(c) by Mark Dempsey

Recently, a student authored an opinion piece for the Davis Vanguard, saying that instead of forgiving, or the government paying off, student debt, the U.S. should work to lower tuition. Sadly, this is the state of play about this issue: even students believe student debt forgiveness is not necessarily a good thing. "It would be unfair to those who did pay debt, too!" is another common reaction.

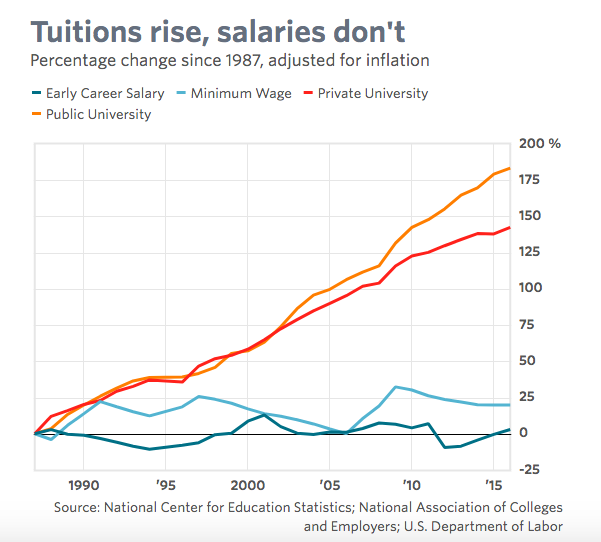

Discussing debt alone ignores one origin of the student debt crisis, too. Investigative reporter David Cay Johnston says that federal grants for higher education have declined 55% since 1972. States have cut their funding for higher education even more sharply. Gosh, I wonder why tuition is so high?

It looks like the fix is in. Ignoring this agrees with then-governor Reagan eliminating civics education in California's high schools, and congress' self-lobotomy, when Newt Gingrich fired its expert staff.

Meanwhile, only mortgage debt exceeds student debt in the U.S, so student loans are a significant problem. Solving that problem has not been helped by the recent bipartisan legislation which says courts can no longer retire student debt in bankruptcy. Members of both parties, Joe Biden and Hillary Clinton included, voted for this change to the law. That change means that in the U.S. now, we're literally garnishing Social Security checks to pay off student debt.

Another source of the problem is mathematically baked into the way debt compounds. When someone asked Einstein what was the most powerful force in the universe, "compound interest" was his reply. The problem is that in compounding, interest inevitably makes the amount owed head toward infinity.

On the other hand, the real economy that provides the means of repayment is finite. Even ancient societies in Israel and Babylon knew debts would inevitably become unpayable, and had periodic "clean slates" (jubilees) during which debts were forgiven, not as something revolutionary, rather as a way of ensuring stability in their societies.

Yet when I've mentioned clean slates as a potential solution, I've even had people suggest that since ancient times, the economy hasn’t really “leveled out” so repaying loans whose interest compounds might be possible today. But interest compounding is up to the task of making loans unpayable. Says one website about "The Explosive Effect Of Compound Interest: If you had invested [a penny] at the time of the birth of Jesus, with a compound interest of 5%, it would have a value today of the number of pure gold balls, each the size of the Earth, shown below:

606,894,448"

So...I’ll stick to my original story: Some loans inevitably become unpayable because it’s impossible for the real economy to keep up with the demands of compound interest owed. Jubilees for societies and bankruptcies for individuals aren’t optional if you want to prevent effectively enslaving debtors.

Currently, the Federal Reserve reports that 40% of the population in the U.S. can't afford a $400 emergency without borrowing or selling something. This means that creditors are in the driver's seat.

Creditors control the popular narrative about debt, too, so it's not surprising that one often hears "everyone should pay their debts." But that statement ignores the context in which previously covered expenses are no longer paid by government, and the fact that, inevitably, compounding makes repayment of some loans impossible.

We cannot count on lenders' kindness, either. For one example, Mr. Potter, the villain in It's a Wonderful Life, was interested in enslaving the population, not empowering them with what they borrowed.

That "everyone should pay their debts" sentiment also ignores the responsibility of the lender. If I have a hot tip on a horse in the fourth race, and persuade a bank to lend me the money for a bet, does the sheriff need to honor that lender's decision and make me forfeit any security for the debt? If a dictator borrows from the World Bank, embezzles the money, then absconds to Switzerland, should the population still be obliged to pay that (odious) debt? Looser bankruptcy makes for better loan underwriting, and believe it or not, sometimes deception and less-than-honest motives make lenders deceive borrowers so they take on more debt than they can possibly afford (see Confessions of an Economic Hit Man by Tom Perkins).

Borrowing is not always fair. Repayment is not always virtuous, and financializing all decisions in pursuit of profit is not always healthy, or even ethical. Ignoring that is at the root of many problems, including student debt.

This is a systemic problem, too, amenable to systemic solutions only. Protesting that individual virtue will save the day is a distraction, not a solution.

Update: Naked Capitalism covers the accounting shenanigans that make the student loan problem even worse.

Update #2: From Why Does College Cost So Much

The article states lower subsidies are not the cause of higher tuition. It blames that on higher administrative costs (CEOs are more expensive now, too), and the fact that overhead--amenities for students--has nearly tripled.

"Here’s the change in average revenue generated per student at American colleges and universities across the last 40 years, in constant inflation-adjusted dollars (1978 through 2018, which is the most recent year for which data are available):

Increase in per student revenue between 1978 and 1988: 18.4%

Increase in per student revenue between 1988 and 1998: 28.6%

Increase in per student revenue between 1998 and 2008: 12.1%

Increase in per student revenue between 2008 and 2018: 24.2%

Total increase in per student revenue at American colleges and universities during the New Gilded Age (1978-2018): 111.9%.....

It is certainly arguable that American higher education should be funded at even higher levels than it is today. What is not defensible is the idea that we should give the people who have constructed the current system even more money, without also creating some better system of accountability in regard to how they are choosing to spend that money."

No comments:

Post a Comment

One of the objects if this blog is to elevate civil discourse. Please do your part by presenting arguments rather than attacks or unfounded accusations.