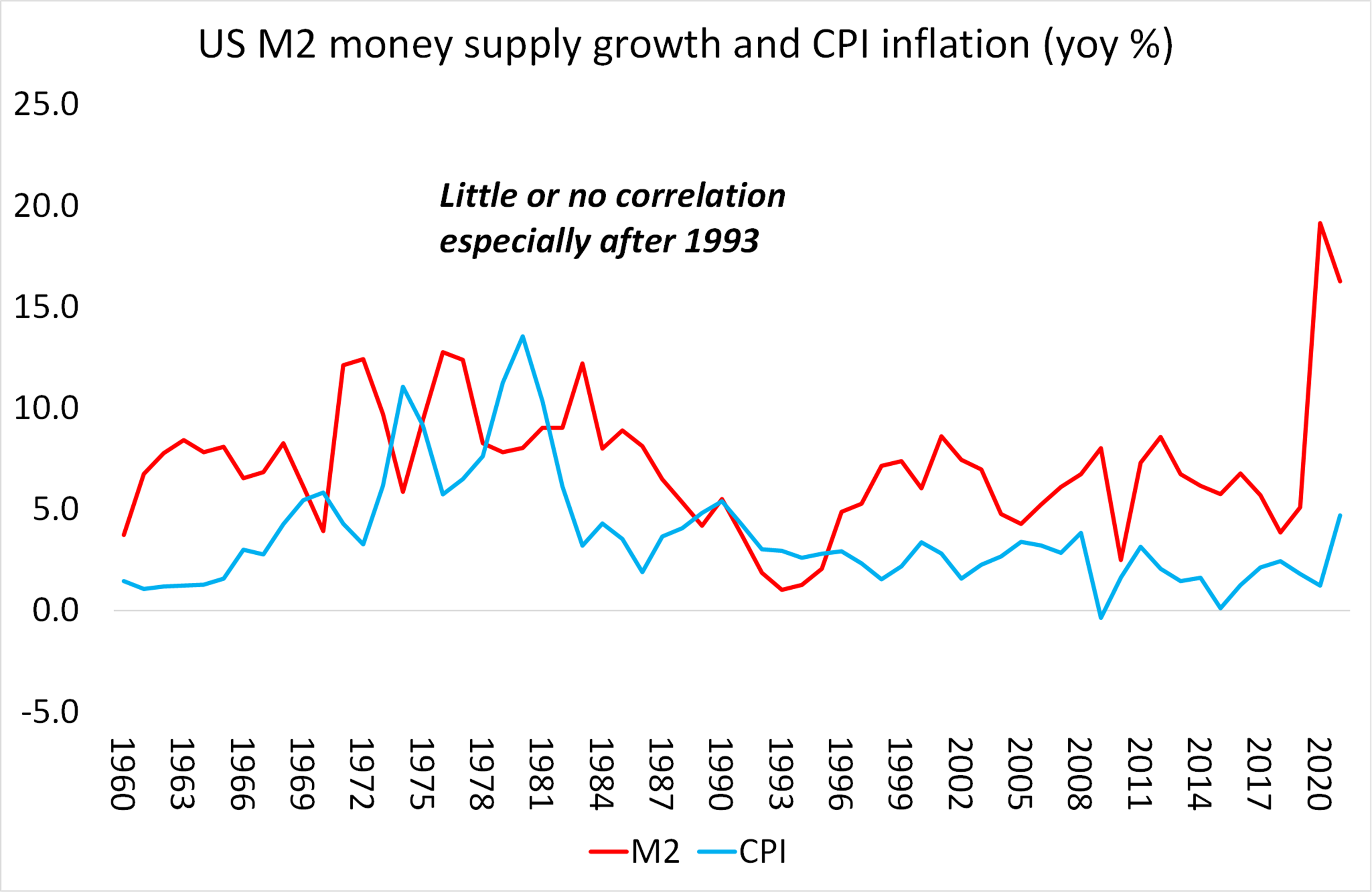

Meanwhile, not all economists agree. See Michael Roberts, for one example. Here's the graph Roberts publishes of the relationship between money supply and inflation. Hanke cannot explain the obvious lack of connection between the two lines, even if you factor in Hanke's suggestion there's a lag between money supply expansion and the appearance of inflation.

Hanke says he studied inflation in 157 countries (between 1990 and 2021) that had an increase in money supply. His assertion: inflation increased 1-to-1 relationship with that money supply. Where is this correlation in the U.S as outlined above in the graph? Hint: it doesn't exist.

At the time of the interview with Stewart, Hanke said Japan had 3% inflation despite a national debt of 240% of GDP--which, according to Hanke, should correlate with a large money supply. Where is the inflation inevitable from such a large money supply? No answer. Japan's pays ~0% interest on its national debt and has low inflation even now (still 3% in 2022, says Google).

Conventional--especially Reagan's "supply side" and "monetarist"--economics is baloney. Remove the baloney, and nothing remains. For the long form of this, see Steve Keen's book Debunking Economics: The Naked Emperor Dethroned. Not an easy read, but, in contrast to charlatans like Hanke, Keen predicted the Great Recession of 2007-8 (and won the Revere prize for doing so). Conventional economists, Hanke included, did not predict this largest-since-the-Great-

Hanke accurately says banks create most of the money supply (90%). He adds deficit increases put that money supply increase on steroids. What he omits saying is that the central bank ("The Fed") therefore cannot ever control the money supply since it only makes 10% of the money. Monetarism is a transparent scam, but it dominates the headlines and much of what advises public policy.

Hanke decries Obama-era regulation (the weak tea of Dodd-Frank, which did not revive Glass-Steagall) as harmful. His point: After Dodd-Frank, banks began withdrawing their contribution to the money supply, and that regulation--not crooked mortgages, derivatives, and Ponzi capitalism--is what caused the Great Recession--something he did not predict, despite his "time lag" theory between money supply decrease and recession.

Hanke never mentions what the Fed did (unrelated to QE) in 2007-8: It extended $16-$29 trillion in credit to Wall St. (the figures are from the Fed's own audit). Where was the inflation during, or immediately after that boost to the money supply? It didn't occur. Is it really a surprise he omits mentioning this?

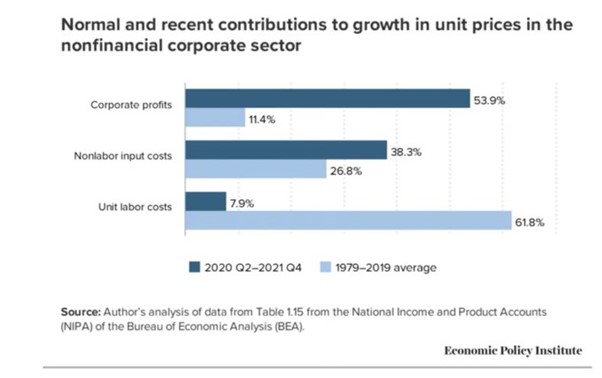

Stewart suggested that record corporate profits might be behind inflation. Hanke denies it. Except this graph shows Hanke's lying again:

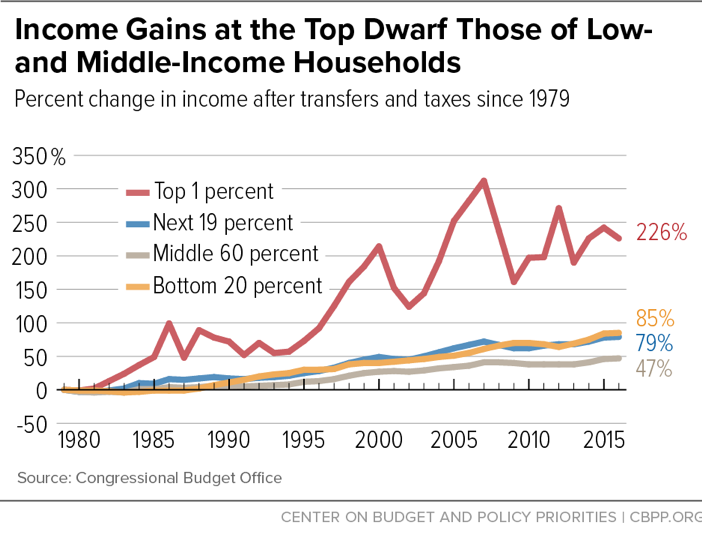

Trying to be sympathetic with labor, Hanke even says "The little guy gets screwed in inflation" - but even that's a lie if the little guy is a debtor. Inflation favors debtors since they repay loans with cheaper currency.

I do wonder why Jon Stewart was so respectful to Hanke. When he interviewed con man stock picker Jim Cramer Stewart was not nearly so polite.

From CNN:

Shell will buy back $4 billion worth of shares and increase its dividend by 15% after posting another gigantic quarterly profit thanks to strong oil and gas prices. The UK company posted net income of $9.45 billion in the third quarter, more than double the $4.1 billion it recorded a year ago. The result was driven by a strong performance in its oil exploration and production business, Shell said. The company’s stock at one point rallied more than 4% in London on Thursday as investors cheered the news. The additional buybacks will increase total share purchases for the year to $18.5 billion, some 10% of the company’s share capital.

Update #2: May God Save Us From Economists.

Over the last half-century, economics has infiltrated parts of the federal government where it has no business intruding. It can be a useful tool for policymaking, but it’s become the only tool. It’s time for economics to back the hell off.

Update #3: I'm not the only one who believes the Inflation Narrative is Fabricated, as is the response.

Update #4: US oil producers reap $200bn windfall from Ukraine war price surge Financial Times. But no! We must be concerned about increasing labor costs!

Update #5: Wall St. investor Richard Vague's article (here) denies inflation is connected to money supply growth. Excerpt:

"Monetarist theory, which came to dominate economic thinking in the 1980s and the decades that followed, holds that rapid money supply growth is the cause of inflation. The theory, however, fails an actual test of the available evidence. In our review of 47 countries, generally from 1960 forward, we found that more often than not high inflation does not follow rapid money supply growth, and in contrast to this, high inflation has occurred frequently when it has not been preceded by rapid money supply growth."

No comments:

Post a Comment

One of the objects if this blog is to elevate civil discourse. Please do your part by presenting arguments rather than attacks or unfounded accusations.