. They very much do.

The political climate — along with judicious dollops of corrupt money injected into politics — dictate how far government spending is constrained by the levels of taxes. The constraints can be shifted — and MMT can help shift them in a helpful direction — but they are still real constraints. (There are also people who argue that MMT is operationally wrong about the link between taxes and spending, but this is outside of our area of expertise.)

But overall McDonnell was correct: more taxes make more spending possible, certainly by creating the political space for it, and MMTers should concede this. Their attack on “tax the rich to pay for teachers and firefighters” is ultimately a presentational issue for them. They don’t generally oppose taxing the rich. They just think this statement makes it harder for them to get their points across. That’s not a good reason to attack and undermine the case for taxing the rich.

Yet at this point we might also make a concession. Instead of saying:

“Taxes pay for schools, hospitals and firefighters”

we are comfortable with adding a word:

“Taxes help pay for schools, hospitals and firefighters.”

And we’d go further still. Since this stuff is so intensely political, and tackling inequality is now such a monumental task, we need stout political mechanisms to tackle it. And we know from long experience that the slogan “Tax the rich to help pay for schools and hospitals” is a transformationally powerful political slogan that builds support for using the tax system to achieve urgent, vital goals. When MMTers attack this linkage, whatever the rights and wrongs of their technical arguments they are politically wrong, introducing a dangerous and misguided narrative of their own.

But beyond these questions of the relative levels of taxes and spending, there is a more fundamental set of points that MMT needs to take on board. Tax doesn’t just serve one purpose: it serves many. And this is where there’s enormous scope for MMT to become more sophisticated — and more acceptable to the mainstream and the wider public. There’s no need for a fundamental clash between our positions and those of MMT.

The Six Rs of Tax

In 2005 and 2007 the Oxford Council on Good Governance published two papers by Alex Cobham, now the Tax Justice Network’s Executive Director. Alex decried the ‘Tax Consensus’ advocated at that time by the IMF and other global actors, as a subset of the well-known ‘Washington Consensus’, which was pushing many countries into austerity, privatisation and financial liberalisation: policies that have been largely discredited in light of all that’s happened since.

The Tax Consensus had an overwhelming focus on ‘efficiency’ (a tricky term at the best of times) and wasn’t bothered about inequality. It focused on persuading countries to lower taxes, to aim for a “neutral” tax system whose taxes shouldn’t distort production or consumption decisions, and argued that any redistribution should happen via spending, not via the tax system. Cobham attacked this tax consensus, and laid out what he called ‘The Four Rs of Taxation,’ which he summarised as:

Raising Revenue. The most obvious purpose of tax. We’ve laid out why the MMTers don’t like this message, because they say it gets the order of things the wrong way round, but also we’ve explained that more tax revenues at the very least create the political space, and even the economic space, for more spending on schools, hospitals etc.

Redistribution. The tax system in itself is a fine tool for tackling economic (and political, gender, racial, and other) inequalities. And to be fair, most MMTers already accept the idea that a tax system should be structured to levy taxes in progressive ways.

Repricing. Tax policy can also create incentives and disincentives to encourage or discourage desirable and undesirable things, like curbing smoking or alcoholism, tackling climate change, stimulating certain kinds of investment, discouraging excessive borrowing, curbing rent-seeking, and so on. (MMTers don’t reject this either.)

Representation. This is a crucial, and the most forgotten, function of tax. The central bargain at the heart of a fiscal system is reflected in the American colonists’ slogan of “no taxation without representation.” Citizens pay taxes as part of a grand social and democratic bargain, that government will be accountable to them in return. This has been shown empirically, and it’s direct taxes that seem to be most effective in generating strong accountability.

More recently, Richard Murphy has added two or three more ‘Rs’ to this list, explicitly to reflect modern monetary theory. These are:

Ratifying the value of money. That’s the anchor role discussed above: money has value because people have faith in it, and they have faith because they know government will accept it for tax payments.

Reclaiming money that has been created. That’s the cinema-ticket role: using the tax system to take back (and Retire, there’s an alternative R word) money that’s been created, to help regulate the economy and stop it overheating or stagnating.

MMTers tend to pay lip service to the Rs that they aren’t busy attacking. Yet each is crucial.

The Structure of a Tax System

MMTers’ main fight is about overall levels of taxes, relative to overall levels of spending. It is not, in general terms, a theory about how to put a tax system together, which in turn hinges on the all-important question of who pays – or how the tax charge is shared among different constituencies. Yet this is the core of our work. We and the MMTers are mostly fighting different battles, so we need not necessarily clash. And MMT creates interesting insights about tax. If a core purpose of tax is to take money out of circulation (or ”destroy money“) to prevent excessive inflation, then the wealthy should love tax, because inflation erodes the value of their assets. The problem we point out is, the wealthy want poorer people, and not them, to have their money taken out through tax.

We’ve noticed that few MMTers are experts on international tax, or tax havens, or on how to structure a good tax system. This gap can be remedied, without doing any damage to MMT itself, except for perhaps that one presentational issue. These are huge areas, so we’ll just take a couple of examples to demonstrate what we mean, and to show how MMT is compatible with tax justice.

The Corporate Tax, Its Many Roles, and the Many Misunderstandings

Take, for instance, the Corporate Income Tax, and some of the roles it plays, even beyond the six Rs of tax. Our document entitled Ten Reasons to Defend the Corporate Income Tax, and accompanying articles, lay out a range of benefits that the corporate tax provides, far beyond what most people would imagine – and even beyond the Four (or Six) Rs. In practice the corporate income tax is one of the most precious taxes of them all.

Here’s one of its functions — one that is strong enough on its own to justify the corporate tax, and indeed was a key reason why many countries introduced the tax in the first place: it is an essential backstop to the personal income tax. If we abolished the corporate tax or cut it severely, large numbers of people would opt to convert their ordinary income into corporate forms held by personal shell companies, so as to pay the lower rate. (Unless they take their income out as dividends, they can defer paying tax on it indefinitely — and often forever.)

So corporate tax cuts can cannibalise the (much larger) personal income tax. In fact, different parts of the tax system ‘spillover’ like this into other parts of the tax system, and onto other countries’ tax systems. (This new article by Andrew Baker of Sheffield Political Economic Research Institute, and Richard Murphy outlines a new framework for understanding these spillovers.) Modern Tax Theory should be able to incorporate these kinds of complexities in how tax systems work.

Not only that, but any theory which has tax at its heart also needs to consider the international dimension.

MMT, International Tax, and the Race to the Bottom

The tax system of Country A can harm the tax system of Country B (tax havens provide ample evidence of this.) A related matter is something that is widely called ‘tax competitiveness.’ Here’s an example from the US economist Randall Wray, a prominent MMTer. He said:

Taxing corporations is a bad idea. It causes corporations to move out of the US. Or to cut special deals: ’give me a tax break and I will build a factory in your community.’ We ought to get rid of the tax. Level the playing field . . . Instead, if we wanted to, we just tax the owners [of corporations.]”

And on taxing the rich, more generally, he said:

Trying to reduce inequality using taxes is not likely to be successful—because the rich influence the tax code and get exemptions. . . I argue for “predistribution”—prevent the growth of excessive income and wealth by . . . eliminat[ing] the practices that lead to inequality.”

These statements don’t generally represent an MMT position on how to structure a tax system or on international tax — there isn’t an easily categorisable position on these matters, as far as we can tell — but it does show how easy it is for MMTers to fall prey to bad old ideas.

Let’s start with the second one: in its purest form — don’t tax the rich because they’ll dodge the tax — is a counsel of despair: a special case of a more general statement: “let’s not try and subject the rich to the rule of law because they’ll use clever lawyers and accountants to escape it.” It’s a version of an argument we see all the time – don’t crack down on tax havens because it’s too difficult, or because the real problem is elsewhere.

These are dangerous, anti-democratic arguments — and we spurn them. Wray’s argument isn’t as stark as this, but he does veer towards the “either/or fallacy” – either we do one thing (raise taxes on the rich) or we do the other (“predistribution.”) Obviously, we should do both.

On corporation taxes Wray, like many MMTers, enters complex terrain without acknowledging enough of the functions of the tax, as laid out in our “10 Reasons to Defend the Corporate Income Tax” document. For one thing, the argument that it’s more efficient to stop taxing corporations and tax the owners of corporations directly, would entail a vast giveaway to the billionaire classes, for reasons outlined here. And his view that corporate taxes encourage corporations to relocate elsewhere is part of a misguided old ‘Competitiveness Agenda,’ laid out here, whose core argument is that we must keep piling tax cuts and other goodies on multinational corporations and mobile global capital, for fear they’ll run away to more ‘hospitable’ locations. This idea is woolly-headed nonsense, from top to bottom.

This takes us into complex terrain, so read this article and this book to get a fuller picture of what we’re talking about. But as a taster, here are a couple of killer problems with this view. When you cut taxes on multinational corporations, or provide them with other goodies, certain things happen, which are eminently measurable. Corporate profits rise, at least in the short term. And corporations may (or, more likely, may not) change their investment plans. Crucially, while the gross benefits that flow from corporate welfare are measurable, many of the costs aren’t. And here are some of those costs:

- lower economic growth

- rising inequality

- greater financial volatility

- larger too-big-to-fail banks

- less competition, more monopolies

- more crime and fraud

- reduced efficiency of investment

- damage to labour and jobs

- less innovation

- corporate cash hoarding

(Click here and associated links to see how each of these works, or refer to the “10 Reasons” document.)

What happens, however, is that traditional tax theorists will look at the measurable benefits of the corporate tax cuts – especially higher profits for corporations – and highlight them, but then airbrush out that much broader range of equally important costs because so many of them are hard or impossible to measure.

Because of this generic imbalance between measurable benefits and unmeasurable costs, a body of tax theory and measurement has grown up that promotes this view that is favourable to corporate tax cuts but isn’t rooted in the real world. As a result, many, if not most of the conventional (academic and other) views on corporate taxes are downright wrong: rooted in generic distortions to the measurements that will never go away. (For a more detailed look at this imbalance, see the “Evidence Machine” in the UK edition of the Finance Curse book.)

Modern Monetary Theory needs to grapple with these issues. Our thinking in this area is a progressive, internally coherent body of work, which encompasses tax havens, the structure of tax systems, crime, and plenty more. Pretty much all of it — tax justice, or Modern Tax Theory, if you like — doesn’t need to be seen as incompatible with Modern Monetary Theory.

___________

NB: This paper by me was one of the consequences of this, and was recognised by Randy Wray as a major contribution to debate on this issue.

No comments:

Post a Comment

One of the objects if this blog is to elevate civil discourse. Please do your part by presenting arguments rather than attacks or unfounded accusations.