The point of this rebuttal is to remind us that the NY Times' agenda isn't always the public's. Remember: The NY Times cheerled the US into a war in Iraq.

The petroleum bias answer comes from this:

This Yglesias piece in the NYT is really bad. Almost every "fact" it cites is provably false. At best it is cocktail party banter from a pundit who knows nothing of energy. At worst, it was cut/paste from oil industry talking points. So, a rebuttal: https://t.co/kbWZ0barjC

— Sean Casten (@SeanCasten) December 20, 2025

The rebuttal (lots of tweets assembled)

1. First: the elephant in the room that he doesn't mention explicitly but haunts the whole piece: climate change is real, we've already overshot and the only way to turn the corner is to leave fossil fuel in the ground. To ignore that is to talk about rocketry and ignore gravity.

2. What he says about climate is patently false (more on that later) but to the extent he's saying "politicians shouldn't do the right thing unless it's popular", I'd note only that that is a toddlers view of leadership. If the popular kids are mean, should you be mean?

3. Leadership is about doing what is necessary, not just what is popular. Read literally anything our founders wrote about virtue, and the inherent risks to a society based on democratic processes to sustain the rule of law to the extent that unvirtuous people gain power.

4. Yglesias instead seems to argue that politicians should only do what wins elections, virtue be damned. One wonders what he thinks of those foolish 1850s abolitionists. As Condleeza Rice once said, politics is the art of making the impossible inevitable. That ain't this.

5. But enough on climate. This is an opinion piece and if MY's opinion is that we shouldn't act on climate at a scale sufficient to the threat there's not much I can do. Let's go to the facts. First, the idea that Obama won in 2012 because of his oil & gas platform. Really?

6. That election had a robust debate over the gulf war and the scope of the 2008 bailout. Romney was framed as an out of touch plutocrat. To the extent energy came up it was the criticism of the Dems for Waxman Markey cap & trade in 2009, not "thank you for drilling".

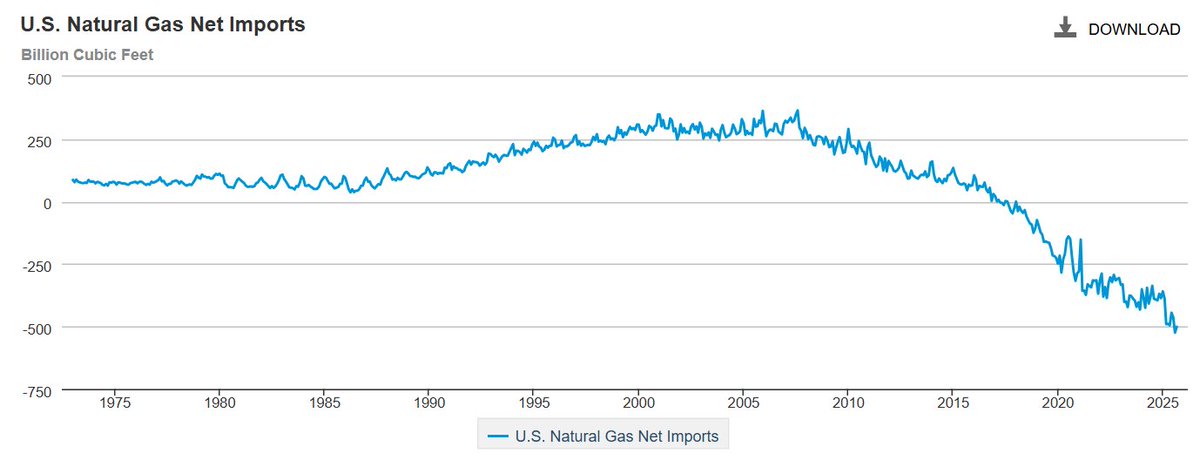

7. But even beyond the political conversation, you can't compare 2012 energy policy to 2025 without understanding the massive shift in US fossil energy production & net imports over that period. Look at the "net imports" line on this chart.

8. In 2012, the US was a net importer of oil and domestic production, after decades of decline was starting to tick up. Today, the US is a net exporter. Couple that with concerns about middle east politics in 2012 and you have a VERY different set of issues for US consumers.

9. As a net importer, every incremental unit of domestic production reduced our exposure to foreign oil & associated price volatility. As a net exporter, every incremental unit gets shipped overseas.

10. IOW, in 2012 new production benefited domestic producers AND consumers. But today, new production only benefits producers. That's a fundamentally different policy and political environment. And note also that domestic consumption is basically flat for the last 20 yrs.

11. That's a good thing! We're just as warm, just as able to travel as we were 20 years ago, and rising vehicle efficiency, EV deployment, etc. is giving consumers more useful energy with less oil expense. That's good for consumers, even if it hurts producers.

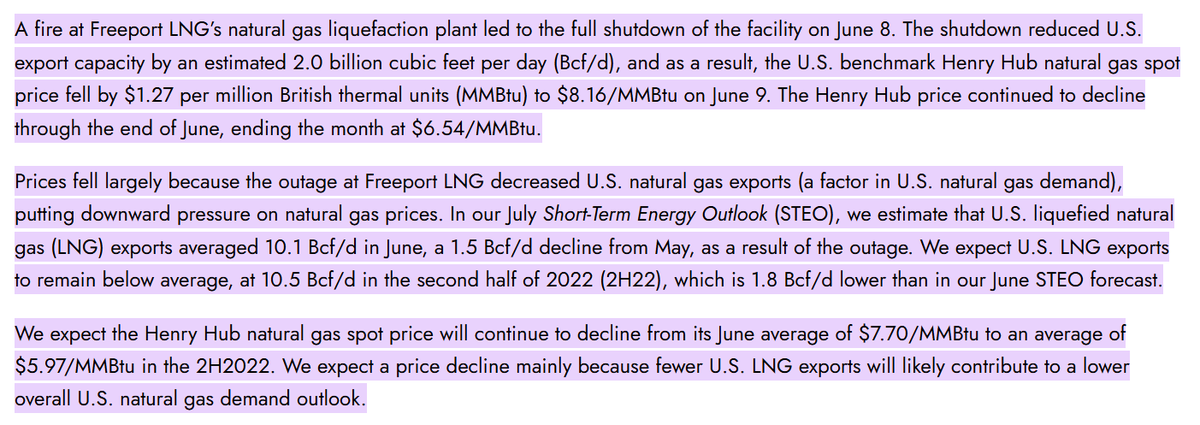

12. And if we want to talk about the politics, here's some easy math: there are a lot more voters who consume energy than there are who produce energy. If you're confused on that point, you might be a crappy pundit...

13. And this isn't just true of oil. We've also moved from a net importer to a net exporter of natural gas since 2012. (Also because fracking.) Which again means that to take Yglesias' advice in 2025 is to prioritize energy producers over energy consumers.

14. The wealth transfer from natural gas is perhaps even more direct since gas - unlike oil - isn't quite a global commodity; the costs to liquefy and transport gas, per MMBtu are a lot higher than oil, which creates much higher local price disparities.

15. As such, when US producers can swap European/Asian markets for the US markets and make a higher margin, even after accounting for shipping costs it puts significant upward pressure on previously land-locked domestic prices.

16. This is the reverse of getting off middle eastern oil in 2012. Now, instead of decoupling from global volatility we absorb it. That gets quantified whenever a US LNG export facility has an outage & domestic NG prices fall. Who ya rootin' for, Matt? .

U.S. natural gas supply and demand balance shifts amid outage at Freeport LNG - U.S. Energy Information Administration (EIA)https://www.eia.gov/todayinenergy/detail.php?id=53079#:~:text=A%20fire%20at%20Freeport%20LNG's,U.S.%20natural%20gas%20demand%20outlook

17. It's worth reading the entirety of what DOE had to say about the impact of that 2022 outage on domestic prices. These are massive price swings - and therefore massive wealth transfers from US consumers to US producers!

18. Because natural gas is used for so much of US power generation, increasing gas exports = higher gas prices = higher electricity. One climate negative impact of that is that after years of decline, we now are seeing an uptick in domestic power generation from coal.

19. This isn't because coal is cheap, or because we're building more coal plants. It's because when the price of gas goes up gas fired power plants are a little less competitive against other asset classes and the competition (in this case, coal) picked up the slack.

20. So this goes back to point 10. When we are a net exporter, decisions to produce more help producers and hurt consumers. And in this case, are ALSO bad for the climate. It's lose / lose all around.

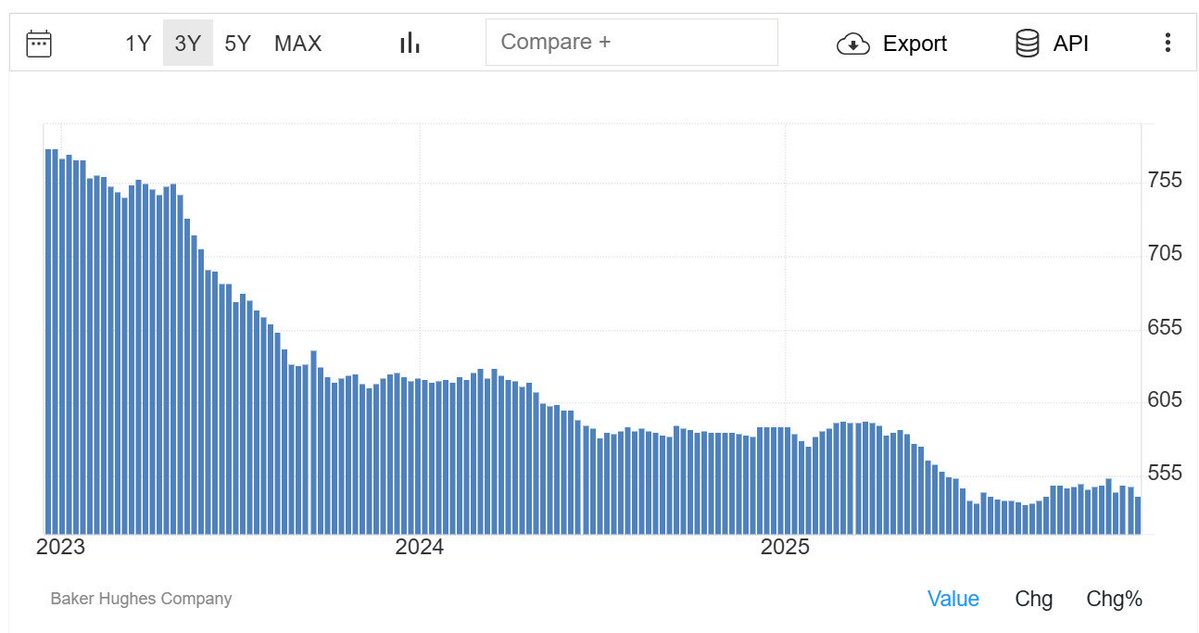

21. And before team Yglesias responds by saying "yeah, but it's bad politics to run on climate and energy"... I'd point out that I've won 4 elections in a very purple district running on climate and energy. Pro-tip: leadership is possible! You don't have to be stupid to win!

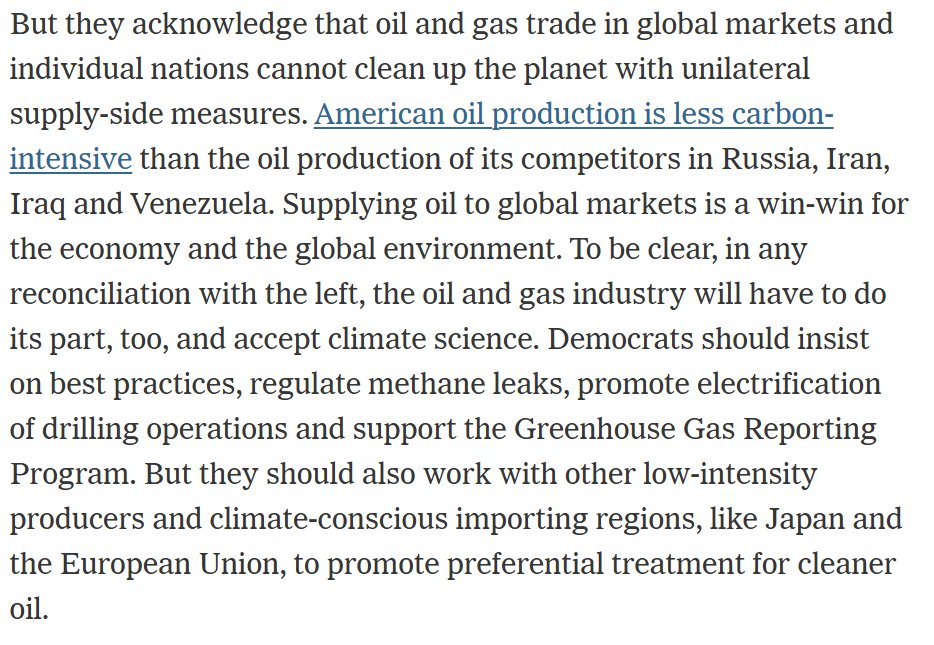

22. Speaking of climate. Let's now pick apart this word salad of stupidity. Specifically the assertion that US oil is "cleaner" than other countries and therefore it is environmentally virtuous for us to drill baby drill.

23. Here's the report he links to in order to prove his point, that compares the carbon intensity of various global oil production regions.

Report: U.S. Beats Competitors with Low Carbon Intensity OilThe United States is a global leader in minimizing greenhouse gas emissions from offshore production, according to a recent from the National Ocean Industries Association (NOIA). The report, commissi…https://www.energyindepth.org/report-u-s-beats-competitors-with-low-carbon-intensity-oil/

24. Here's the chart. I don't know if he looked at it, and I certainly don't think he thought about it but I'd encourage you to as it refutes much of that word salad paragraph.

25. First, note who is the cleanest: Saudi Arabia. So when he says that we should "work with other low-intensity producers", he is essentially saying that we should maximize production in Saudi before bringing on US production. How does that help win elections in TX and OH?

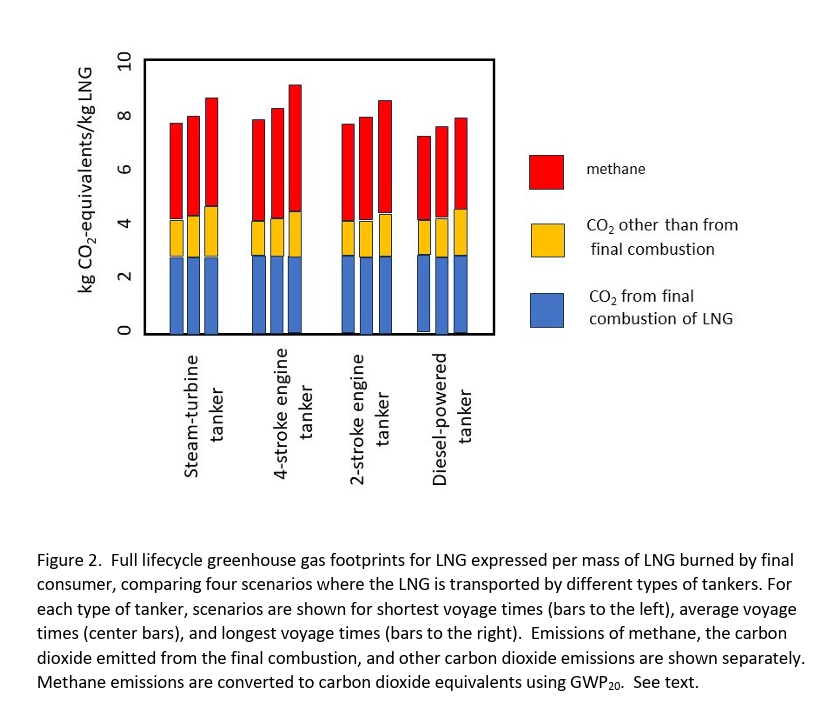

26. Interestingly, since the Saudis gave Kushner his PE fund and Trump his LIV tournament he's been quiet as they've kept the oil price under $70 which in turn has suppressed US rig counts. So maybe Trump is taking Yglesias' advice? How's that polling? tradingeconomics.com/united-states/…

https://tradingeconomics.com/united-states/total-rigs

27. Back to the chart. Look at how much dirtier Canadian oil is than US oil. (Because tar sands are very energy intensive to extract). You know who pushed to stop imports of dirty Canadian oil into the US? Obama! Google "keystone XL pipeline" if you've forgotten that history.

28. Recall that the oil industry (and the GOP) demonized Obama for blocking Keystone because they had spare refining capacity and wanted to make money exporting the resulting finished products. So again, this is about producers v consumers.

29. Now look at the US bars on that chart. Bars is plural because US production is not monolithic. Conventional oil production (offshore gulf, southwest) uses relatively little energy to lift the oil to the surface and as a result is much cleaner than "other US" (aka fracking).

30. Which means that if you're making the argument that US oil production is cleaner, you have to be honest about where the marginal production is happening. And in OH, PA and those other swing states he describes, it ain't from conventional drilling.

31. On natural gas, his arguments are just as bad. It is true that at the burner tip a unit of natural gas emits less CO2 than a unit of coal. And if you have a coal mine and a gas well in your back yard, both of which are hooked up to your furnace that is a relevant comparison.

32. That's of course not the norm. And because methane is such a potent greenhouse gas (>80x as bad as CO2 for the first 20 years after release) even a minor leakage rate in the collection and distribution makes natural gas worse than coal from a global warming perspective.

33. That's even more true for exported natural gas which also has to be liquefied since the liquefaction process is so energy intensive. Roughly speaking, you need nearly 120 units of gas to make 100 units of LNG. So more CO2 and magnified impacts of upstream leaks.

34. And of course you also need to fuel the ship that transports the LNG - which means that environmental impact of exported natural gas is primarily driven by methane leaks and liquefaction / distribution. The burner tip comparison is just a vapid industry talking point.

35. Source for that graph if you want to get into the details: research.howarthlab.org/publications/H…

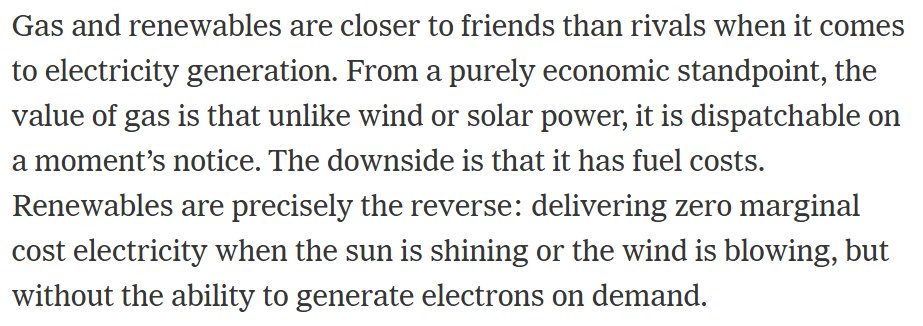

36. Finally this. The mark of the fossil fuel shill who never loses the arrogance to walk into a room, say "the sun doesn't shine at night and its not always windy", drop the mic and leave, confident that no one else knows what they just discovered.

37. I will concede. Night is real. Some days I can't fly a kite. It is also true that sometimes coal trains are stuck, gas pipelines fail, warm weather derates thermal power plants and unplanned outages happen.

38. Every utility manager and operator knows this. NERC standards explicitly require that in any given utility control area you cannot have a coincident failure mode that affects more than 10% of your load. The scary scenario (night time blackouts!) doesn't happen and won't.

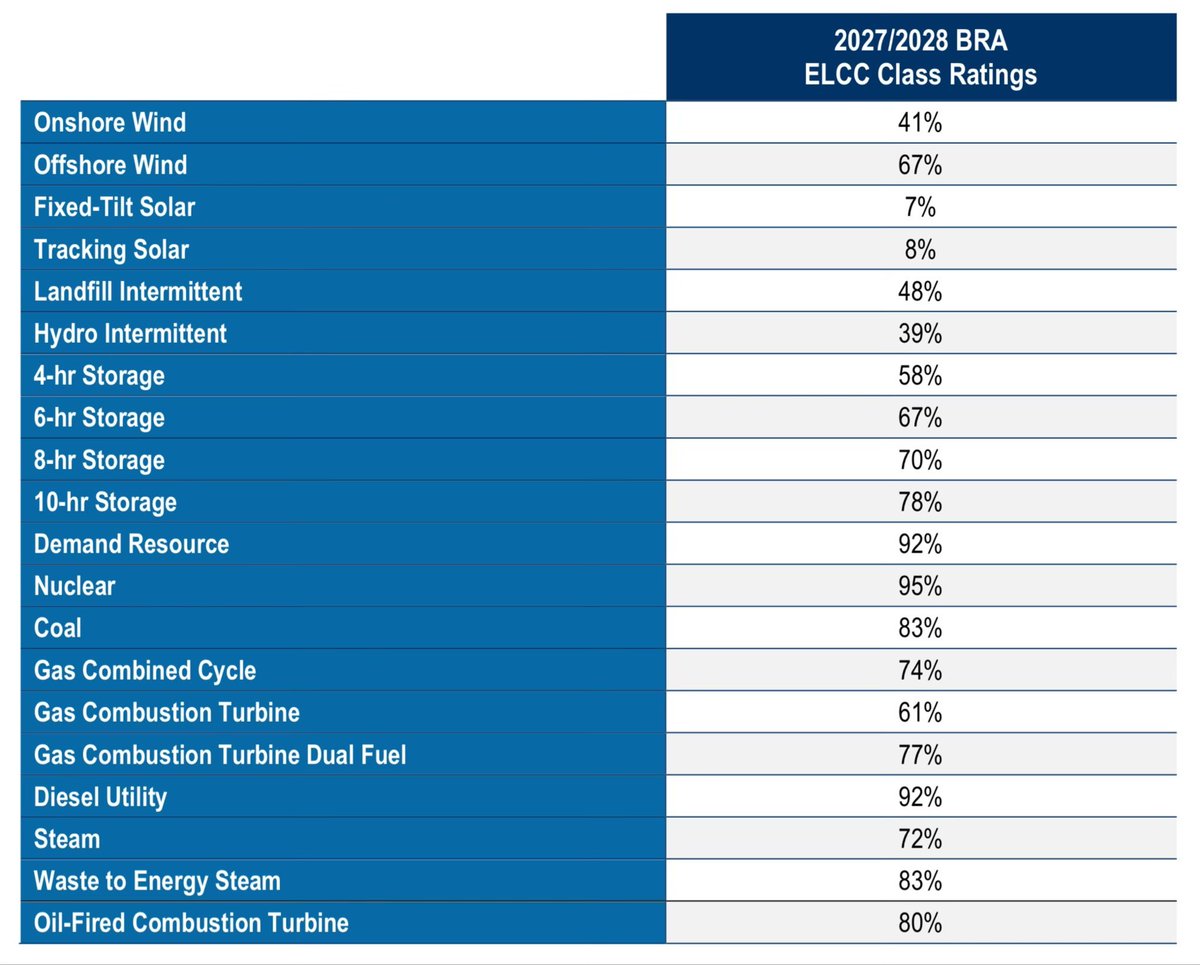

39. Moreover, wholesale power markets include variable time of use rates and capacity payments to pay a premium to sources that can ramp up on a moments notice. Here is a list of what PJM used last year (% is the likelihood that the given source will be there when called.)

40. So we have a grid with lots of stuff. The most reliable backup in that PJM analysis was nuclear and load sited demand reduction. Diesel gen sets. Pumped hydro. Battery storage is a big deal and a bigger one as costs fall and longer durations are available. Gas peakers too.

41. Not shown here, but also a big deal is transmission to connect different parts of the system so that the wind in Iowa can power Chicago, or the sun in Florida, or the geothermal in Nevada, or the hydro in Oregon, etc.

42. Point is, markets and existing regulatory structures also know that no source is available 24/7/365 and manage the grid accordingly. They don't learn anything from Yglesias insight about nighttime and you didn't either.

43. If you're still reading at #43... thanks, I guess? But also this. :) Anyway, a final thought to wrap up.

44. I've spent my entire career in the energy industry. As a consultant, as a manufacturer, as a power plant developer/owner/operator and as a legislator. There is something really optimistic about the moment we're in that pundits like Yglesias said was impossible 20 yrs ago.

45. Specifically, we've decoupled economic growth from fossil energy consumption. Coal demand has collapsed. Oil use is flat. Natural gas use is growing but < GDP, even as standards of living have gone up. That's happened because of higher efficiency and decarbonization.

46. We are, in a word, investing in energy productivity, getting more value out of less input. That is great news, for the same reason that higher returns on capital are good or increases in labor productivity good. Make more useful stuff with less input and we get richer.

47. As Amory Lovins has said for years, no one wants a lump of coal, or a barrel of oil. All we want is a hot shower and a cold beer. And if we can get that heat and light and chilling without paying for (or burning) fuel, we're all happier... with one notable exception.

48. That exception of course is the fossil fuel producer. They are hostile to energy productivity for the same reason John Henry didn't like the steam shovel. They can't compete with it. Wins for consumers come at their expense. Wins for the climate come at their expense.

49. The game isn't over by far. But we are winning. That's something to be proud of. It's something to accelerate. It's nothing to take for granted. And it's certainly no time to take Yglesias' advice and fumble the ball so the other team won't feel so sad. /fin

No comments:

Post a Comment

One of the objects if this blog is to elevate civil discourse. Please do your part by presenting arguments rather than attacks or unfounded accusations.