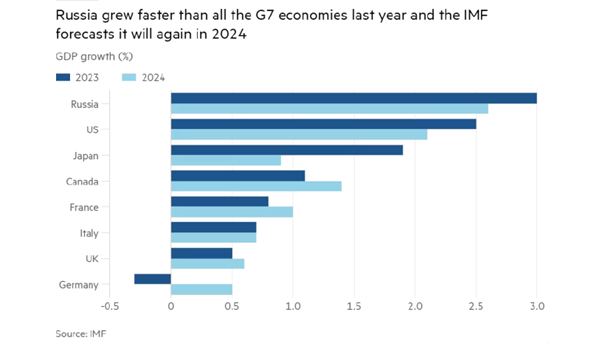

From Michael Roberts' blog. Contrary to Western predictions, Russia has weathered the sanctions imposed by the NATO allies without a significant downturn (see the graph below)

Excerpt:

Over the past two years of war, Russia has managed to steer through sanctions, while investing nearly a third of its budget in defence spending. It’s also been able to increase trade with China and sell its oil to new markets, in part by using a shadow fleet of tankers to skirt the price cap that Western countries had hoped would reduce the country’s war chest. Half of its oil and petroleum was exported to China in 2023. And it became China’s top oil supplier in 2023, according to Chinese customs data. Chinese imports into Russia have jumped more than 60% since the start of war, as the country has been able to supply Russia with a steady stream of goods including cars and electronic devices, filling the gap of lost Western goods imports. Trade between Russia and China hit $240 billion in 2023, an increase of over 64% since 2021, before the war.

Contrary to Western forecasts, Russian industry has grown due to war-related production, while demand for domestic manufactures has also increased due to a fall in imports because of sanctions. The automobile industry – which was hit hard initially, as Western and Japanese car manufacturers left Russia en-masse – has been recovering strongly month by month, as Chinese companies have stepped in.

....And the Russian economy remains fundamentally natural resource linked. It relies on extraction rather than manufacturing. Mining accounted for around 26% of gross industrial production in July 2023, and three industries – extraction of crude petroleum and natural gas, coke and refined petroleum products manufacturing and basic metals manufacturing – made up more than 40% of the total. “The regime is resilient because it sits on an oil rig,” says Elina Ribakova, a non-resident senior fellow at the Peterson Institute for International Economics. “The Russian economy now is like a gas station that has started producing tanks.”

War production is basically unproductive for capital accumulation over the long run. And Russia’s potential real GDP growth is probably no more than 1.5% a year as growth is restricted by an ageing and shrinking population and low investment and productivity rates. The profitability of Russian productive capital before the war was very low.

The Russian war economy is well placed to continue the war for several years ahead if necessary, but when the war is over, Putin may face a significant slump in production and employment.

....

Meanwhile, a contradiction from Foreign Policy: Claims That Sanctions Hurt Europe More Than Russia Are Wrong

No comments:

Post a Comment

One of the objects if this blog is to elevate civil discourse. Please do your part by presenting arguments rather than attacks or unfounded accusations.