In a continuation of a conversation with my brother about inflation, he’s responded to this blog post with the text in italics below.

…from what I can see, suppressing the economy (through raising interest rates or using other methods) is the only method that has historically worked to lower inflation….do you have a historical reference to your approach that documents that you are correct?

If you reread that original blog post, you’ll see several suggested inflation suppressing alternatives to raising Fed Funds rates. Also, your insistence that Volcker’s rate rise was the definitive template for dealing with inflation confuses correlation with causation. Your thinking is “Volcker raised interest rates, and inflation receded. He must have caused the receding!” It was a coincidence, not a cause, though.

So…what you believe is historically truth is not necessarily so. Other things were going on at the time Volcker raised rates.

I doubt there’s much controversy about the cause of the inflation in the ‘70s. Petroleum went from $1.75/bbl in 1971 (U.S. pre-fracking peak oil), quadrupling overnight when OPEC withheld production in 1973 until it reached $42/bbl in 1982.

This period was the first time the U.S. couldn’t produce its way out of an energy shortfall. Remember, one reason the Japanese attacked Pearl Harbor is that the U.S. stopped shipping oil to Japan inresponse to its invasion of Manchuria.

A shortage of goods (oil) and a balance of payments problem (imported oil), not “too much money” were at the source of the ‘70s inflation problem. Note that the growth rate of U.S. GDP declined after this energy crisis and has never recovered.

The price rise in oil seriously damaged the American economy and Volcker used inflation as an excuse to raise interest rates until prime commercial loans cost 21%, and mortgages were 16% - 18%. That made the economy much worse. It’s hard to imagine any economy thriving after that beating (and the beatings must continue until morale improves).

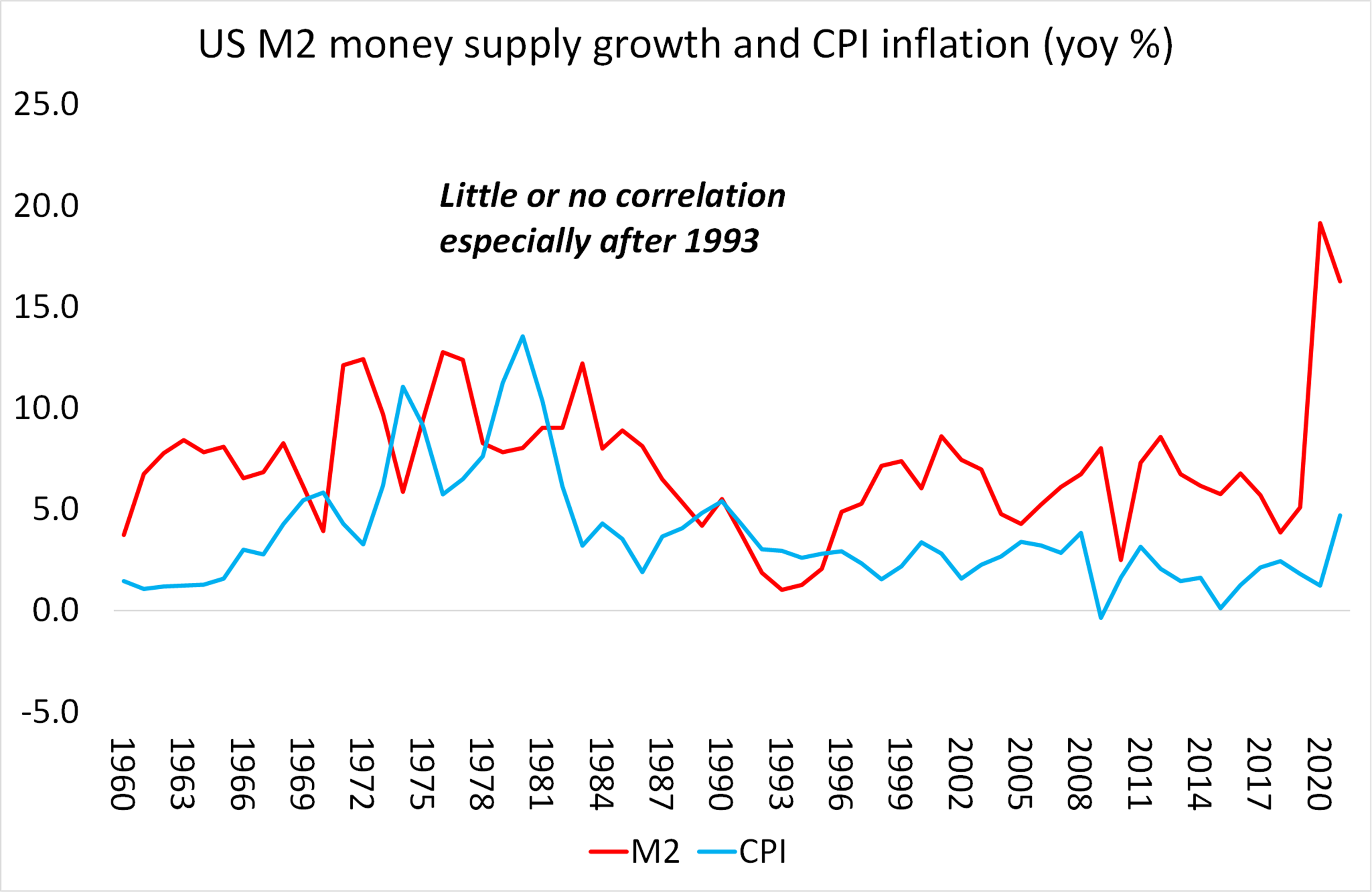

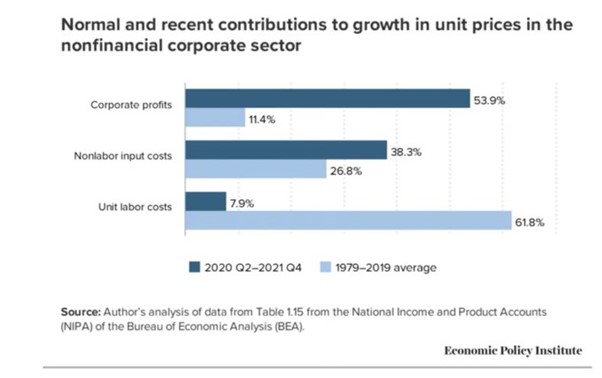

But Volcker’s primary agenda was to reduce wages–something he and current economists believe is at the root of inflation despite all the evidence to the contrary (see the graph below). Inflation reduction was incidental. (Historian and economist Michael Hudson’s tells the full story).

That’s the history. You may ask: If Volcker’s high-interest “medicine” didn’t make inflation subside and was merely coincidental, what did suppress inflation? First: Jimmy Carter deregulated natural gas. The effect wasn’t immediate–it takes time to drill and produce, and as you know, oilmen won’t drill unless they can charge more than it costs to produce the stuff. Offshore and fracked oil requires $70/bbl oil at least.

More difficult to get gas meant they had to get higher prices. The price of natural gas as delivered to consumers peaked in 1986 at about six times its cost in the early 70s (see this for the graph). Compare the six times more expensive natural gas inflation to oil going from $1.75 in 1971 to $42 in 1982 (That's a 24 times increase). So deregulated gas was orders of magnitude less inflationary than OPEC oil.

One side note: the petroleum industry is not above stirring up trouble internationally to raise oil prices. The Iraq war is a prime example. They didn’t support the war to get Iraqi oil, they supported it to keep that cheaper oil in the ground.

Second: One other thing brought down inflation in the Reagan administration: Alaska’s North Slope oil production came online, alleviating the petroleum shortage to the extent that prices retreated to nearer $10/bbl. That’s a little less than six times the $1.75 1971 price. Again, less inflationary than the $42 peak price.

So addressing the source of inflation was effective. Volcker’s Fed interest rate rise was a sideshow.

Nevertheless, Carter was on board with Volcker’s attack on labor. He deregulated trucking and airlines, demonstrating deregulation for Reagan to mimic. This deregulation essentially kicked unions out of those heavily unionized industries. In response, the Teamsters endorsed Reagan in the next election.

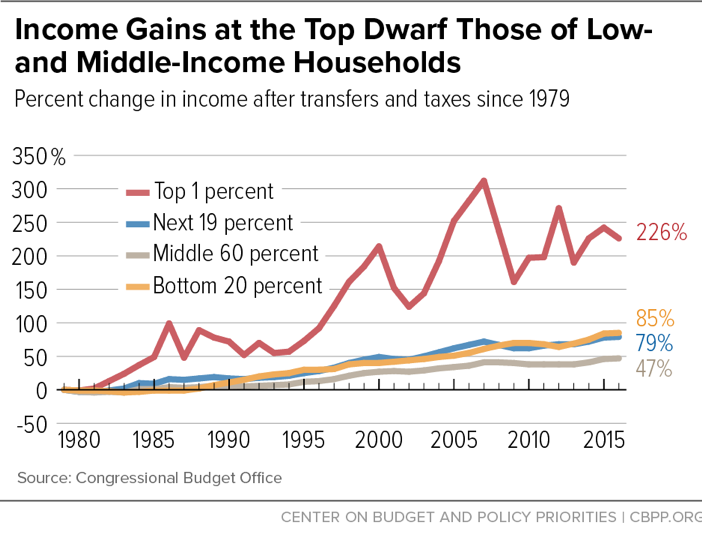

Before Carter did this, unions were powerful, and 70% of American workers had defined-benefit pensions. Defined-contribution retirement plans (IRAs, 401Ks) are about half as remunerative as the defined benefit pensions. The current population with defined-benefit pensions is around 4%. So what’s all this nostalgia about making America Great Again about? There’s a hint for you.

Reagan was very slick and persuasive, and Carter is not a kindly Christian, as his current, carefully curated public image suggests. He ruthlessly attacked labor to lower wages (and Reagan attacked their pensions...see Ellen E. Schultz' Retirement Heist), just as Volcker did.

You might remember this graph of our current situation:

It demonstrates that wages (the red line) are not the source of current inflation, but egregious corporate profits (the blue line) just might be. You want an alternative strategy to curb inflation? How about an excess profits tax on corporate America? Or isn’t that a plausible cure for inflation? Our last liberal president, Richard Nixon, addressed inflation with wage and price controls.

As for the history of inflations:

Studies of extreme inflation demonstrate issuing too much currency did not produce hyperinflation. "Not a single one of … 56 cases [of historic hyperinflation documented by a recent Cato study] was caused by a central bank that ran amok. In virtually every case, the inflation was not caused by too much money but too few goods." In the most famous of often-cited hyperinflations, farming collapsed in Zimbabwe as Rhodesian farmers left, leading to a food shortage, and German World War I payments deprived German consumers of goods. The cherry on top of this goods shortage came in 1923 when France sent troops and annexed the industrial Ruhr further depriving Weimar Germany of goods while it was still burdened with those Reparations. - (Quote from Stephanie Kelton, commenting on the Koch-funded Cato institute history of hyperinflations)

Historically, inflation "is overwhelmingly driven by cost-push variables... Printing money just doesn't do it. If it did, Japan would have exploded decades ago, because they've been trying quantitative easing for nearly 20 years, and they can't move the needle on inflation. We've been trying it here in the U.S. for about five years, and [the Fed can’t even hit its then current] 2% [inflation] target." – Stephanie Kelton, Senate budget committee economist commenting in 2013.

In other words all the “money printing” by central banks in history did not initiate inflation–even hyperinflation!

… giving money to the poor is an undesirable method of lowering inflation which can be seen by Bidon's American Rescue plan

The big question: “undesireable” to whom?

Biden’s “giving money to the poor” plan was a smaller successor to a similar Trump policy. Here’s the Trump administration’s economic record from Wikipedia.

Poverty receded (2016: 12.7%, 2019: 10.5%)

Trump’s Coronavirus Aid, Relief, and Economic Security Act (CARES) had a $2.3 trillion price tag compared to $1.9 trillion for Biden's plan. Trump’s plan gave and lent people money, but inflation remained low. Here are the (annualized) inflation rates for the months following that act's passage: 2.3% 1.5% 0.4% 0.2% 0.7% 1.0% 1.3% 1.4%.

So here’s the question you need to answer: Trump’s distribution of money did not cause inflation, certainly not at current levels. Why would Biden’s smaller distribution suddenly be inflationary now?

So, though you’re free to believe otherwise, Biden giving people “rescue” money is not at the root of inflation, that's just the propaganda you'll read on the editorial pages. Shortages of goods from COVID-19, industrial shutdowns in China and domestically, the sanctions restricting access to petroleum, and the war in Ukraine are all to blame back here in reality. It’s not “too much money”; it’s too few goods.

If inflation were a product of high demand or higher wages, the Fed raising interest rates might be justified. That Volcker-esque strategy “works” by suppressing wages and making employment uncertain, as the previous post documented. In other words: it promotes labor discipline. Remember, labor discipline sends the message that “You had better take whatever crappy job is on offer, or suffer the indignities of poverty, even homelessness, and starvation. And if you’re extra ornery, we’ll put you in a cage.” With 5% of the world’s population, the U.S. has 25% of its prisoners. The beatings must continue until morale improves, too.

Here’s a recent tweet about how that threat of labor discipline shows up in local law enforcement:

Conditions in Cleveland's Cuyahoga County Jail are so horrific that at one point a judge refused to send people there, releasing everyone charged with crimes without bail.

Wardens and guards have been criminally prosecuted for beating and killing people. Hard to see the humor.

Meanwhile: US is becoming a ‘developing country’ on global rankings that measure democracy, inequality

In its global rankings, the United Nations Office of Sustainable Development dropped the U.S. to 41st worldwide, down from its previous ranking of 32nd. Under this methodology – an expansive model of 17 categories, or “goals,” many of them focused on the environment and equity – the U.S. ranks between Cuba and Bulgaria. Both are widely regarded as developing countries.

The U.S. is also now considered a “flawed democracy,” according to The Economist’s democracy index.

As a political historian who studies U.S. institutional development, I recognize these dismal ratings as the inevitable result of two problems. Racism has cheated many Americans out of the health care, education, economic security and environment they deserve. At the same time, as threats to democracy become more serious, a devotion to “American exceptionalism” keeps the country from candid appraisals and course corrections. [emphasis added]

Also, you did not address my point about addressing social problems instead of handing out money to the poor. Giving money to the poor does not guarantee social engagement or provide people with the tools, or knowledge or support to combat poverty.

Your proposal is sort of like Mitt Romney’s advice for the poor. He suggested poor people just borrow $20K from their family to start a business. It’s superficially credible, but clueless, especially in an economy where (according to the Fed) 40% of the population can’t handle a $400 emergency without selling something or borrowing, and where 95% of new businesses fail.

Your "strategy" completely ignores the systemic component of poverty, too, focusing exclusively on individual responsibility. It covertly endorses the popular narrative that the poor are just lazy, Cadillac welfare queens. If they’d only show some initiative, darn them…!

Not sucking up, but kicking down on someone exhausted by economic deprivation is not an effective motivator. That’s not how motivation works. See Barbara Ehrenreich’s Nickled and Dimed for an account of how exhausting poverty is. Or take a look at George Orwell’s Down and Out in Paris and London (1933). Excerpt:

“Hunger reduces one to an utterly spineless, brainless condition, more like the after-effects of influenza than anything else. It is as though all one’s blood had been pumped out and lukewarm water substituted.”

“It is fatal to look hungry. It makes people want to kick you.”

Feeding the starving must precede the demand that they become sensible. Your suggested strategy is something like "Look, I know they're sick, but they've got to do this really strenuous dance/gymnastic before we give them medicine." See Steve Martin's sobriety test for an example.

Economic inequality actually distorts the public narrative, too.

“In … Domination and the Arts of Resistance (1990), James Scott makes the point that whenever one group has overwhelming power over another, as when a community is divided between lords and serfs, masters and slaves, high-caste and untouchable, both sides tend to end up acting as if they were conspiring to falsify the historical record. That is: there will always be an 'official version' of reality--say, that plantation owners are benevolent paternal figures who only have the best interest of their slaves at heart--which no one, neither masters nor slaves, actually believes, and which they are likely to treat as self-evidently ridiculous when 'offstage' and speaking only to each other, but which the dominant group insists subordinates play along with, particularly at anything that might be considered a public event. In a way, this is the purest expression of power: the ability to force the dominated to pretend, effectively, that two plus two is five. Or that the pharaoh is a god. As a result, the version of reality that tends to be preserved for history and posterity is precisely that 'official transcript.' – From (footnotes) The Dawn of Everything: A New History of Humanity by Graeber and Wengrow

The political talking point is that poor people deserve their poverty. Its corollary is that rich people deserve their wealth, and no rich person stole their fortune! Unfortunately, curing poverty means having to treat entire populations for the PTSD stemming from this misinformation. Why? Because the beatings will continue until morale improves.

Deserving, and “earning” privileges is paramount in this point of view. It’s a false premise. Think of the dogs retrieving bones in my example of systemic problems. Whether they deserved a bone or not, one came up short because the system only had nine bones when there were ten dogs. The self-flattery that you deserve existence, wealth, health, etc. is part an parcel of this kind of delusional thinking. These things are gifts! They are not earned.

Humans often feel they must earn, or repay as part of the instinctual programming that enhances social cohesion, but gifts are very tough on us all. I’d say all those prayers of thanks and sacrifices on altars are to relieve the pent up tension of feeling obligated. God doesn’t need any of that stuff. We do.

Honestly, unless we just decide to ignore inflation as a necessary evil, I can't seem to find any other tool to lower it.

Well of course you can’t find it. You’re not looking anywhere except at the story you’ve already told yourself. You ignore the alternatives suggested in my previous blog post. Things like making peace in Ukraine, or a job guarantee.

In this writing, I remind you that ending a critical shortage (Carter deregulating natural gas, Alaska's North Slope) was the cause of lower inflation, it wasn’t Fed funds rate manipulation. My suggestion: stop clinging to a false narrative, and believing the “official” history. It’s propaganda with an agenda.

Incidentally, I don’t blame you for adopting this narrative’s point of view. Practically every mainstream medium emits it constantly. Says New Zealand blogger Caitline Johnstone:

“Make no mistake, maintaining narrative control is the single highest priority of the establishment. Not keeping taxes down, not keeping Bernie out of office, not even keeping the wars going. Without narrative control, their entire empire will crumble. Never lose sight of this….

If you can control what happens, you’ll have power until the public gets sick of your bullshit and removes you. If you can control what the public thinks about what happens, you’ll have power forever ….

The overwhelming majority of human effort goes into competing against other humans. We do have the ability to take all that lost energy and re-route it toward collaborating with each other toward health and thriving. There is no real reason we can’t do this. There are no hard obstacles preventing us from moving away from our failed competition-based model to a collaboration-based model. All that’s stopping us is plutocratic propaganda and our collective belief in it. We do have the ability to drop that belief and move toward sanity.

For a fuller explanation of the economic narrative you must abandon to see alternatives, I’d recommend reading Economics is Bunk (written before this dialog). Here’s an excerpt:

“Leading active members of today’s economics profession… have formed themselves into a kind of Politburo for correct economic thinking. As a general rule—as one might generally expect from a gentleman’s club—this has placed them on the wrong side of every important policy issue, and not just recently but for decades. They predict disaster where none occurs. They deny the possibility of events that then happen. … They oppose the most basic, decent and sensible reforms, while offering placebos instead. They are always surprised when something untoward (like a recession) actually occurs. And when finally they sense that some position cannot be sustained, they do not reexamine their ideas. They do not consider the possibility of a flaw in logic or theory. Rather, they simply change the subject. No one loses face, in this club, for having been wrong. No one is disinvited from presenting papers at later annual meetings. And still less is anyone from the outside invited in.” [emphasis added] - from James K. Galbraith’s Who are these economists anyway?]

Conventional economics is baloney, through and through. The policies you believe are the only alternatives come from orthodox, neoclassical (monetarist) economics.

I teach a senior education course called “Heterodox Economics.” And I’m certainly not the only one who disagrees with the current economic orthodoxy. Orthodox (Republican) economist Greg Mankiw has had protests staged by his students because he insists on ignoring a wider point of view.

Changing your mind

In my experience, humans have great difficulty changing their minds, or their mental narratives–and narratives always trump facts. The thrust of what I’ve been saying is that your economics narrative is mistaken. I’m not sure the facts are completely convincing to you, though.

Hans Christian Anderson’s story about the emperor parading proudly until a child says “Hey! He’s naked!” does not end with the emperor saying “Thanks little child for pointing out my mistake. I’ll go back home and put some clothes on so I’ll be warm and can parade with dignity.” Instead, the emperor “grimly continues the parade.” That’s human nature. None of us is exempt from the impulse to cling to faulty narratives. Admitting a mistake is like pulling teeth.

Calling what guides your life a “narrative” is not something exotic. If I asked you whether you left your keys on your bedside table, odds are you’d look at the picture of that table in your head before you walked back to see it in the flesh–a tremendous time saver and one of the reasons human beings are this planet’s dominant species.

The picture in your head is part of the narrative, and contradicting even a tiny corner of that story is something most people resist fiercely. Losing a piece of the narrative may appear to be life-threatening (In the extreme: “I’ll die if those keys aren’t where I picture them!”).

Historical examples of resistance to narrative changes.

When Copernicus and Galileo contradicted the conventional geocentric system of planets during their time, the church “corrected” them. Copernicus published posthumously, evading punishment, but Galileo endorsed the heliocentric solar system and spent his later years under house arrest for contradicting the official narrative, even though his facts were accurate.

Max Planck, the discoverer of the quanta of quantum mechanics, tried in vain to persuade his physics professor peers that quanta solved some major difficulties with the Newtonian physics they taught. Among other things, Newton’s physics predicts the heat death of the universe. In Newtonian physics, electrons must spiral into the nucleus of atoms, essentially wiping out everything. Quanta corrects that obviously false prediction..

So…did the very smart physicists Planck contacted say “Thanks, Max! You’ve shown us the error of our ways”? Nope. They stuck to their story, saying “We can see no solution to the problem of heat death.” Planck famously proclaimed “The truth never triumphs. Its opponents simply die out. Science advances one funeral at a time.”

The “enlightenment” promoted by eastern religions is at least partly cultivating the ability to entertain alternative narratives. Zen Koans disclose flaws in language describing reality. Christian parables (e.g. the Prodigal Son) disclose that our ideas about obligation may be limited–after all, the prodigal, not the good son who deserved it, got the fatted calf. Eric Berne’s work (particularly What Do You Say After You Say Hello?) describes how people become servants of narratives that can be literally centuries old. How many people are waiting for prince/princess charming before they wake up? The fiction of Sleeping Beauty is that such a wait doesn’t age the princess, but people still believe they can wait without consequence or aging!

Various courses (New Warrior Adventure Training, The Forum, etc.) promise enlightenment, explore alternative narratives, and are very popular. Why? Because unenlightened ways of being imprison us, sapping our energy, distorting our perception, etc. People feel liberated and lighter after they escape their previous narrow thinking.

...reference my preference for dealing with social problems.

As far as I can tell, your preference for dealing with social problems is to find deserving poor people and “enrich” them with training, scholarships, and/or laptops. These means-tested grants would eliminate the problem of giving money to the undeserving poor.

In addition to my evaluation of the problem as systemic (see the previous blog post), I say “Judge not lest ye be judged” is the standard to follow here. We’re not equipped to evaluate others without prejudice and find the people who “deserve” a healthy, productive life, and those who do not. Individual actions that do not change the system are impotent when it comes to solving such problems. One example: Giving homes to homeless people (as Finland does) often predates their return to sanity.

Even people with disabilities can be treated compassionately, without the cruel suppression and homelessness currently in vogue. Our current cruelty to the unhoused is a long time coming, too. Nixon stopped the government building affordable housing. After he cut taxes on the wealthy roughly in half, Reagan cut HUD's affordable housing budget by 75%.

Decades ago, American mental institutions were defunded, closed, and a substitute was never funded. Ever wonder where all those homeless mentally ill come from? Answer: public policy.

Science tells us, for another example, that special needs kids need a maximum of eight in a classroom if they are to progress and have productive lives, yet our public policy chronically underfunds special ed.

A crappy public realm (what's available to all) is part of labor discipline. It reminds poor people that poverty is a major hassle. Meanwhile, there are alternatives: The arts budget for the City of Berlin exceeds the National Endowment for the Arts’ budget for the U.S. of A. But no! We can't have that! We must have labor discipline! The beatings must continue until morale improves!

It’s not a shortage of resources that constrains us to this kind of cruelty, San Francisco has five times its homeless population in vacant homes. Even the finances make more sense when kindness guides policies. Studies in Colorado and Nevada demonstrate housing the homeless is cheaper than hassling them with cops and taking them to emergency rooms.

History has many examples of societies refusing to value outcasts. People of color could not access social safety nets before 1964 (the Civil Rights Act changed that). So…were all people of color unqualified for our sympathy and support? All were certainly denied those safety nets. Ever wonder why people of color are so poor…?

And yes, people with an agenda–like Carter and Volcker–will distort history to favor their cruel conclusions. The Confederate South even fantasized that the Civil War wasn’t about slavery, it was to enforce the dominance of the northern banks (They want to teach this in schools). Critical Race Theory is controversial now because we apparently can’t acknowledge that African Americans were really Kidnapped Americans.

What’s worse, even those on top suffer from this setup. Harry Truman proposed single-payer healthcare in 1948. The Dixiecrats were concerned that they would have to integrate their hospitals, so they killed that proposal.

We’re still dealing with the fallout from that. The U.S. has a half million medical bankruptcies and an estimated 40,000 annual deaths because people don’t have the kind of care they need. Canada has none of that (and one-seventh the prisoners, per capita, without any increase in crime).

Meanwhile:

More Than 335,000 Lives Could Have Been Saved During Pandemic if U.S. Had Universal Health Care (excerpt: "In the United States, death rates from COVID-19 are higher than in any other high-income country—and our fragmented and inefficient health system may be largely to blame, Yale researchers say in a new study.").

That’s how even the dominant race suffers from prejudice. It’s lose-lose. Yet how many people do you know who would rather than die than admit a mistake?

Single-payer healthcare has better outcomes and costs roughly half of what we currently pay for health care. How about single-payer as a non-raising-interest-rates solution for inflation?

And I’m not kidding when I say we have to deal with entire populations with PTSD. That’s not light duty, and standing in judgment on such people, means testing programs that address their problems, is more than beside the point, it’s cruel, ineffective and insensitive. It’s not what they need, and it’s not what works. As long as you want means-tested scholarships and laptops to solve our problems, and ignore the big issue–poverty that afflicts undeserving and deserving alike–you’re straining at a gnat while swallowing a camel.

The overall impression I get from your recommendations is that a little unemployment is good for us all if we cure inflation with it, right? They (those undeserving poor people) deserve unemployment after all! They’re lazy! Unambitious! Undeserving! Heck, even unproductive!

But you didn’t deserve to exist, or deserve to be born without birth defects, or to have funds for college, or to be white and male, or to inherit from parents. Deserving has nothing to do with that. You were born on third base. Yes, you’ve made some good decisions, but acting as though you hit a triple isn’t credible. Why do you pick the mote from poor peoples' eyes and ignore the beam in your own?

Incidentally, in case you’re thinking “But if we pay those economic losers, or provide cheap or free housing, won’t taxes rise?” No. Not even that. Financially speaking, the cruelty is entirely unjustified.

Federal programs are not provisioned by tax revenue. They can’t be. Federal spending is constrained by available resources, but the Fed says U.S. economic capacity is about 79% employed. It’s not possible for a new program to “steal” resources from existing ones (as Nancy Pelosi’s “PayGo” principle says) if resources used are less than 100%, at least not yet. It is, however, possible for federal spending to mobilize unemployed resources. So…no sacrifice is necessary to provide a humane environment even for the poor, disabled, widows and orphans.

So…sorry…your economic illusions are a small part of you, so I won’t like you any less because you cling to the story that you’re deserving and certain poor people aren’t, even if it’s not true.

This discussion of changing minds reminds me of a scene in an old Andy Griffith show I saw recently where Floyd the Barber said something like “It’s like Mark Twain said ‘The more things change, the more they stay the same.’” Andy replied: “Floyd, I don’t think Mark Twain said that.” Floyd deferred to Andy’s knowledge, and the conversation continued. Then, a little later, Floyd said “Yep, it’s just like Mark Twain said ‘The more things change, the more they stay the same.’…” The persistence of incorrect knowledge was a gentle joke.

That’s us.

Update: The Inevitable Financial Crisis

Update #2: Today Yves Smith of Naked Capitalism writes about the now Inevitable Financial Crisis….

The

second warning comes from ‘Dr. Doom’ Nouriel Roubini….

The central banks have misdiagnosed the reason for the currently high inflation rates. They were caused not only by too much stimulus provided by governments and the central banks but to a large part by the lack of supplies which is to the consequence of the pandemic and the ‘western’ sanctions following the war in Ukraine. By increasing interest rates the central banks fought against the wrong enemy. They made things worse….

Update #3: From Hyman Minsky (the economist of disequilibrium, cited by

Stephanie Kelton):

...if an economy with a sizeable body of speculative financial units is in an inflationary state, and the authorities attempt to exorcise inflation by monetary constraint, then speculative units will become Ponzi units and the net worth of previously Ponzi units will quickly evaporate. Consequently, units with cash flow shortfalls will be forced to try to make position by selling out position. This is likely to lead to a collapse of asset values.

Update #4: [Contradicting predictions] Physical child abuse dipped substantially [during COVID], according to a

recent analysis of child abuse indicators and statistics published in a journal of the American Medical Association—in large part due to the substantial government investment in keeping families financially afloat during the economic shutdown.

It illustrates a major analytical error underpinning American child abuse policy. Appalling cases of beating or rape of children are a major political motivation behind child protective services (CPS) and their habit of “child separation,” or taking kids from their families and placing them into foster or group homes. But in reality, a large and growing majority of child abuse is simple neglect, which can be greatly ameliorated with the welfare state; and CPS actions are themselves often abusive.