Spirit Airlines CEO Got A $3.8 Million Bonus A Week Before Its Bankruptcy

In January of 2024, a judge blocked the attempted merger of Spirit Airlines and JetBlue. “The airline industry,” wrote Boston-based Judge William Young, “is an oligopoly that has become more concentrated due to a series of mergers in the first decades of the twenty-first century, with a small group of firms in control of the vast majority of the market.”

Young was correct in his assessment. But at the time of the decision, I made the point that a re-regulation of airline travel was essential if we are to end a cycle of bankruptcies and consolidation. “You can’t just hope competition will win out,” I wrote, “in an unregulated industry, the result will be mal-investment, bankruptcies, consolidation, and then mass bailouts.”

Eleven months later, on Monday, Spirit declared bankruptcy, negotiating a deal with its creditors to reduce its debt, wipe out its shareholders, and continue flying as an independent airline. All tickets are still being honored, it’s still a going concern, so there’s no actual change to the air travel system. Still, a lot of observers have used this example to show why antitrust enforcement is bad. The Wall Street Journal, for instance, wrote an editorial making this point directly.

Meet the latest victim of Biden Administration antitrust policy: Spirit Airlines. Spirit declared bankruptcy Monday after the Justice Department cut off a lifeline by blocking its merger with JetBlue Airways. Too bad the government won’t compensate the workers, flyers and creditors harmed by its blunder.

This argument isn’t correct, and I am going to explain why. But let’s start with something that you won’t hear from from most of the people making the argument about how antitrust drove the bankruptcy. The CEO of Spirit Airlines, Ted Christie, a man who presided over the insolvency of the firm, was paid a $3.8 million retention bonus the week before the bankruptcy filing. The reason such a fact matters isn’t just because it’s outrageous, it’s because it’s one more bad decision by a bad management team that is blaming the government for their own choices.

Let's start at the beginning. Prior to Covid, the big four trunk airlines - American Airlines, Delta Air Lines, Southwest Airlines, and United Airlines - had focused on business travel, while ultra-low cost segment of carriers, which includes Spirit Airlines, had targeted price-sensitive leisure travelers. After Covid, demand for air travel shifted from business to leisure as businesses replaced in-person conferences with Zoom meetings. So the big four began going after leisure travel.

The big four have significant competitive advantages. They control a disproportionate share of airport infrastructure, and can cross-subsidize money losing routes. They have more flights, erect barriers to entry through loyalty programs, and can hire away pilots during a staff shortage. So when they started competing, it put pressure on the low cost airlines.

One result is that Frontier, in 2022, sought to merge with Spirit Airlines to create a significant ultra-low cost network that could match some of the advantages of the big four. Only, at that point, JetBlue, which had already engaged in a quasi-merger with American Airlines through a joint program called the Northeast Alliance, made a hostile bid for Spirit. They proposed, on overlapping routes where they competed, to rip out seats and hike prices, which is a classic indication of a strategy to lessen competition.

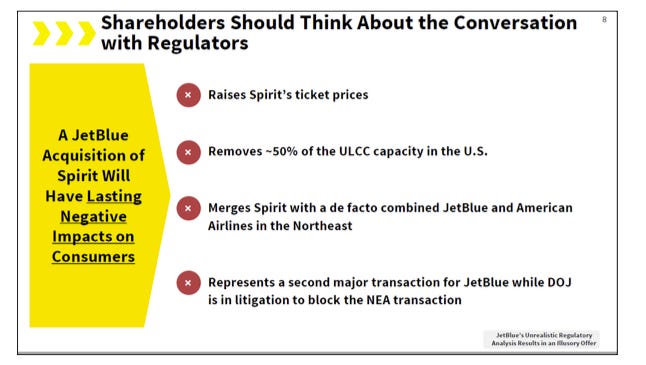

Spirit's board hired a consultant to evaluate the deal, who told execs/shareholders that the JetBlue offer would likely violate the antitrust laws. Their CEO publicly recommended against the JetBlue bid, saying “The latest offer from JetBlue does nothing to address our Board’s serious concerns that a combination with them would not receive regulatory approval.” The board even presented this legal analysis to shareholders. Here’s one of the slides.

What ensued was a bidding war between Frontier and JetBlue over Spirit Airlines. JetBlue raised their bid, and ultimately, shareholders and executives accepted the higher JetBlue offer. The result was exactly what the Spirit Board had predicted; the Antitrust Division sued in 2023 to block the JetBlue-Spirit deal. The law is the law.

That’s not all. In 2024, during the trial over JetBlue’s proposed acquisition of Spirit, the judge directly asked Spirit executives if they would go bankrupt should the merger fail. The reason is that there’s a special loophole in merger law, such that if your firm would otherwise fail absent a merger, you can get special dispensation to sell your company even if such a sale would erode competition. And that makes sense, if the company goes out of business then there wouldn’t be competition anyway. So what did Spirit executives tell the judge? They said, no, we’re not a failing firm, we’ll be fine if the merger doesn’t happen.

In other words, they turned down the Frontier merger and accepted JetBlue’s proposed illegal one to get more money. Then the executives misled the court or themselves on the firm's financial condition so they wouldn’t have to admit they had run the airline into the ground.

So that’s the situation. But an additional question is as follows. Is the bankruptcy actually bad? Sure shareholders will get wiped out. Guess what? GOOD. They deserve it. They opted for an illegal deal instead of a legal one. Plus Spirit will keep flying as a competitive airline, at least for now. This particular kind of bankruptcy isn’t necessarily a bad thing, it just means you reorganize the creditor relationships but keep the entity as a going concern.

Financial failure in the airline industry is exceedingly common and has been since the 1970s. American Airlines, Delta, United, Northwest, U.S. Air, they all went through it. Why? Well it's a a function of deregulation, as I noted in 2022 during that nightmarish travel summer.

To understand the roots of this instability, we have to go back to legal changes in the 1970s. At the time, a government agency called the Civil Aeronautics Board set routes and prices. Airlines were a regulated public utility service, with essentially a guaranteed reasonable return on their capital. They didn’t have to harm their customers to earn money, and they weren’t subjected to the same boom and bust cycle regularly buffeting the industry. Despite the more intrusive public rules, there was a lot more competition, with new airlines entering on a regular basis. And air service was evenly distributed around the country, you didn’t have mid-size cities cut off from the air grid when an airline decided to close a hub, as happens today.

The reason for the success and necessity of this particular regulatory framework has to do with the economics of flight. It is costliest to take off and land, so airlines like flying long routes over short ones. And it is cheaper to serve a busy airport than an empty one, because you can use the same equipment on more flights. So everyone in the industry naturally wants to serve long flights between big cities, not short flights or small cities.

The result is that, absent any regulation, airlines will all cut flights to smaller cities, and pile into the popular routes. If a bunch of airlines are all trying to compete on the New York to LA route, they will be willing to cut prices to nearly nothing simply to capture an additional customer, since the plane is already budgeted to fly the route. The net effect, if everyone is doing this, is that the industry becomes structurally unprofitable, airlines go bankrupt, and then there’s consolidation. As with ocean shipping and rail, air travel is a high capital cost industry, and without public rule-setting ‘ruinous competition’ takes over and bankrupts everyone.

When we deregulated airlines in 1978 and let airlines charge whatever they wanted and fly wherever they wanted, that’s what happened. Service to small cities ended, and the busiest routes went way down in price to consumers. The Department of Transportation saw promoting the financial health of airlines as its charter, so it didn’t really protect consumers for fear of harming the airlines financially. Then came waves of bankruptcies and consolidation, leading to price regulation, only this time privately through monopoly.

Part of this change, from public price-setting to private price-setting, involved refusing to enforce predatory pricing laws, which allows larger airlines to intentionally lose money and drive smaller ones out of business. We can see this dynamic in a different airline merger the DOJ did recently allow. After the Department of Justice challenged Spirit’s merger attempt with JetBlue, those same enforcers allowed Alaska Airlines to buy Hawaiian Airlines.

Why? Well, financial fragility. About five years ago, Southwest entered the Hawaiian market, and it did so by vastly undercutting pricing, such that it was almost certainly losing money to drive Hawaiian out of business. That’s probably an illegal predatory pricing strategy, but predatory pricing law is notoriously hard to enforce, such that the practice has driven consolidation across many industries, including airlines. There really was no choice but to let the two firms combine, or have Hawaiian go under. Hawaiian is now cutting jobs after its merger, showing that mergers are not panaceas for poorly run or financially fragile companies.

This financial attack happened to Hawaiian, but the ability of large players to undercut ultra-low cost carriers with money losing strategies, cross-subsidized by higher tickets elsewhere, has hit a whole host of smaller airlines, including Spirit. Only, instead of doing a legal combination, or being honest about their financial fragility, Spirit executives and shareholders demanded enforcers let them violate the law.

In other words, the real reason for blaming this bankruptcy on antitrust enforcement is because it’s too embarrassing to point to the real problems, which are poor management, lax predatory pricing law, and ultimately deregulation. But again, just remember the CEO’s multi-million dollar payday. This guy drove Spirit into bankruptcy, got a big bonus, and then blamed enforcers for upholding the law. Nice work if you can get it.

Thanks for reading. Send me tips on weird monopolies, stories I’ve missed, or comments by clicking on the title of this newsletter. And if you liked this issue of BIG, you can sign up here for more issues of BIG, a newsletter on how to restore fair commerce, innovation and democracy. If you really liked it, read my book, Goliath: The 100-Year War Between Monopoly Power and Democracy.

cheers,

Matt Stoller

No comments:

Post a Comment

One of the objects if this blog is to elevate civil discourse. Please do your part by presenting arguments rather than attacks or unfounded accusations.