"The first principle is that you must not fool yourself and you are the easiest person to fool." - Richard Feynman

"You Yanks don't consult the wisdom of democracy; you enable mobs." - Australian planner

Sunday, October 30, 2022

Saturday, October 29, 2022

Conventional Economics' Inflation Explanation is Bunk - a continuation, based on Jon Stewart's interview with a Reagan economist

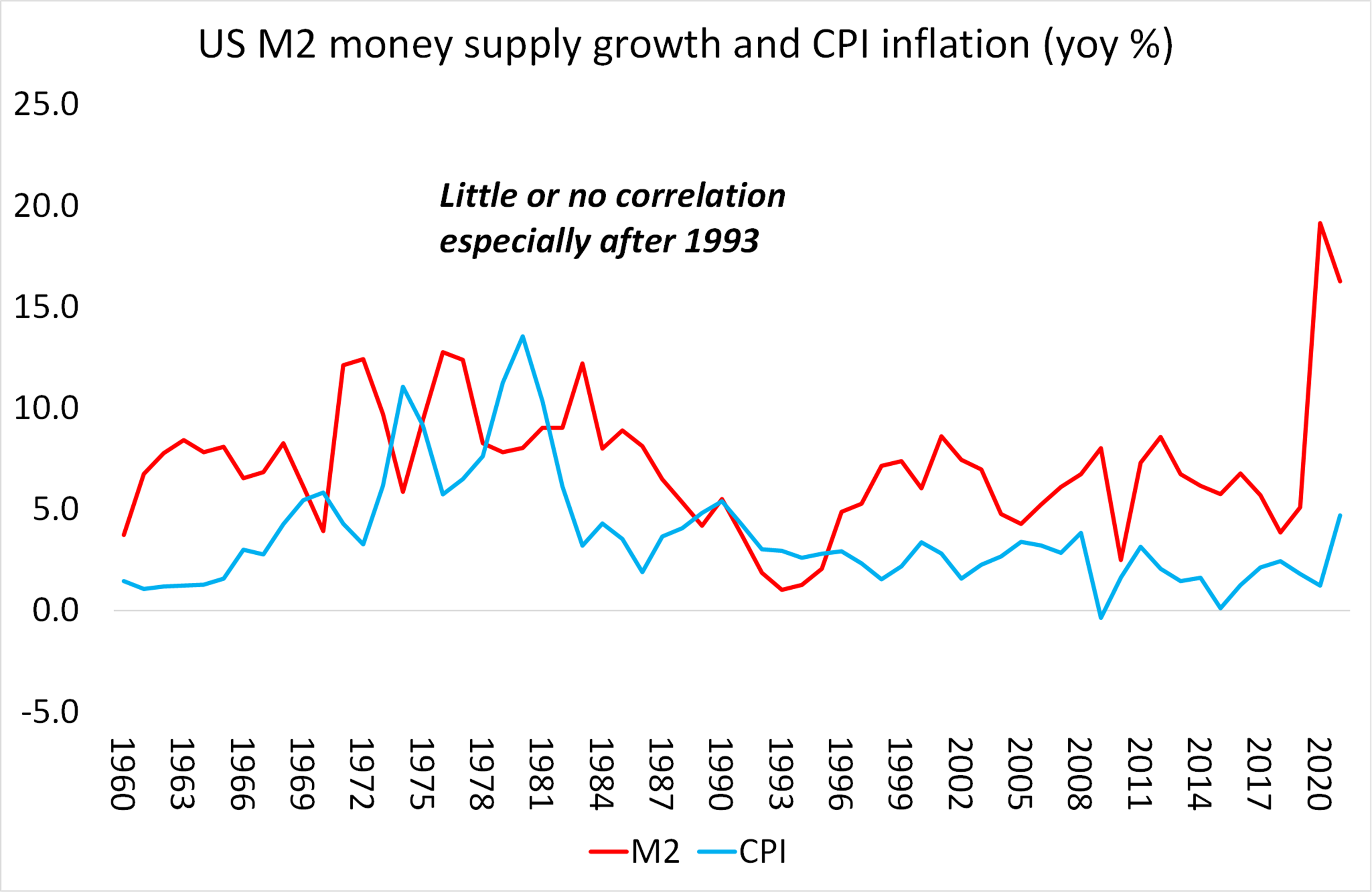

Meanwhile, not all economists agree. See Michael Roberts, for one example. Here's the graph Roberts publishes of the relationship between money supply and inflation. Hanke cannot explain the obvious lack of connection between the two lines, even if you factor in Hanke's suggestion there's a lag between money supply expansion and the appearance of inflation.

Hanke says he studied inflation in 157 countries (between 1990 and 2021) that had an increase in money supply. His assertion: inflation increased 1-to-1 relationship with that money supply. Where is this correlation in the U.S as outlined above in the graph? Hint: it doesn't exist.

At the time of the interview with Stewart, Hanke said Japan had 3% inflation despite a national debt of 240% of GDP--which, according to Hanke, should correlate with a large money supply. Where is the inflation inevitable from such a large money supply? No answer. Japan's pays ~0% interest on its national debt and has low inflation even now (still 3% in 2022, says Google).

Conventional--especially Reagan's "supply side" and "monetarist"--economics is baloney. Remove the baloney, and nothing remains. For the long form of this, see Steve Keen's book Debunking Economics: The Naked Emperor Dethroned. Not an easy read, but, in contrast to charlatans like Hanke, Keen predicted the Great Recession of 2007-8 (and won the Revere prize for doing so). Conventional economists, Hanke included, did not predict this largest-since-the-Great-

Hanke accurately says banks create most of the money supply (90%). He adds deficit increases put that money supply increase on steroids. What he omits saying is that the central bank ("The Fed") therefore cannot ever control the money supply since it only makes 10% of the money. Monetarism is a transparent scam, but it dominates the headlines and much of what advises public policy.

Hanke decries Obama-era regulation (the weak tea of Dodd-Frank, which did not revive Glass-Steagall) as harmful. His point: After Dodd-Frank, banks began withdrawing their contribution to the money supply, and that regulation--not crooked mortgages, derivatives, and Ponzi capitalism--is what caused the Great Recession--something he did not predict, despite his "time lag" theory between money supply decrease and recession.

Hanke never mentions what the Fed did (unrelated to QE) in 2007-8: It extended $16-$29 trillion in credit to Wall St. (the figures are from the Fed's own audit). Where was the inflation during, or immediately after that boost to the money supply? It didn't occur. Is it really a surprise he omits mentioning this?

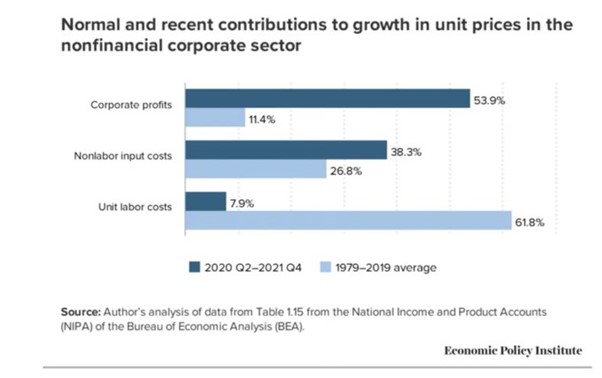

Stewart suggested that record corporate profits might be behind inflation. Hanke denies it. Except this graph shows Hanke's lying again:

Trying to be sympathetic with labor, Hanke even says "The little guy gets screwed in inflation" - but even that's a lie if the little guy is a debtor. Inflation favors debtors since they repay loans with cheaper currency.

I do wonder why Jon Stewart was so respectful to Hanke. When he interviewed con man stock picker Jim Cramer Stewart was not nearly so polite.

From CNN:

Shell will buy back $4 billion worth of shares and increase its dividend by 15% after posting another gigantic quarterly profit thanks to strong oil and gas prices. The UK company posted net income of $9.45 billion in the third quarter, more than double the $4.1 billion it recorded a year ago. The result was driven by a strong performance in its oil exploration and production business, Shell said. The company’s stock at one point rallied more than 4% in London on Thursday as investors cheered the news. The additional buybacks will increase total share purchases for the year to $18.5 billion, some 10% of the company’s share capital.

Update #2: May God Save Us From Economists.

Over the last half-century, economics has infiltrated parts of the federal government where it has no business intruding. It can be a useful tool for policymaking, but it’s become the only tool. It’s time for economics to back the hell off.

Update #3: I'm not the only one who believes the Inflation Narrative is Fabricated, as is the response.

Update #4: US oil producers reap $200bn windfall from Ukraine war price surge Financial Times. But no! We must be concerned about increasing labor costs!

Update #5: Wall St. investor Richard Vague's article (here) denies inflation is connected to money supply growth. Excerpt:

"Monetarist theory, which came to dominate economic thinking in the 1980s and the decades that followed, holds that rapid money supply growth is the cause of inflation. The theory, however, fails an actual test of the available evidence. In our review of 47 countries, generally from 1960 forward, we found that more often than not high inflation does not follow rapid money supply growth, and in contrast to this, high inflation has occurred frequently when it has not been preceded by rapid money supply growth."

Wednesday, October 26, 2022

Wokeness needs to wake up

Conservative commentator Sohrab Ahmari’s critique of the purpose of wokeness:

"Wokeness serves two functions for today’s ruling elites. The first is a kind of ideological control directed against Western working classes: wokeness covers over concrete class and economic injustices—massive wealth inequality, health precarity, stagnant wages and so on—with a thick fog of mystification. It creates an impression of furious change and even revolutionary activity. Yet what is in fact taking place is mostly intra-elite competition and redistribution: a disabled trans woman may be on the board, but workers still have to relieve themselves in bottles for lack of sufficient breaks."

This somewhat Marxist critique of wokeness is far more honest than the Left’s strained defenses of it.

Hey, they may be Nazis, but they're women Nazis!

Monday, October 24, 2022

Does Sacramento Really Need a Bigger Jail?

(c) by Mark Dempsey

By my count, a proposal to expand the

downtown County jail is on the Sacramento Board of Supervisors agenda

for the third time on December 7th, 2022 at 2 PM. If you're unfamiliar

with what motivates the County, it lost a lawsuit, convicting it of

mistreating prisoners. The advisory commission County Supervisors formed

to provide solutions did not recommend expanding the jail, but so far

it's what the Supervisors are considering...for the third time. I'm

betting some contractor is anticipating a big payday for the roughly $89

million job.

At that December 7th meeting the Supervisors will

vote on their plan to address the consent decree in the lawsuit. They

need two things: 1. reduce the jail population, and 2. to “remedy

physical plant deficiencies.”

The county can choose to reduce the jail population through investments in prevention and scaling up existing diversion programs. They can also renovate the current downtown jail for the plant deficiencies instead of building a 3-story “annex.” Guess which one is cheaper.

All of this occurs in the

context of one of the biggest incarceration binges in world history.

With 5% of the world's population, the U.S. has 25% of the

prisoners--five times the world average per-capita rate, and seven times

the age-demographic-identical Canadians' rate. But Canadian and U.S.

crime are about the same (per capita), even though Canadians

incarcerate far fewer people. Cages do not prevent crime.

Putting people in cages has been extraordinarily

expensive, too. Between 1982 and 2017, the U.S. population increased by 42%.

Spending on policing increased by 187%. Do police receive such generous

funding because people have an infinite appetite for (i.e. addiction to)

safety, even if that safety is an illusion?

Police don't solve, much less prevent, the majority

of crimes, either--solving only about 15% of reported crimes in

California, according to the FBI. On the other hand, there's good evidence social safety nets do prevent crime.

Canadians have single-payer health care, for one thing. That means they

don't experience the half-million medical bankruptcies and 40,000

estimated deaths caused by the lack of medical care we have in the U.S.

every year.

Caging people doesn't solve mental health issues like addiction, either. As an addiction cure, it's much less effective than medical treatment (rehab) and about seven times more expensive. Oh yes, and 65 percent of the prison population has a substance use disorder.

The Federal Reserve reports that 40% of Americans can't

handle a $400 emergency without selling something or borrowing.

Desperate populations make for desperate situations and make policing

far more difficult. I have friends on the police force who I do not want

unnecessarily endangered, but that's what all this reliance on more

policing and incarceration does--it unnecessarily endangers them, producing only the illusion of safety.

Policing and criminalization don't prevent or solve crimes. It doesn't cure addicts. It does line the pockets of contractors who build cages, and who could be building something we really need--like affordable housing. But it doesn't address the problem, and (bonus!) it's very expensive.

The

persecution of the poor is bipartisan, too. Clinton signed Newt

Gingrich's "end of welfare as we know it." That meant AFDC became TANF,

and while 76% of those needing public assistance got it under AFDC, only

26% of such candidates qualified for TANF. It's hardly credible that

half of the welfare recipients were frauds, but that incredible belief is

what continues to excuse the attacks on poor people.

And yes,

it's class warfare. As billionaire stock picker Warren Buffett says:

"There’s class warfare, all right, but it’s my class, the rich class,

that’s making war, and we’re winning." I say let's stop believing our

addiction to safety and do something that will actually work. What do

you say?

-----------

Also worth a look, the Davis Vanguard

weighs in about the many abuses and misuses of our "justice" system.

Excerpt: "...right now mental health and substance use disorder

underlie a huge percentage of crimes. Forty-three percent of the prison

population is diagnosed with a mental health disorder. Former SF DA

Chesa Boudin used to point out that the San Francisco Jail was the

largest mental health provider in their city/county.

"Instead of addressing those problems, we throw people in cages.

"A lot of prison reformers have visited facilities in Germany and Norway and are stunned by the difference, even for serious offenses.

"For one thing... 'American correction officers are trained for a few weeks, with a heavy emphasis on how to [abusively] keep control. In Germany, aspiring prison officers study for two intensive years, including college-level courses in psychology, ethics, and communications skills.'

Here’s the amazing part—it works a lot better."

Monday, October 17, 2022

European economics update: The U.K. is the canary in the coal mine

For the U.K component, see Richard Murphy's tweets.

And while we are comparing the severity of the UK’s and Germany’s pathologies, let us also consider a warning from Pozsar that doesn’t appear to have gotten as much attention as his conclusion about the economic leverage of Russian gas:

More broadly, the three “moments” of reckoning we discussed above mean that

global supply chains, whether they produce military or civilian goods, are facing

a Minsky Moment – a Real Minsky Moment. Paul McCulley’s term referred to

the implosion of the long-intermediation chains of the shadow banking system

that marked the onset of the Great Financial Crisis. Today, we are witnessing

the implosion of the long-intermediation chains of the globalized world order:

masks, baby formula, chips, missiles, and artillery shells, for now. The triggers

aren’t a lack of liquidity and capital in the banking and shadow banking systems,

but a lack of inventory and protection in the globalized production system,

in which we design at home and manage from home, but source, produce, and

ship everything from abroad, where commodities, factories, and fleets of ships

are dominated by states – Russia and China – that are in conflict with the West.

Inventory for supply chains is what liquidity is for banks. In 2007-08, big banks

ran on “just-in-time” liquidity: the dominant form of liquidity was market liquidity,

for which you could always sell assets into a deep market without moving prices,

so you did not have to have liquidity reserves at the central bank. Similarly,

big corporations today run “just-in-time” supply chains for which they assume that

they can always source what they need without moving the price. But not really:

the U.S. military has to wait a little bit as Raytheon “will take a little while”;

Taiwan and Saudi Arabia have to wait as well until the conflict in Ukraine is over;

and if your washing machine broke recently, you’ll have to wait a bit too until

defense contractors are done buying them up to rip chips out to make missiles.

We’re borrowing from “here” to make things “there”. Do you remember the

three units of Minsky? Hedge units can cover their payments from their incomes.

Speculative units have to borrow to be able to make payments. And Ponzi units

can make their payments only if they sell some of their assets and are thus the

most exposed to rising interest rates. As our chip examples demonstrate,

Minsky would classify our military supply chains as “speculative” units at best,

which are exposed to a further escalation of geopolitical tensions that could

easily turn them into Ponzi supply chains. We can also apply Minsky’s framework

in Europe, where Germany can’t cover its payments without Russian gas and

the government is asking citizens to conserve energy to leave more for industry…

Protection by Pax Americana for global supply chains is what capital is for banks.

In 2007-08, big banks didn’t have enough capital to deal with systemic events,

because they were Too Big to Fail. The assumption was that the state will bail

them out. The state did provide a bailout, but at a cost, which was Basel III…

Today, the assumption among investors is that globalization is Too Big to Fail…

…but globalization is not a bank in need of a bailout. It’s in need of a hegemon

to maintain order. The systemic event is someone challenging the hegemon,

and today, Russia and China are challenging the U.S. hegemon. For the

current world order and its trade arrangements and network of global supply chains

to survive the challenge, the challenge must be squashed quickly and decisively,

in the spirit of the Powell Doctrine. But Ukraine and Taiwan aren’t Kuwait,

Russia and China aren’t Iraq, and Top Gun 2 isn’t the same movie as Top Gun.

Commentary on the new British Government

There's a danger in what happened in the past three weeks since the mini-budget. That is that in the coming years, Chancellors of whatever stripe run scared of the bond markets, thinking they'll tolerate nothing other than 'balancing the books.'

— Andy Verity (@andyverity) October 15, 2022

Talk of 'unfunded' tax cuts is at best a form of shorthand. At worst, though, it perpetuates a myth, namely that the there is a 'fund'; or that the money has to 'come from' somewhere.

— Andy Verity (@andyverity) October 15, 2022

ThIt may suit governments intent on either shrinking the state (the right of the Conservative party) or demonstrating their 'fiscal discipline' (the right of the Labour party) to talk about the public finances as if they were like a household's. But they simply are not.

— Andy Verity (@andyverity) October 15, 2022

...there's more to this thread, but the "Eeek! We're out of money" still hasn't been laughed out of office.

Saturday, October 15, 2022

Passages from Michael Tomasky's The Middle Out

This book is the best defense I've read of the Biden administration's (and previous corporate Democrats') policies. The author believes Biden is a transformative president, and one necessary to steer the ship of state away from the neoliberal policies that have so damaged its population.

Tomasky even mentions Modern Money Theory and Stephanie Kelton and says he's not particularly a fan of deficit reduction, but continually cites deficit reduction as an economic positive, while ignoring its ill effects. That's false, but many other things are factual in the book. Here are the passages I flagged as memorable:

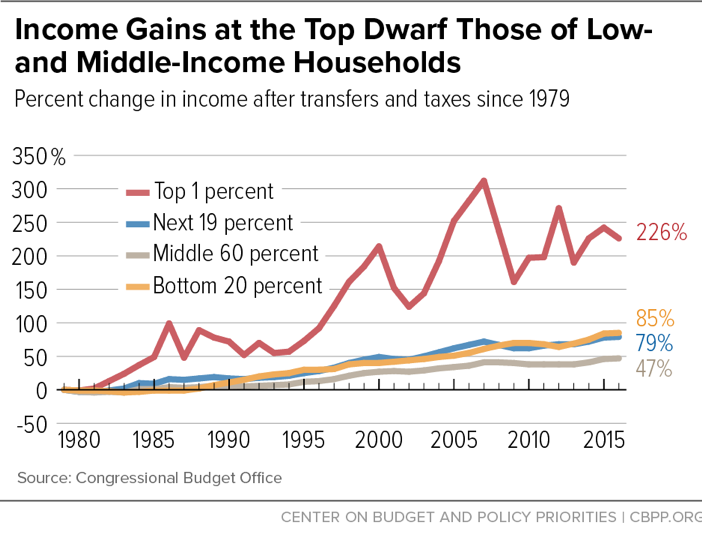

p.78 "The Reagan tax cuts went mainly to the rich, and the George W. Bush tax cuts were even more stacked in their favor. According to the Tax Policy Center, 73 percent of the benefits of the Bush tax cuts went to the top 20 percent of tapayers; withi that, a jaw-dropping 30 percent went to the top 1 percent. Thus revealed, the Laffer Curve's big lie has three hidden purposes: first, to shift wealth from the middle class to the top; second, to give congressional Republcans the cudgel of the deficit to scream about when the next Democratic president comes along; thrid, to use as a convenient and ever-ready excuse to cut domestic programs, especially for poor peole (the "moochers")."

p. 93f "I'd argue that the wholesale dismissal of the Clinton era as hopelessly neoliberal is too revisionist. The first thing that should be said in Clinton's defense is the obvious: The economy, in broad terms, performed very well under Clinton. He was, in fact, the most economically successful president of the last sixty years. Job creation was highest under Clinton (yes, higher than Reagan, by about six million). Median household income increased the most during his tenure. The stock market performed best during his eight years in office. And the deficit, of course, disappeared entirely, he left office handing George W. Bush a $236 billion surplus, which Bush instantly squandered on tax cuts that did not pay for themselves and a war the United States did not need to fight.

"[interest rates were not] exatly at an all-time low under Clinton, but they were stable in the low-to-middle range...Inflation, too, was generally on the low side...between 2 and 3 percent most years."

p. 111 "After the Great Society kicked in, the poverty rate for adult Americans under age sixty-five was less than 10 percent for twelve years running, from 1968 through 1979 (inclusive), something that didn't happen before and hasn't come close to happening since. Similarly, child poverty went down in the period (fro 27.3 percent in 1958 to 14 percent in 1969), and poverty among seniors dropped even more dramatically (35.2 percent in 1959 to 14.6 in 1975). The poverty level crept back up during the early Reagan years before declining again, and went up again after the Great Meltdown of 2008-2009, which bankrupted families and devoured jbos. But it has never gotten close to where it was before the Great Society programs. These were government interventions that undeniably worked to alleviate poverty without destroying overall prosperity."

p.164 "In more recent years...systemic racism in the United States has come under much more thoroughgoing scrutiny.

"Three recent books--none of them by economists, incidentalloy--have been particularly imprtant to this shift....Richard Rothstein's 2017 The Color of Law, which dramatically lays bare how the federal government--mostly Democrats and liberals--facilitated discrimination in the residential housing market for decades by allowing developers and lenders to bar Black families from home ownership. Rothstein noted that while 'most of these policies are now off the books, they have never been remedied and their effects indure.' Heather McGhee's 2021 The Sum of Us [shows] how racism imposes costs not just on people facing discrimination but on society as a whole. ....Finally, The Whiteness of Wealth, also from2021, by ... Dorothy Brown, shows in unrelenting detail how the tax code is in effect a tool of white supremacy--how loopholes and deductions that mostly benefit well-off white people didn't just happen but were in many cases litigated into being by wealthy whites."

p. 218 The author recommends Nick Hanauer's TED talks, which say "The problem isn't that we have some inequality. Some inequality is necessary for a high-functioning capitalist democracy. The problem is that inequality is at historical highs today, and its getting worse every day....Our society will change from a capitalist democracy to a neo-feudalist rentier society like eighteenth-century France."..."It isn't capital that creates economic growth; it's people. And it isn't self-interest that promotes the public good; it's reciprocity. And it isn't competition that produces our prosperity; it's cooperation. What we can now see is that an economy that is neither just nor inclusive can never sustain the high levels of social cooperation necessary to enable a modern society to thrive."

p.225 The author discloses what even corporate Democrats fear from Trump: "...Trump, if reelected [will] destroy the executive branch, turning it from (at its best) in essence a large corporation promoting the public interest, driven by people with expertise who actually care about outcomes, into a fiefdom of unqualified lackeys who will perform his bidding, ignoring law and custom to do what Trump wants them to do."

p. 229 Bragging about the economic legacy of the respective major parties:

"Clinton took the country from a $290 billion deficit to a $236 billion surplus, for a $526 [sic, he means $526 billion] improvement. The deficit did increase under Obama by $126 billion (though he cut it by more than half in his second term). Combined, they left the country $400 billion better off [sic!]. The Bushes and Trump combined to add nearly $3.5 trillion to the deficit.

"...median household income increas: Democrats, 9.5 percent; Republicans, 0.6 percent. Yeas, that's 0.6 percent, as in less than 1. It went up under Trump by 9.2 percent wich is very good, but it went down under both Bushes. It went up 5 percent under Obama and around 14 percent under Clinton."

p.240f. Cites studies of BIG (basic income guarantees, or transfers): "Aggregating evidence from randomized evaluations of seven government cash transfer programs, we find no systematic evidence of an impact of transfers on work behavior, either for men or women. Moreover, a 2015 review of transfer programs worldwide by Evans and Popova also shows no evidence--despite claims in the policy debat--that the transfers induce increases in spending on temptation goods, such as alcohol and tobacco. Thus, on net, the available evidence implies that cash transfer programs do not induce the 'bad' behaviors that are often attributed to them in the policy sphere."

Citing a 2018 World Banks study:"The simple 'Econ 101' model in which the income effect of a cash transfer results in recipients reducing wor and increasing leisure is very seldom what we see happening in reality. The closest approximatin to this odel appears to come in the labor of th elderly when they receive government pensions. Yet thi is hardly the group for whom more leisure is viewed as being a social bad, and ther are few headlines excoriating lazy pensioners. In contrast, prime age adults tend to see very little change in either the amount they work, or the amount they earn when receiving unconditional or conditional cash transfers, or charitable grants."

Thursday, October 13, 2022

"Progressives" betray their mandate

Absolutely heart-wrenching pics of deplorable Russian aggression in Ukraine.

— Alan MacLeod (@AlanRMacLeod) October 11, 2022

Only joking, they are pics of NATO bombing Serbia, Libya and Afghanistan. pic.twitter.com/mvMur1s0Up

Tuesday, October 11, 2022

Thorstein Veblen and maintenance...

Inventions that would not exist without black women... GPS!

Inventions that would not exist without Black Women. pic.twitter.com/OIABdEaqas

— Africa Archives ™ (@Africa_Archives) October 3, 2022

Sunday, October 9, 2022

What you don't have, and why

This short history of socialism explains a lot. Excerpt:

"While visiting Denmark recently, I developed an infection in my hand and wanted to see a doctor. The hotel in the provincial city where I was staying directed me to a local hospital. I was quickly shown into a consulting room, where a nurse questioned me and told me to wait. Only a few minutes passed before a physician entered the room, examined me, and said in excellent English, yes, indeed, I did need an antibiotic. He promptly swiveled in his chair, opened a cabinet behind him, took out a bottle of pills, handed it to me, and told me to take two a day for 10 days. When I thanked him and asked where I should go to pay for the consultation and the medicine, he responded simply, “We have no facilities for that.”

"No facilities for that.

"It’s a phrase that comes back to me every time I’m reminded how, in the world’s richest nation, we still don’t have full national health insurance. And that’s far from the only thing we’re missing. In a multitude of ways, we’re known for having a far weaker social safety net than many other wealthy countries and behind that lies a history in which the Espionage Act played a crucial role."

Meanwhile, in Sacramento...

The local electricity provider is publicly-owned SMUD (the Sacramento Municipal Utility District). Surrounding communities use PG&E. SMUD is 35% cheaper than PG&E. PG&E executives, while paid orders-of-magnitude more than SMUD execs, have lately been compelled to consult with criminal attorneys because they might face negligent homicide charges for short-changing maintenance that led to enormous forest fires and explosions of gas pipelines (San Bruno).

Socialism...works better and is cheaper.

Saturday, October 8, 2022

Saturday, October 1, 2022

Busting the Deficit Myth

Also worth a look: Central Bank Myths (about inflation) Drag Down the Global Economy. The economics that justifies the draconian "inflation fight" really is bunk. Excerpt: "World Bank chief economist Michael Bruno and William Easterly asked, “Is inflation harmful to growth?” With data from 31 countries for 1961-94, they concluded, “The ratio of fervent beliefs to tangible evidence seems unusually high on this topic, despite extensive previous research.”

Chinese Humor

In 🇨🇳Nanchang, Jiangxi, sanitation workers dress as Ming dynasty imperial guards as they patrol the streets! They keep the city clean wh...

-

Here's a detailed explanation by a Modern Monetary Theory founder, Stephanie Kelton. The bottom line: Social Security's enabling l...

-

Posted on March 26, 2019 by L. Randall Wray The attacks on MMT continue full steam ahead. Janet Yellen (former Fed chair, but clueless on...

-

© by Mark Dempsey In the year 2000 the World Health Organization (WHO) ranked countries’ health care system outcomes according to thin...