November 25, 2023 by Matthew B. Hallinan BEYOND BIOLOGY

The Israeli/Palestinian conflict is perhaps, the most complex political dispute on the planet. What makes it so complicated is that both sides see themselves as victims, and each depicts the other as an aggressor. And on one level, both are right.

Israel was born of antisemitism. This is an important starting point for understanding the conflict. There is a tendency of many on the left to see Israel as simply an instrument of Western Colonialism. While certain Western Powers did play an important role in the creation of a Jewish state in Palestine, seeing Israel from this perspective fails to take into account the impulse that drove millions of Jews to seek refuge there.

Zionism, the idea that Jews should return to their ancient homeland in Palestine, was initiated by Theodor Herzl in response to the Dreyfuss Affair. Dreyfuss was a French Army officer who in 1896, was wrongfully accused of spying for the Germans. His trial and conviction revealed a shocking level of antisemitism, not only in the French military, but also, in the larger society. Herzl, an assimilated Austrian Jew, was devastated by this revelation. Doubting that Jews would ever be accepted as full citizens in European society, he issued a call for a First Zionist Congress to meet in Basel in 1897.

Zionism played an important role in the birth of Israel. But it actually came on the scene quite late. It did not have a major demographic impact in Palestine until the rise of Hitler and the Nazis during the 1930s. In 1922, even with support from the controlling colonial power, Great Britain, Jews constituted only 11% of Palestine’s population. By 1931 that number had grown to 16%. After 1934 (when Hitler was appointed chancellor) immigration gained momentum, and by 1945, Jews constituted 31% of the population of Palestine–Muslims 60%, Christians 8%.

The end of WWII left millions of European Jews without homes or a homeland. Most did not want to return to countries that either could not protect them, or actively collaborated with the Nazis. This added a new dimension to Zionism. More than simply a safe place to practice their religion, the creation of a Jewish state was increasingly seen as fundamental to their survival. The Holocaust had convinced most that they must acquire a capacity to defend themselves. They needed a state of their own. “Never again” would they allow themselves to be led like lambs to the slaughter.

That’s pretty much where the founders of Israel were coming from. A people traumatized by an organized, methodical effort of a major industrial power to physically exterminate them. I do not see Zionism, as such, as the driving force in the creation of Israel. The main impulse was survival. Zionism provided a religious and mythological framework that connected a vast array of different nationalities to a cultural core and to a land from which they had been separated from for 2000 years. Religion in Israel is more than a belief system: it is a “deed” to the land.

The Palestinians

My involvement with this issue began in 1987 when a Palestinian friend invited me to travel to Jerusalem to spend a few weeks in their home. From what little I knew about this conflict, I was sympathetic to the Palestinians–but more sympathetic to the Israelis. I held a view that I believe was widespread in the American left at that time. I thought the Jews did what they had to do to secure their survival—what any people in their place would have done. At the same time, I understood that the creation of Israel inflicted a wound on the Palestinians. However, I saw the on-going conflict as due to the stubbornness of the Palestinian: their refusal to come to terms with the existence of Israel and their unwillingness to accept a solution that could be mutually acceptable.

My friend knew my thinking on the situation and organized a trip that would allow me to see things from a different perspective. We visited every major city and refugee camp in the West Bank and Gaza, and talked with a wide variety of different Palestinian activists and groups. I didn’t take long for me to recognize what was wrong with my previous point of view. I had not understood what the Palestinian realty was all about.

The debate over relative victim-hood disappears when you are over there. One people have all the rights and the power to enforce them—the other have no rights. They are essentially powerless. That doesn’t mean that Israelis are always abusing and mistreating Palestinians. It means that whenever there is a conflict between an Israeli and a Palestinian, it is ultimately up to some Israeli (police, judge, administrator, military officer, etc.) to decide how to settle it. That’s the bottom line to living under military occupation.

If military power, the ability to defend themselves and control their own fate, is the central motif of Israeli culture, powerlessness, the subjugation by outsiders, has been defining feature of Palestinian history. It began when their homeland, without their consultation or consent, was divided in two to provide the territory for the new Jewish state. They rejected the decision of a UN, which at that point in time, was dominated by a few major Western Powers. They attempted to resist militarily, but were overwhelmed in a short, one-sided war. By the end of that war, somewhere between 700,000 and 900,000 thousand Palestinians lost their homes and ended up in refugee camps–many in Gaza. Indeed, the current population of Gaza consists largely of the descendants of those refugees.

The 1948 war—the “Nakba,” or catastrophe for the Palestinians–was only the beginning of their tragic saga. A critical turning point came in 1967 when another war resulted in the Israeli conquest of what was left of the land granted to the Palestinians by the UN resolution–the West Bank, Gaza, and East Jerusalem. For the past 56 years, Israel has controlled these territories and has prevented the Palestinians from consolidating them into a nation. Instead, they have subjected them to one form or another of military rule.

Unless you are living and travelling with Palestinians, walking in their shoes so to speak, it is difficult to get a true picture of what a military occupation is all about. It is a life of constant harassment, humiliation, and insecurity.

Military checkpoints are everywhere, making any trip to see friends or relatives an unpredictable and complicated hassle. Everything the Palestinians want to do—buying a new car, remodeling a kitchen or putting a new bathroom in one’s house, requires written permission: interminable paperwork. Decisions are arbitrary, and denials cannot be appealed.

And then there is the relentless encroachments of the settlers—bullying and threatening their way onto the land, seizing farmsteads and homes that lack “proper documentation” or are on “sacred” soil—mentioned in the Bible. Their threats are backed up with automatic weapons and the certainty that in stealing other’s lands, they are doing God’s work.

Many of the settlers are Americans. I talked with a number of them—one who had spent the summer of 1967 in San Francisco (the Summer of Love –“come to San Francisco with flowers in your hair”). They see immigration to Israel as “returning” to their real home–a place they have been disconnected from for over 2000 years. Apparently there is no statute of limitations when it comes to abandoned real estate in Palestine. They see the Palestinians who live in the villages and cities, the people whose parents, grandparents and distant ancestors built the houses, erected the fences and planted the olive trees, as “squatters:” illegitimate interlopers who need to find some other place to live.

Young Palestinian men are rounded up on the word of informants they cannot confront or cross-examine. 40% of Palestinian men have been arrested and held under one or another of the 1600 military orders that control every aspect of Palestinian life. When charged with a crime, Palestinians are tried in Israeli courts and can only be represented by Israeli lawyers. Because they are not citizens of Israel, they cannot vote in Israeli elections and thus, have no political or peaceful means to influence the laws and policies they have to live under.

Israelis like to talk about their generosity in granting Gaza self-rule. One only has to go to Gaza to see what a poor gift that was. Gaza is a little strip of desert surrounded by Israel, Egypt and the Mediterranean Sea. It has no natural resources and 96% of its water is undrinkable. It is one of the most densely populated places on earth, made up of impoverished war-refugees and their descendants. 80% of its residents live below the poverty line. It has been accurately described as an “open-air prison.” Israel did not give it—it dumped it.

A slow-burning fuse

Palestinians are not fools—they know what is going on. They have been haggling and negotiating with Israel since 1967 to get control over the lands taken in the war. Negotiating with Israel, according to a joke going around, is like this. Two men decide to have lunch together. They order a number of different plates, and at some point, they begin to argue over how to divide up the bill. While the argument is proceeding, one of the men begins eating off the plate of the other. That’s a pretty apt description of the Palestinian’s experience in negotiating with Israel.

Because I don’t want to write a book on this subject, I would like to end this blog with a few final thoughts. I will write more later.

1) For a historical overview, I would recommend reading Simha Flapan’s book—“The Birth of Israel: myths and realities.” He uses historical documents, dairies and personal papers to establish that Israel’s Zionist leadership –all of them, from Ben Gurion on– did not accept the boundaries laid down by the UN, but intended to eventually bring the whole of Palestine under Jewish control. That was, and still is, the Zionist vision of Israel. That is why Israel never published a map of its boundaries—leaving expansion open– and that is why it did everything in its power to prevent the formation of a Palestinian state—which would have set limits to its growth.

2) The establishment of settlements, which began under Begin, was aimed at creating “facts on the ground.” The goal was (and is) to establish an irreversible process of Israeli takeover of the West Bank and Jerusalem. Israel has short-circuited the negotiation process—and has made creating a Palestinian state extremely difficult.

3) The new right-wing Israeli government is giving the green-light to settlement expansion.

4) The formation of an alliance between the USA, Saudi Arabia, and Israel threatens the one leverage the Palestinians have had in their struggle with Israel—the ability to deny Israel peace and normal relations with the Arab World until the Israelis come to terms with the Palestinians. This new alliance promises to side-line the Palestinian issue, reorganizing power relations in the Middle East without solving the Palestinian issue.

How to Look at Hamas

All of the above was well known to Hamas. They acted to derail the process towards a new political arrangement in the Middle East. I believe they knew exactly what they were doing. They consciously and deliberately designed a horrific crime against unarmed Israeli civilians. They knew that this went to the core of Israel’s very purpose for being—a state to protect its people from slaughter. They knew that Israel would not be able to control its rage and desire for revenge, and that in order to destroy Hamas, who was ensconced in the population centers of Gaza, it would have to deal a devastating blow to innocent Palestinians. This would enrage the Arab and Muslim world, and bring an end to any efforts for a reconciliation with Israel.

So far, it looks like Hamas has achieved what it set out to accomplish. Indeed, it may even have succeeded in giving life to the moribund goal of Two-state solution.

Is Hamas to be congratulated? Do the ends justify the means? It appears that many on the left are prepared to accept Hamas’ slaughter of innocents, and to see their brutality as merely payback for past wrongs done by Israelis to Palestinians.

This thinking will spell the death of the left. The ends do not justify the means—the means determine the ends. Wanton brutality and inhumanity only begets more of the same. Many of us have lived long enough to see how movements that sought to embrace the highest human ideals were undermined by brutal methods—the purges of Stalin, the Cultural Revolution of Mao, and the killing fields of Pol Pot. In 1948, over 100 Palestinian villagers—men, women, and children were slaughtered at Deir Yassin by the Irgun. And the Palestinians have never forgot it. Just as the Israelis will never forget October 7. Reconciliation between these two peoples can never be built on acts of cruelty and brutality. Hamas is an outlaw movement. It must be held responsible for its crimes. I believe that it will end up doing more harm to the Palestinians than to the Israelis

Without a higher moral vision, the left is just another player in an endless saga of bloodshed and suffering.

Matthew B. Hallinan received his PhD in Anthropology from the University of California, Berkeley. In Beyond Biology, he brings together his years of study and independent research to answer a question that has long fascinated him: How could humans have gone through the same kind of evolutionary process as every other animal and yet have come out so different? This question has been central to Hallinan’s intellectual life. His passion for the subject is not driven simply by curiosity, but rather by a sense that time is growing short for us to come to terms with our place in the natural world. More

"The first principle is that you must not fool yourself and you are the easiest person to fool." - Richard Feynman

"You Yanks don't consult the wisdom of democracy; you enable mobs." - Australian planner

Sunday, November 26, 2023

Gaza and the Palestinian/Israeli Conflict: Without a higher moral vision, the left is just another player in an endless saga of bloodshed and suffering.

Sunday, November 19, 2023

Saturday, November 18, 2023

A German Jew Speaks Out About Gaza

I spent much time repackaging this interview on TV in Germany into English for the world to watch.

— AHMED | أحمد (@ASE) November 17, 2023

I’ve been ruminating on @deborah_feldman’s wise words, which offer light in this cruel and dark time.

She makes more sense than anyone else spewing hatred and trying to justify… pic.twitter.com/KiQwI4sWX8

Tyrannies

“All tyrannies rule through fraud and force, but once the fraud is exposed they must rely exclusively on force.”

― George Orwell

It's worth remembering that (per Henry Kissinger) insurgencies resisting that force don't have to win, they just have to survive.

Meanwhile, between 1982 and 2017, US population increased 42% while spending on policing increased 187%...

Yet police solve only 15% of the "blue collar" crimes (muggings, robberies, etc.) in California, and less than half (40%) of the murders. According to the FBI, blue collar crime costs the nation $12 billion annually. Wage theft costs $50 billion, and "white-collar" crime (subprime mortgages, financial fraud) costs $1,000 billion.

Guess who goes to jail more often?

And Sacramento County Supervisors just voted to spend a billion dollars expanding the County Jail. Yes, the jail is full, but 60-80% of its prisoners aren't convicted of anything other than being too poor to afford bail.

Update: 11/19/23 UPI publishes an article saying 58% of those surveyed think the justice system isn't harsh enough.

Thursday, November 16, 2023

Study: Wide Lanes Are Deadlier — So Why Do Many DOTs Build Them Anyway?

By Kea Wilson 12:00 AM EST on November 13, 2023

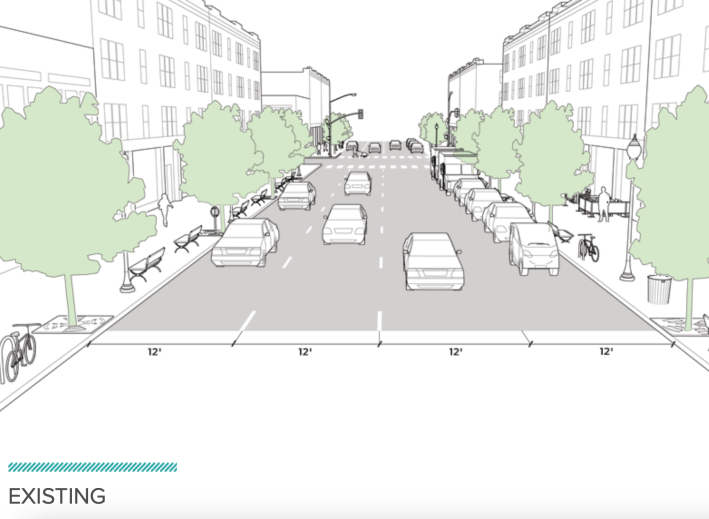

A 12-foot lane can expect roughly 50 percent more crashes than a 10-foot one. Yet many traffic engineers still pick the wider design.\

Photo: Matt Johnson|

The wide lanes of Salt Lake City make even big SUVs look diminutive.

Ten is plenty — and nine is even better.

The lightning-fast twelve-foot lanes that run down countless roads in U.S. neighborhoods are associated with a roughly fifty percent higher rate of crashes than nine-foot ones, a new study finds — but many state and national design guidelines are still encouraging engineers to build them based on the false assumption that wider is safer.

The finding is a result of a painstaking Johns Hopkins analysis of more than 1,100 non-interstate street sections in seven major U.S. cities — and amazingly, it may be the first time the relationship between lane width and safety has ever been comprehensively studied on such a large scale.

Roomy roads are proven to encourage faster, deadlier driving regardless of the speed limit, but previous research based on more limited data found less correlation between gargantuan lanes and high crash rates — with some researchers and engineers even arguing that narrow roads are more dangerous because they increase the possibility of “side friction” between cars. Unlike the 129-page Hopkins paper, though, those studies didn’t go street-by-street on Google Maps and use advanced machine learning to identify and control for all the other traffic-calming features that might be cutting crashes besides paint, including the number of lanes, the curvature of the road, and the presence of bike lanes, street trees and generous sidewalks.

Even in the absence of good data on lane width, though, the American Association of State Highway and Transportation Officials’ Green Book — a national design guide known simply as “the Bible” among traffic engineers — has long recommended minimum lane widths between 10 and 12 feet on the high-volume arterial roads that criss-cross many U.S. neighborhoods. Many state street design standards, meanwhile, skew towards the upper bound of that range to avoid liability, based on the assumption that wider lanes are more “forgiving” of drivers’ mistakes; some streets in the researchers’ sample even clocked in as wide as 16 feet.

In Europe, by contrast, minimum lane widths typically vary between 8.2 and 10.6 feet — and that difference may be showing up in our higher fatality totals.

“When you compare the U.S. to other countries, the rate of traffic fatalities is almost 10 times higher here than it is for our European counterparts — and it’s just getting worse,” said Dr. Shima Hamidi, the principal investigator on the study. “The main reason is just car dependency. We’re designing our streets for more convenient and fast driving — and a big component of that is lane widths.”

Of course, all this new data will only confirm the suspicions of sustainable transportation advocates, many of whom have been calling for a re-striping revolution for decades.

Back in 2014, “Walkable City” author Jeff Speck named ditching the 12-foot lane “the number one most important thing that we have to fight for” in the battle to end America’s pedestrian death crisis — and he came to that conclusion based largely on a literature review that was conducted way back in 2003. (The Hopkins researchers didn’t look at how lane width affected pedestrian crash numbers, specifically, but a Transportation for America analysis found that non-interstate arterial highways — which frequently feature 12-foot lanes or wider — were the site of 70 percent of walking deaths in urban areas in 2020, despite the fact they make up just 15 percent of overall roadways.)

In the years since Speck made his bold proclamation, pedestrian deaths have increased a shocking 52 percent nationwide, but national lane width guidelines haven’t changed much.

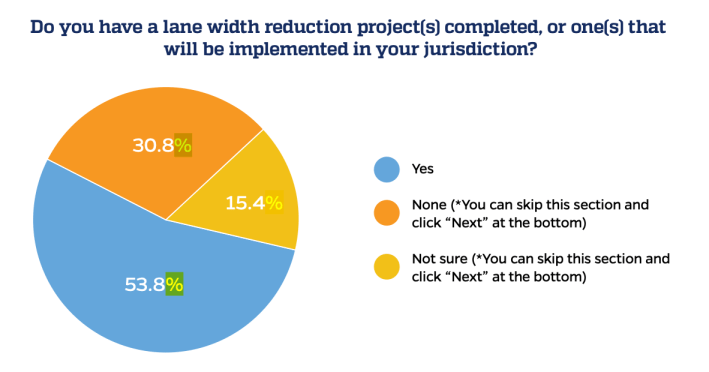

Hamidi points out that even communities that have created their own skinnier statewide standards aren’t necessarily losing lane width, either. The state of Vermont — which adopted the nine-foot minimum standard when it became the first state to depart from the Green Book in 1997 — hasn’t actually built any roads that narrow in the years since; only a slim majority of the 13 state DOTs the researchers surveyed (53.8 percent) said they had conducted any type of lane width reduction project at all.

From a survey of 13 state DOT representatives.Graphic: Johns Hopkins

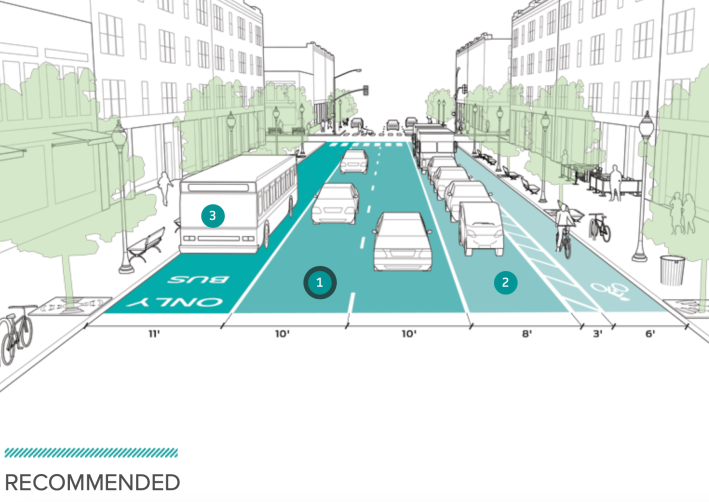

With this new data in hand, Hamidi is hopeful that states will finally feel empowered to be more aggressive about rethinking lane size, at least in areas that don’t truly need the extra space, like bus corridors and roads with frequent freight traffic. Because if they do, they’ll open up a conversation about what’s possible on their roads — not to mention a lot of new asphalt. She calls lane width reduction “probably the most cost efficient way to repurpose streets,” while simultaneously avoiding the thorny political challenges involved in removing a driving or parking lane completely.

“A three-foot difference per lane can make the difference between having a bike lane or not, or between having a sidewalk or not,” she added. “Lane width reduction is important, but equally important is thinking about how to best use that extra space that’s going to be freed up as a result … These things go hand by hand, and can lead to a world that is so much safer for pedestrians and cyclists.”

The post Study: Wide Lanes Are Deadlier — So Why Do Many DOTs Build Them Anyway? appeared first on Streetsblog California.

Kea Wilson@streetsblogkea

Kea Wilson has more than a dozen years experience as a writer telling emotional, urgent and actionable stories that motivate average Americans to get involved in making their cities better places. She is also a novelist, cyclist, and affordable housing advocate. She previously worked at Strong Towns, and currently lives in St. Louis, MO. Kea can be reached at kea@streetsblog.org or on Twitter @streetsblogkea. Please reach out to her with tips and submissions.

Monday, November 13, 2023

The moral superiority of the rich...(Anatole France and John Kenneth Galbraith)

"The modern conservative is not even especially modern. He is engaged, on the contrary, in one of man’s oldest, best financed, most applauded, and, on the whole, least successful exercises in moral philosophy. That is the search for a superior moral justification for selfishness. It is an exercise which always involves a certain number of internal contradictions and even a few absurdities. The conspicuously wealthy turn up urging the character-building value of privation for the poor. The man who has struck it rich in minerals, oil, or other bounties of nature is found explaining the debilitating effect of unearned income from the state. The corporate executive who is a superlative success as an organization man weighs in on the evils of bureaucracy. Federal aid to education is feared by those who live in suburbs that could easily forgo this danger, and by people whose children are in public schools. Socialized medicine is condemned by men emerging from Walter Reed Hospital. Social Security is viewed with alarm by those who have the comfortable cushion of an inherited income."

John Kenneth Galbraith — “Wealth and Poverty,” speech, National Policy Committee on Pockets of Poverty (13 Dec 1963)

Friday, November 10, 2023

Health vs. Profit

The US chooses profit, Japan chooses health...

The real success story is Japan.

— Dr. Lucky Tran (@luckytran) November 9, 2023

Japan has one of the strongest economic recoveries, but over 5-fold fewer deaths per capita from COVID-19 than the US.

The US chose to sacrifice the vulnerable for the economy.

Japan shows protecting public health can strengthen the economy. https://t.co/gCjjMk8gyU pic.twitter.com/WuFlCtUuk5

Thursday, November 9, 2023

Wednesday, November 8, 2023

Ignorance or Lies? The single worst economic scare-mongering bullshit ever encountered.

From: Rodger Malcolm Mitchell November 7, 2023

J.D. Tuccille, the Libertarians, and surprisingly, the highly respected University of Pennsylvania’s Penn Wharton School may have set a world record for utter nonsense and wrongheaded scaremongering.

Moving on from the “ticking debt time bomb” that never explodes, we have arrived at “20 Years to Disaster.”

Don’t you love predictions of 20 years? They are so safe. You can’t be proved wrong. Twenty 20 years from now, the world will have changed many times, and anyway, no one will remember what you said.

Aside from the idiocy of making a 20-year economic prediction, the entire premise of the article is wrong.

20 Years to Disaster

“The United States has about 20 years for corrective action after which no amount of future tax increases or spending cuts could avoid the government defaulting on its debt.”

J.D. TUCCILLE | 11.6.2023 7:00 AM

For decades, budgetary experts have warned that the U.S. federal government is backing itself—and the country—into a corner with expenditures that consistently exceed revenues, driving the national debt ever higher.

What Tuccille, the Libertarians, and the Wharton School seem not to understand is that federal deficits are absolutely necessary for economic growth.

You have seen this graph many times:

GRAPH I

|

| Federal “Deficits” (red) and Gross Domestic Product (blue) rise in parallel. |

And this graph:

GRAPH II.

|

| Before every recession (vertical gray bars), federal deficits (blue) decline. Then, to cure the recession, the government increases federal deficit spending. |

The latest red flag is raised by the University of Pennsylvania’s Penn Wharton Budget Model (PWBM), which says that the federal government has no more than 20 years to mend its ways. After this time, it will be too late to remedy the situation.

Every time the federal government “controls” (i.e. cuts) spending, we have recessions if we are lucky and depressions if we are not as fortunate:

U.S. depressions come on the heels of federal surpluses.

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

1997-2001: U. S. Federal Debt reduced 15%. Recession began 2001.

Having learned nothing from history, Tucille, the Libertarians, and Wharton continue the same old ignorance about federal deficit spending: They equate personal finances with our Monetarily Sovereign government’s finances, not recognizing the massive differences between the two.

While monetarily, non-sovereign entities like you and me need to run balanced budgets over the long term, or we’ll face bankruptcy, the federal government must never run a balanced budget and never will face bankruptcy.

20 Years to Control Spending

“Under current policy, the United States has about 20 years for corrective action after which no amount of future tax increases or spending cuts could avoid the government defaulting on its debt whether explicitly or implicitly (i.e., debt monetization producing significant inflation)” Jagadeesh Gokhale and Kent Smetters, authors of the October 6 Penn Wharton Budget Model brief, write in summarizing their findings.

“Unlike technical defaults where payments are merely delayed, this default would be much larger and reverberate across the U.S. and world economies.”

To say that the above is 100% bullshit would be to insult bullshit. Here’s why:

- The federal government, being Monetarily Sovereign, has the infinite ability to create its sovereign currency, the U.S. dollar. It has infinite dollars with which to pay its bills. It never needs to default.

- Despite concerns about “debt monetization” (aka “money printing’) causing inflation, this never has happened to any nation in world history. All inflations have been caused by shortages of crucial goods and services, most often oil and food.

- Many years of massive U.S. federal deficits didn’t cause today’s inflation. Only when COVID caused shortages of oil, food, computer parts, shipping, metals, lumber, labor, etc., did inflation arise. Now, the government’s massive spending to prevent and cure recession continues while inflation ebbs. The massive federal spending has helped cure the shortages and thus cure the inflation.

1. The historical fact that increasing government deficit spending increases economic activity (See Graph I, above) seems lost on the Wharton authors.

Mathematically, GDP = Federal Spending + Nonfederal Spending + Net Exports

2. There is no historical example of “crowding out of capital formation.” In fact, the federal money added to the economy increases the funds available to the private sector for capital formation.

3. Future tax increases are not necessary because federal taxes do not fund federal spending:

B. Even if the federal government collected zero tax dollars, it could continue spending forever. It has the infinite ability to create spending dollars.

C. The purposes of federal taxes are not to fund federal spending but rather:

a. To control the economy by taxing what the government wishes to discourage and giving tax breaks to what the government wishes to reward.

b. To assure demand for and acceptance of the U.S. dollar by requiring taxes to be paid in dollars.

c. To fool the public (and presumably Wharton economists) into believing federal benefits require federal taxes. (This last purpose is promulgated by the rich to discourage the populace from demanding benefits that would narrow the Gap between the rich and the rest.)

If debt gets too big, lenders can’t be paid back, credibility is shot, the dollar loses value, and the economy tanks.

This is the oft-claimed “ticking time bomb” that never seems to explode. There never has been and never will be a time when the federal debt “gets too big” to be paid.

Again, the Wharton economists demonstrate they don’t understand the differences between a Monetarily Sovereign government and a monetarily non-sovereign government.

Alan Greenspan: “A government cannot become insolvent with respect to

obligations in its own currency. There is nothing to prevent the federal

government from creating as much money as it wants and paying it to

somebody. The United States can pay any debt it has because we can

always print the money to do that.”

Ben Bernanke: “The U.S.

government has a technology, called a printing press (or, today, its

electronic equivalent), that allows it to produce as many U.S. dollars

as it wishes at essentially no cost.

Scott Pelley: Is that tax money that the Fed is spending?

Ben Bernanke: It’s not tax money… We simply use the computer to mark up the size of the account.

Statement

from the St. Louis Fed: “As the sole manufacturer of dollars, whose

debt is denominated in dollars, the U.S. government can never become

insolvent, i.e., unable to pay its bills. In this sense, the government

is not dependent on credit markets to remain operational.”

“It

would be an unfettered economic catastrophe,” economists Joseph

Brusuelas and Tuan Nguyen predicted earlier this year of such a

scenario. “Our model indicates that unemployment would surge above 12%

in the first six months, the economy would contract by more than 10%,

triggering a deep and lasting recession, and inflation would soar toward

11% over the next year.”

Strange how history says exactly the

opposite. Following many years of massive federal spending, unemployment

was at historical lows. The reason: Federal spending stimulated GDP

growth, which required more labor.

So long as investors believe federal officials will eventually balance their books, you have a grace period as debt grows—that is until the debt burden is so enormous that it crushes economic activity.

History shows that balancing the federal books creates recessions and depressions.

The so-called “debt burden” is not debt, and it’s not a burden. It’s deposits into Treasury security bills, notes, and bond accounts which are owned by the depositors.

It’s not debt because the government never touches the dollars in those accounts. The government creates dollars at will. It has no need to borrow dollars, and indeed, the U.S. federal government never borrows dollars.

To “pay off” the debt (that isn’t debt), the government merely returns the dollars in the accounts to their owners. This is no burden at all.

The purpose of T-securities is not to provide spending money to the government but rather to give the world with a safe, interest-paying place to store unused dollars. This makes the dollar an attractive international medium of exchange.

“Even with the most favorable of assumptions for the United States, PWBM estimates that a maximum debt-GDP ratio of 200 percent can be sustained,” the authors add. “This 200 percent value is computed as an outer bound using various favorable assumptions: a more plausible value is closer to 175 percent, and, even then, it assumes that financial markets believe that the government will eventually implement an efficient closure rule.” (That’s a mix of tax and spending changes to curtail deficits and debt.)

As we have demonstrated numerous times, the Debt/GDP ratio is meaningless. It tells nothing about the current or future health of an economy. It predicts nothing; it evaluates nothing. It is 100% meaningless.

That is why economists who don’t understand the fundamentals of Monetary Sovereignty love to quote it.

The 20-year countdown assumes that investors remain optimistic about the willingness and ability of U.S. officials to bring spending in-line with tax revenues. “Once financial markets believe otherwise, financial markets can unravel at smaller debt-GDP ratios,” according to the PWBM analysis.

We suspect financial markets understand history better than the economists at Wharton. We suspect they know that when the federal government spends more, stock prices rise.

|

| As federal deficit spending has increased, the value of corporate stock has risen. |

As PWBM points out, “Financial markets demand a higher interest rate to purchase government debt as the supply of that debt increases… Forward-looking financial markets should demand an even higher return if they see debt increasing well into the future. Those higher borrowing rates, in turn, make debt grow even faster.”

That’s already happening.

Increasing Costs and a Looming Deadline

“To finance trillions of dollars in spending beyond what incoming revenue can support, the US Treasury is now issuing more debt in the form of Treasury securities than global financial markets can readily absorb,” Yahoo! Finance’s Rick Newman wrote on October 30.

“That forces the borrower—the US government—to pay higher interest rates, which in turn pushes up borrowing costs for consumers and businesses in much of the Western world.”

Again, the Wharton experts misunderstand Monetary Sovereignty and the realities of federal financing.

The federal government does not finance spending by borrowing (“issuing debt.”) It finances spending by creating dollars, ad hoc.

It can allow as much or as little in T-security deposits as it wishes. If the public fails to invest as much as the Federal Reserve wishes (to stabilize the dollar), the Fed merely uses its infinite money creation ability to fill the gap.

Federal spending never is constrained by the public’s desire to own T-securities.

As for interest rates, the Fed sets them not to attract depositors but to control inflation. If the Fed smells inflation, it raises rates. If the inflation scare passes, the Fed lowers rates. This has nothing to do with any need for deposits into T-security accounts.

(Sadly, raising interest rates, far from moderating inflation, exacerbates it by raising prices. The only thing that moderates inflation is federal spending to ease shortages of critical goods and services.)

Just when the U.S. federal government hits that magic unsustainable debt-to-GDP ratio of between 175 and 200 percent depends on investor confidence and how much the markets charge to finance more borrowing. PWBM estimates it will happen between 2040 and 2045—if we’re lucky.

The notion of a “magic, unsustainable debt-to-GDP ratio” is utter nonsense. Japan already has exceeded that meaningless ratio.

The U.S. Treasury concedes that “since 2001, the federal government’s budget has run a deficit each year. Starting in 2016, increases in spending on Social Security, health care, and interest on federal debt have outpaced the growth of federal revenue.”

The 2001 Clinton surplus caused the 2001 recession. See Graph I.

Options for Fixing the Mess

In September, PWBM explored three policy options to render fiscal policy less disastrous: increasing taxes on high incomes, reforms to Social Security and Medicare that reduce payouts and increase taxes, and a mix of tax increases and spending cuts.

Increasing taxes on high incomes would help narrow the Gap between the rich and the rest, which would be a good thing. It would do nothing to improve the federal government’s already infinite ability to pay its creditors.

“Reforms” to Social Security and Medicare (i.e. cuts to benefits paid to those who need them most, while increasing taxes on those who can afford them least) also would do nothing to improve the federal government’s bill-paying ability.

The “mix of tax increases and spending cuts” would take spending dollars from the private sector and cause a recession or depression. Remember this equation: GDP = Federal + Nonfederal Spending + Net Exports.

Spending cuts and tax increases would decrease Federal + Nonfederal Spending, which would reduce GDP, i.e. cause a recession or depression. Simple mathematics.

The authors predict entitlement reforms and a mix of tax increases and spending cuts would both stabilize the debt-to-GDP ratio, with entitlement reform allowing the greatest economic growth.

Hmmm. Giving the economy fewer Social Security and Medicare dollars and taking dollars from the economy by increasing taxes would “allow the greatest economic growth”???? Also, pouring water out of a bucket fills it??

The St. Louis Federal Reserve Bank has tax revenues hitting 19 percent

of GDP last year—the highest share in two decades. The IRS may scream

about a “tax gap” between what is owed and what it collects, and

lawmakers may supercharge the tax agency with funds, but fixing the

federal government’s spendthrift ways by squeezing taxpayers won’t just

be unpopular—it’s a scheme that defies historical trends.

Spending

cuts and entitlement reforms will also elicit resistance. But at least

they’re within reach of lawmakers who could spend no more than they

collect—or even to run surpluses to pay down debt.

Twenty years

to fix the federal budget should be plenty of time. But brace yourself.

The record so far suggests it won’t be enough.

The above is so

staggeringly ignorant one scarcely can believe it was written by humans.

Indeed, it must have been written by an Artificial Intelligence gone

rogue. Cuts to federal spending and tax increases do the same: They take

dollars out of the economy and cause recessions and depressions.

The Libertarian (aka anarchist) comments are not surprising. Anti-government ignorance is expected from them.

But, if this is the best to come out of Wharton, heaven help its students.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Friday, November 3, 2023

Why is November 3 special?

November 3rd is Godzilla's birthday

— Tokyo Walking (@Tokyowalking08) November 2, 2023

Shinjuku Japan 🇯🇵

新宿 東京🇯🇵#photograghy pic.twitter.com/sl53AtwAtD

The destination of prosperity

From a tweet by Rutger Bregman: Wrote this 12 years ago, in Utopia for Realists. I didn't realize at the time how soon this scenario c...

-

Here's a detailed explanation by a Modern Monetary Theory founder, Stephanie Kelton. The bottom line: Social Security's enabling l...

-

Posted on March 26, 2019 by L. Randall Wray The attacks on MMT continue full steam ahead. Janet Yellen (former Fed chair, but clueless on...

-

© by Mark Dempsey In the year 2000 the World Health Organization (WHO) ranked countries’ health care system outcomes according to thin...